There are many different types of retirement plans for self-employed individuals. A Keogh plan is one of them.

A Keogh (pronounced KEE-oh) plan was once a very popular retirement savings tool for sole proprietors and those who work for unincorporated businesses. However, in 2001, the Economic Growth and Tax Relief Reconciliation Act ushered in big changes to this tax-advantaged retirement plan.

While Keogh plans still exist today, they’re mainly used by highly compensated individuals because they offer high contribution limits. Unfortunately, the administrative burden of operating them can be substantial.

What is a Keogh plan?

A Keogh plan is a type of retirement plan for self-employed individuals and those who work for unincorporated businesses. Contributions to Keogh plans can be made with pre-tax dollars, subject to annual contribution limits.

Keogh plans can be structured as defined benefit plans that guarantee a certain income in retirement. However, most are defined contribution plans -- they don’t provide an income guarantee, but rather allow workers to contribute a set portion of their salaries. The most common types of Keogh plans include:

- Profit-sharing plans: These are a type of defined contribution plan that enables companies to contribute the lesser of 25% of compensation or $72,000 in 2026 ($70,000 in 2025). For those 50 and older, this annual maximum is $80,500 in 2026 ($77,500 in 2025) while workers ages 60 to 63 can contribute up to $83,250 ($81,250 in 2025).

- Money purchase plans: These are a type of defined contribution plan similar to a profit-sharing plan, but companies are required to make annual contributions regardless of whether the business turns a profit or not. They have the same contribution limit as profit-sharing plans.

- Qualified defined benefit plans: These provide a guaranteed annual benefit to retirees, with the amount based on the employee’s years of service. For 2026, the maximum annual benefit is the lesser of 100% of employee compensation or $290,000, up from $280,000 in 2025.

Keogh plans were named after Eugene James Keogh, a New York congressman. The congressman was instrumental in the passage of the Self-Employed Individuals Tax Retirement Act of 1962, a law allowing unincorporated businesses to sponsor retirement plans for workers. However, the IRS has indicated this term is outdated, with Keogh plans now referred to as qualified retirement plans or HR 10s.

Keogh plans can only be used by self-employed individuals and unincorporated businesses.

What are the rules for a Keogh plan?

The rules for a Keogh plan are similar to those applicable to many other retirement plans for the self-employed:

- Contributions are tax-deductible up to annual limits.

- Money in a Keogh plan can be invested and grow on a tax-deferred basis until retirement.

- Withdrawals can be made penalty-free after 59 ½. You are subject to a 10% penalty for early withdrawals unless a hardship exemption applies.

- You are required to take retired minimum distributions after age 73.

- Ordinary income tax applies to withdrawals.

- You can roll over a Keogh plan into a traditional or Roth IRA but may owe taxes on a Roth conversion.

However, Keogh plans can only be used by self-employed individuals and unincorporated businesses. When you start a Keogh plan, you’re obligated to adopt a written plan in accordance with the requirements of IRS Publication 560, although many financial institutions such as banks and brokerage firms can provide you with prototype plans the IRS has approved.

You’re also required to file IRS Form 5500 annually.

Related Retirement Topics

How does a Keogh plan differ from other retirement plans?

Although there are similarities, there are also important differences between Keogh plans and other retirement plans for the self-employed:

- Keogh plans provide a higher limit for tax-deductible contributions than several other plan types, including traditional IRAs and Roth IRAs.

- Keogh plans come with more administrative paperwork and higher costs than other plan types. This can include initial setup fees associated with the creation of your plan documents that can add up to several thousand dollars, as well as annual administration fees

- Anyone with earned income can contribute to a traditional or Roth IRA (provided they fall within income limits), but Keoghs are limited to self-employed individuals and unincorporated businesses

Pros and cons of having a Keogh plan

Keogh plans provide flexibility in how they are structured, with a choice of a defined benefit plan or one of several types of defined contribution plans including a profit-sharing plan or money purchase plan. They also enable higher tax-deductible contributions, so highly compensated individuals may prefer them to other alternatives.

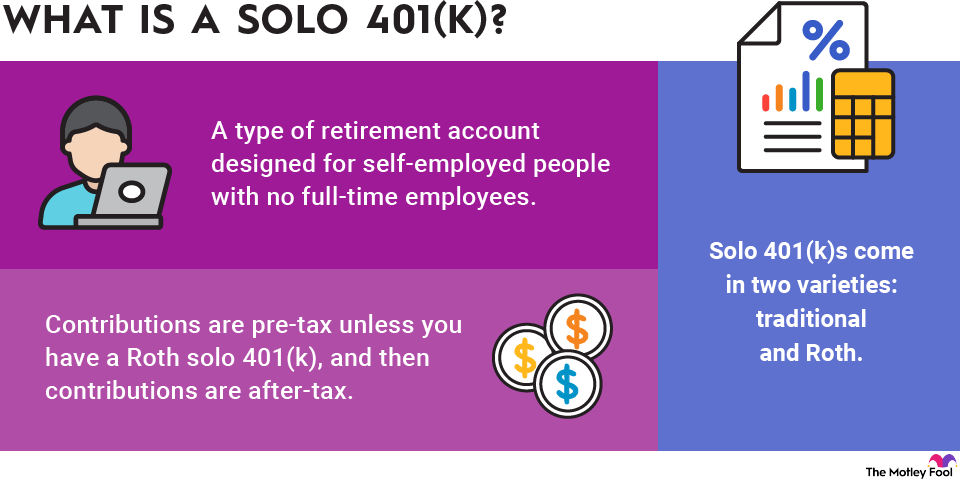

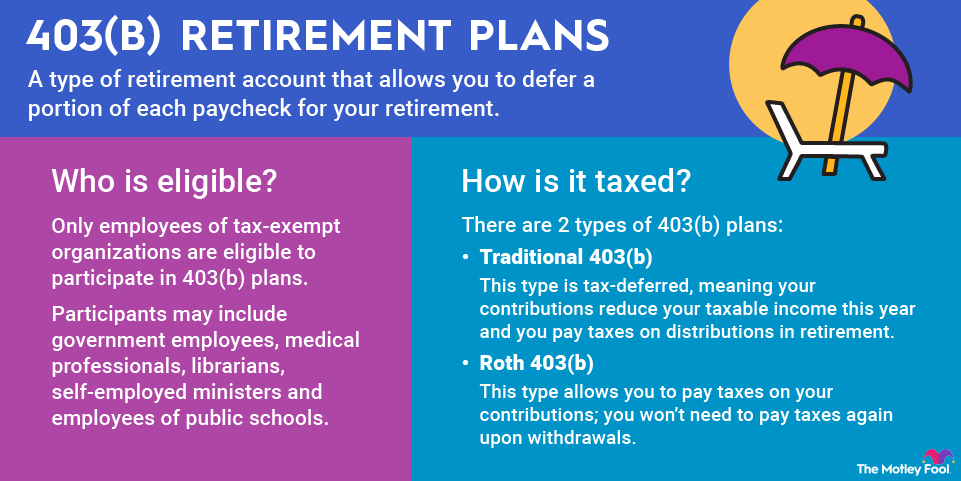

However, the major downside of a Keogh plan is the substantial administrative burden, including the requirement to file an annual Form 5500 with the IRS, and the costs of establishing and maintaining a plan can be higher. Before determining a Keogh plan is right for you, you should consider a SEP-IRA, SIMPLE IRA, Solo 401(k) or traditional or Roth IRA.