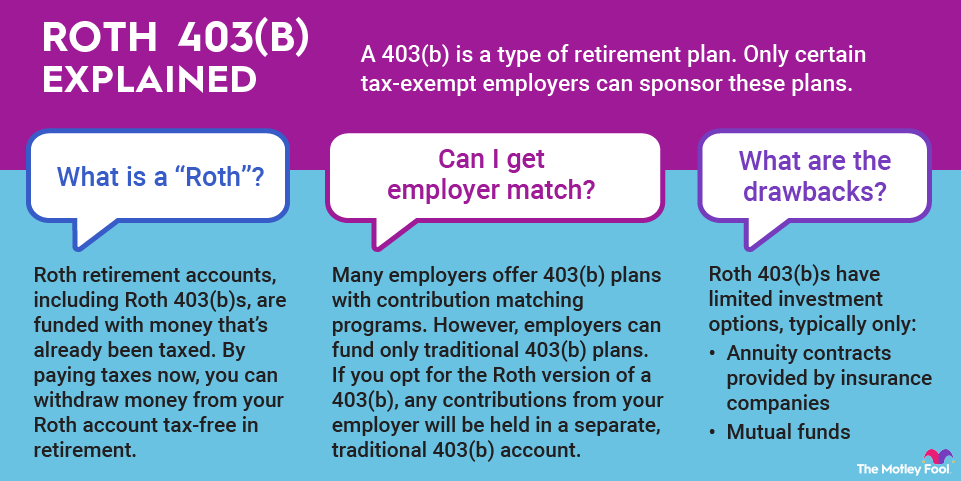

If you work for a nonprofit organization, you may have the opportunity to contribute to a Roth 403(b) retirement plan. A Roth 403(b) is a type of 403(b) plan that employees fund with money that has already been taxed. Withdrawals from Roth 403(b) plans have the benefit of being tax-free in retirement.

Keep reading to learn more about the basics of Roth 403(b)s.

What is a Roth 403(b) and how does it work?

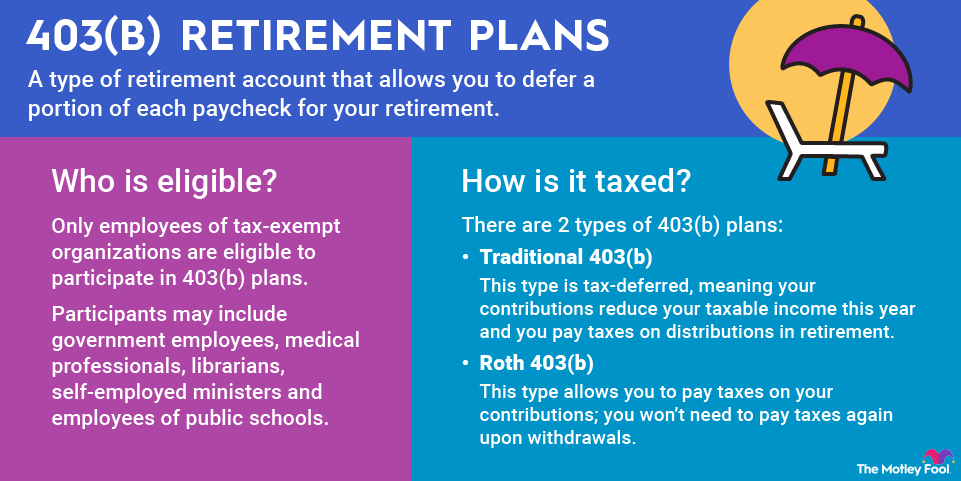

A 403(b) is a type of retirement plan that only certain tax-exempt employers can sponsor. If you're a teacher, healthcare worker, librarian, or minister, you may have access to a 403(b) plan.

A Roth 403(b) is like a Roth 401(k) or a Roth IRA in that Roth 403(b) accounts are funded with money that's already been taxed. By forgoing the tax break now, you earn the right to withdraw money from your Roth account tax-free in retirement.

Many employers that offer 403(b) plans have contribution matching programs, meaning that they match employees' 403(b) contributions up to a certain amount. In the past, employer matches had to be made on a pre-tax basis, even for Roth accounts.

However, the Secure Act 2.0 changed the rules in 2023 to allow employer matches to be made as Roth contributions if the employee chooses. Many plans don't yet offer this feature, though.

A drawback of Roth 403(b)s is that your investment options are typically limited to annuity contracts provided by insurance companies and mutual funds.

Roth 403(b)s vs. traditional 403(b)s

If your employer offers a 403(b) plan, then you may have a choice between a traditional 403(b) and a Roth 403(b). The difference between them is the tax treatment now and in retirement.

Contributions to Roth 403(b) plans are made with after-tax dollars and withdrawals in retirement are tax-free

Contributions to traditional 403(b) plans are made with pre-tax dollars and withdrawals in retirement are subject to income tax.

Roth 403(b) contribution limits

You can contribute to a Roth 403(b) annually no matter how much money you earn. For many employees, 403(b) contribution limits are identical to 401(k) contribution limits.

In 2025, these annual limits are:

- $23,500 for employees younger than 50

- $31,000 for workers ages 50–59 and 64 and older, who are eligible for a catch-up contribution of up to $7,500

- $34,750 for workers ages 60–63 under new Secure Act 2.0 rules

- $70,000 for employee and employer contributions combined for workers younger than 50

- $77,500 for employee and employer contributions combined for workers ages 50–59 and 64 and older

- $81,250 for employee and employer contributions combined for workers ages 60–63

In 2026, the annual limits are:

- $24,500 for employees younger than 50

- $32,500 for workers ages 50–59 and 64 and older, who are eligible for a catch-up contribution of up to $7,500

- $35,750 for workers ages 60–63 under new Secure Act 2.0 rules

- $72,000 for employee and employer contributions combined for workers younger than 50

- $80,000 for employee and employer contributions combined for workers ages 50–59 and 64 and older

- $83,250 for employee and employer contributions combined for workers ages 60–63

Note that these are aggregate contribution limits, meaning that they apply across all of your employer-sponsored retirement accounts.

Internal Revenue Service (IRS) rules provide extra flexibility on catch-up contributions for 403(b) plan participants. If you've worked for your employer for at least 15 years and have a 403(b) plan, then you can contribute an additional $3,000 per year even if you're younger than 50. The lifetime cap on this additional contribution is $15,000.

Roth 403(b) withdrawal rules

Money that you contribute to a Roth 403(b) account cannot be withdrawn at any time without tax or penalty. Qualified withdrawals, which are not subject to tax or penalty, are those that occur after you reach 59 1/2 and have held the Roth 403(b) plan for at least five years. (Certain exceptions are permitted, such as if you become permanently disabled.) Non-qualified withdrawals from a Roth 403(b) account are subject to income tax and a 10% penalty on the earnings portion of the withdrawal.

As of 2024, Roth 403(b) accounts are no longer subject to annual required minimum distributions (RMDs). Those with traditional 403(b)s still need to take RMDs starting at age 73. If you want to avoid taking RMDs, you can explore the option of a Roth IRA rollover.

Taxes with a Roth 403(b)

Money held in a Roth 403(b) account grows tax-free and can be withdrawn tax-free in retirement, provided that you follow the IRS rules for receiving qualified distributions.

If you invest in a Roth 403(b) and your employer matches your contributions -- with those matched contributions and earnings held in a traditional 403(b) account -- then you are liable for paying income tax on those contributions and earnings in the employer-funded account. The income tax would be assessed at the time of withdrawal in retirement.

Should you invest in a Roth 403(b) plan?

A Roth 403(b) or any Roth-style retirement account is a good option if you want to minimize your taxes in retirement or expect tax rates in general to rise. A good rule of thumb is that a Roth account is best if you expect your tax rate in retirement to be higher than your current tax rate.

Contributing to a Roth 403(b) plan, in addition to a traditional 401(k) or individual retirement account (IRA), could be a smart tax diversification strategy. By contributing to multiple types of plans, you can benefit from some tax breaks now and receive some income tax-free in retirement.

Since you can contribute to a Roth 403(b) no matter how much you earn, it is also a great option if your annual pay exceeds the Roth IRA income limits. But since these are employer-sponsored plans, it's incumbent upon your employer to offer one.