SIMPLE IRAs vs 401(k)s

A SIMPLE IRA has its advantages and disadvantages versus a 401(k). First, 401(k) plans require significantly more work to establish and administer, which means they are more expensive for the business owner. 401(k) plans also require nondiscrimination testing and annual tax reporting at the plan level.

Additionally, 401(k) plans may restrict investment options for participants to facilitate easier administration and ensure plan compliance. It's possible to establish self-directed 401(k) accounts, but SIMPLE IRA plans are more typically self-directed, allowing account holders to invest in a broad range of options, including individual stocks, bonds, and mutual funds.

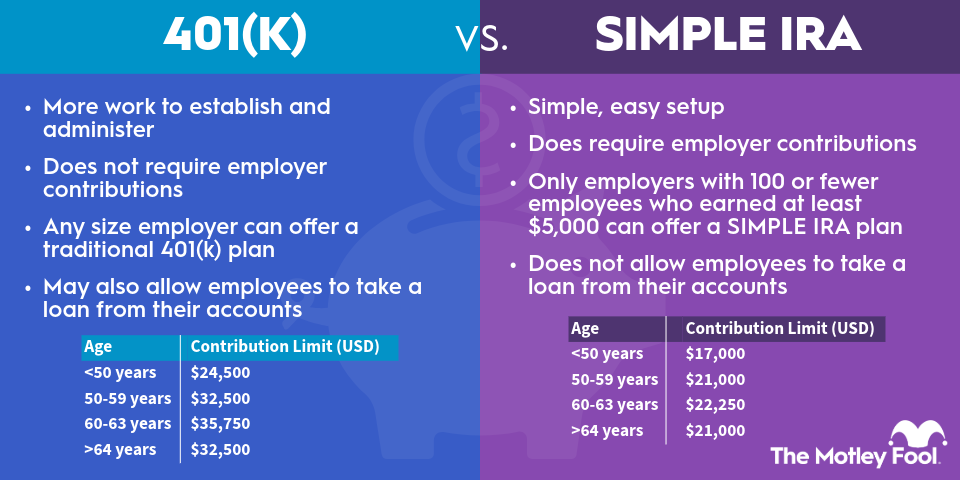

On the other hand, 401(k) plans allow employees to contribute more to their retirement than a SIMPLE IRA if they choose. The contribution limit for employee salary deferrals into 401(k)s is $23,500 in 2025 and $24,500 in 2026. Individuals aged 50 to 59 or 64 and older can contribute up to $31,000 in 2025 or $32,500 in 2026. Those aged 60 to 63 can set aside up to $34,750 in 2025 or $35,750 in 2026.

There's also more flexibility for the employer contribution. Employers can contribute anywhere from 0% to 25% of an employee's compensation, as long as they offer the same employer contribution terms to all participants. Additionally, matching contributions don't have to be dollar-for-dollar like in a SIMPLE IRA.

An employer can also implement vesting periods for the employer contribution in a 401(k). That means the employee needs to continue working to receive the benefit of the matching contribution. That can keep employees around longer. SIMPLE IRA employer contributions vest immediately.

401(k) plans may also allow employees to take a loan from their accounts. That can allow them to temporarily access their retirement funds for a big purchase or emergency spending, making them more appealing to employees.