Can I contribute to an IRA if I'm over the IRA income limit?

If your income exceeds these limits, you are still allowed to contribute money to a traditional IRA. However, the contribution that you make will not be tax-deductible.

You may still wish to make a nondeductible contribution, either because you would prefer to allow your investments to grow tax-free and to defer taxes on gains or because you want to make a backdoor Roth IRA contribution by contributing to your traditional IRA and then converting it to a Roth account.

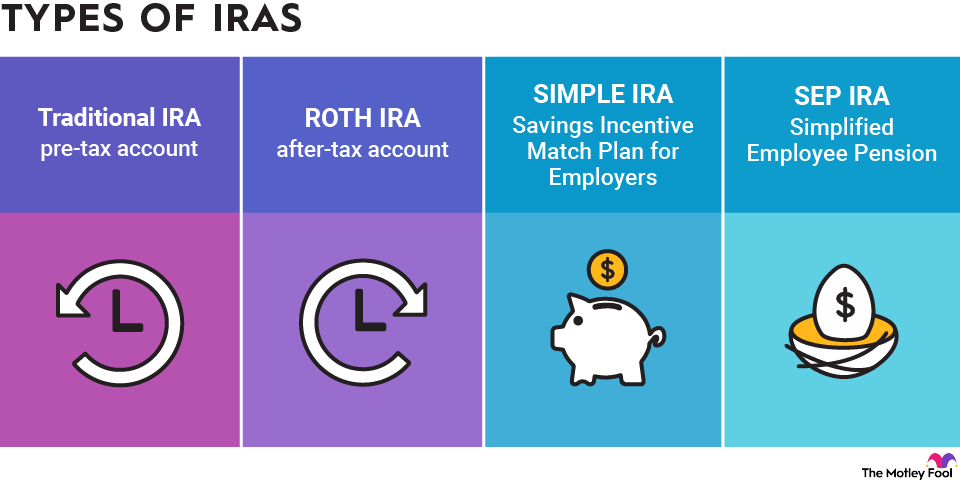

Remember, you are also not subject to these income limits when you make contributions to either a SIMPLE IRA or a SEP-IRA -- options available only if your employer offers them, if you own a small business, or if you are self-employed and can open one for yourself.

The ability to make nondeductible contributions, regardless of income level, makes a traditional IRA a valuable retirement savings account, as it allows for the conversion into a backdoor Roth IRA. Alternatively, some high earners may simply prefer to wait and pay taxes on investment gains in their retirement years, rather than owing the IRS as investments are sold throughout their career.