You can deduct up to $7,000 in 2025 or $7,500 in 2026. Those 50 and older can save up to $8,000 and $8,600, respectively, in 2025 and 2026. These are the maximum amounts you can contribute for the year between both traditional and Roth IRAs. Contributions are also fully tax-deductible if neither you nor your spouse has a workplace retirement plan.

Your eligibility to deduct contributions begins to phase out at the following income levels in 2025:

- $79,000 for single filers

- $126,000 for a married joint filer with a workplace plan

- $236,000 for a married joint filer whose spouse has a workplace plan

Your eligibility to deduct contributions begins to phase out at the following income levels in 2026:

- $81,000 for single filers

- $129,000 for a married joint filer with a workplace plan

- $242,000 for a married joint filer whose spouse has a workplace plan

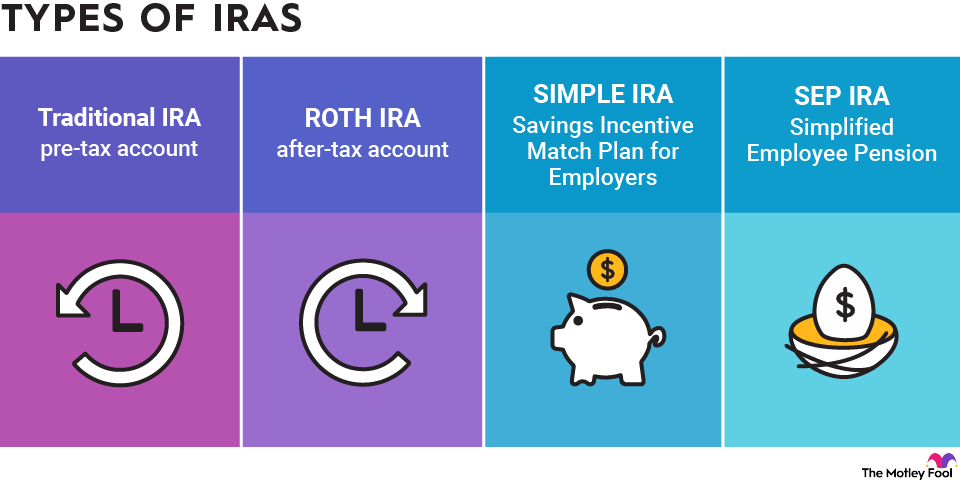

A traditional IRA has many benefits and can be an ideal choice if you feel that your tax bracket is likely to be lower in retirement than it currently is. If you expect your tax rate to drop, it makes sense to claim your tax benefits up front when they are worth more and to pay taxes on distributions at your ordinary income tax rate later when your rate is lower.

Roth IRAs

The main difference between a traditional IRA and a Roth IRA is that you make contributions to a Roth IRA with after-tax dollars. While contributions aren’t deductible in the year they’re made, this money grows tax-free, and you don't owe taxes on withdrawals in retirement. Roth IRAs are also subject to the same aggregate contribution limit as traditional IRAs: $7,000 in 2025 and $7,500 in 2026, or $8,000 in 2025 and $8,600 in 2026 if you're 50 or older. Unlike traditional IRAs, Roth IRAs have income limits on who can contribute.

If you expect your tax rate to increase in retirement, a Roth IRA is a good choice. That's because you will be able to make tax-free withdrawals later on when your money would otherwise be taxed at a higher rate.

If you are worried about crossing the income threshold where Social Security benefits become taxable, then a Roth IRA can also be a good idea. That's because the IRS doesn't count distributions from a Roth IRA when determining if your Social Security is taxable.

SEP IRAs

Small business owners and self-employed individuals can set up Simplified Employee Pension IRAs, or SEP-IRAs. Only employers and the self-employed can make contributions to this type of account.

The annual contribution limit is the lesser of 25% of employee compensation, or $70,000 in 2025 and $72,000 in 2026. There are no income limits for contributing to a SEP-IRA. You deduct your contributions in the year you make them.

SEP-IRAs are a good choice for self-employed workers or small-business owners who want to contribute the maximum amount of money to their retirement account. However, you must contribute the same percentage to all eligible employees who participate. If you have a large staff, you could be required to contribute a significant amount to their retirement accounts if you want to maximize your own retirement contributions.

SIMPLE IRAs

Just as with SEP-IRAs, employers and the self-employed can set up SIMPLE IRAs, but both employers and employees can contribute to this type of account. Employees may contribute up to $16,500 in 2025 and $17,000 in 2025. Some workers are eligible for an increased elective deferral limit, which allows contributions of up to $17,600 in 2025 or $18,100 in 2026.

Workers 50 and older in the smallest SIMPLE IRA plans (25 or fewer employees) have a special catch-up contribution limit of $3,850 for 2025 and 2026. Larger SIMPLE IRA plans (26 to 100 employees) permit catch-up contributions of $3,500 in 2025 and $4,000 in 2026 for those 50 and older. Employees aged 60 to 63 in all SIMPLE IRA plans may make catch-up contributions of up to $5,250 in both years.

There are no income limits for contributions to this type of account.

This account may have lower contribution limits than the SEP-IRA, but you have more flexibility in structuring contributions to employees.

Rollover IRAs

A rollover IRA is a type of IRA that allows you to transfer money from another retirement account. For example, if you leave a job and you had a 401(k) at your workplace, you can move the money from your 401(k) into a rollover IRA.

You do not need to open a specific "rollover IRA" in order to move your money from your existing retirement account. You can transfer your funds into any existing IRA that you already have. However, rolling over money can sometimes have tax consequences.

If you do not want to owe taxes, move your money into the same type of account that you currently have. For example, you can roll over a traditional 401(k) into a traditional IRA or a Roth 401(k) into a Roth IRA.

Spousal IRAs

A spousal IRA is a regular IRA that you fund on behalf of a spouse who has little or no earned income. You can use either a traditional or Roth IRA to save for a non-employed spouse. The contribution limit is the same as it is for a traditional and Roth IRA that you would open for yourself -- $7,000 in 2025 and $7,500 in 2025, plus an additional $1,000 in catch-up contributions for those who are 50 and older ($1,100 in 2026).

If you or your spouse does not have enough earned income to contribute to your own IRA, a spousal IRA can be an ideal choice.