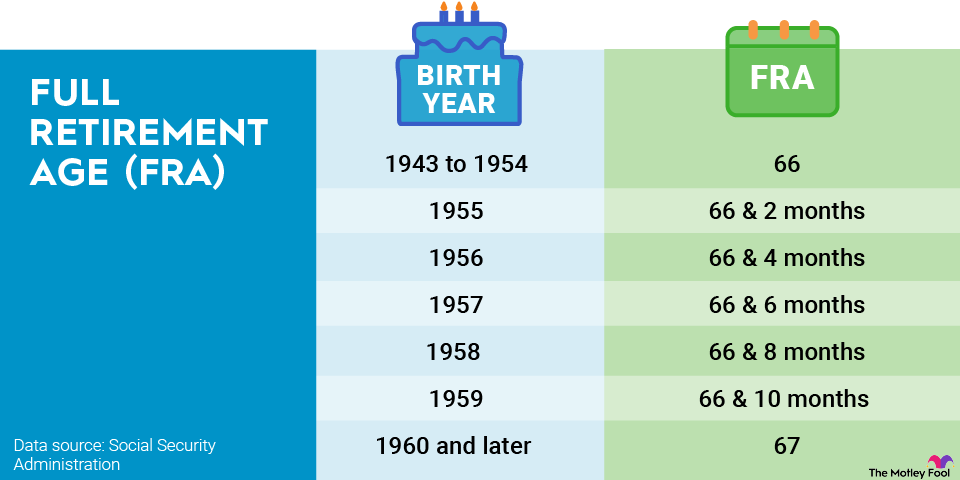

Then, you have to add a further 5/12 of 1% monthly deduction for claiming checks between 62 and 63. So you'd take (((5/12) x 0.01) x 12) x 100, and you'd get an additional 5% decrease. Added together, the two steps above result in 25% smaller checks for claiming at 62 as opposed to waiting until 66.

For those who choose to delay benefits past their FRA, the process is pretty similar. You add 2/3 of 1% per month for every month you delay past your FRA. However, this only continues until you turn 70. After that, your benefit won't grow anymore.

6. Subtract your Medicare Part B premiums if necessary

The five steps above will tell you the kind of benefit you're entitled to based on your work history and claiming age, but that's not always the same as your take-home benefit. Seniors on Medicare have their Part B premiums automatically deducted from their Social Security checks.

In 2025, that's $185 per month. If you're not on Medicare yet, you won't have to worry about this until you sign up for it.

7. Round your benefit amount down to the nearest dollar

The final step in calculating your take-home Social Security benefit is to round your answer from Step 6 down to the nearest dollar. Even if your result from the previous step was $1,680.99, you'd still round down to $1,680 rather than rounding up to $1,681.

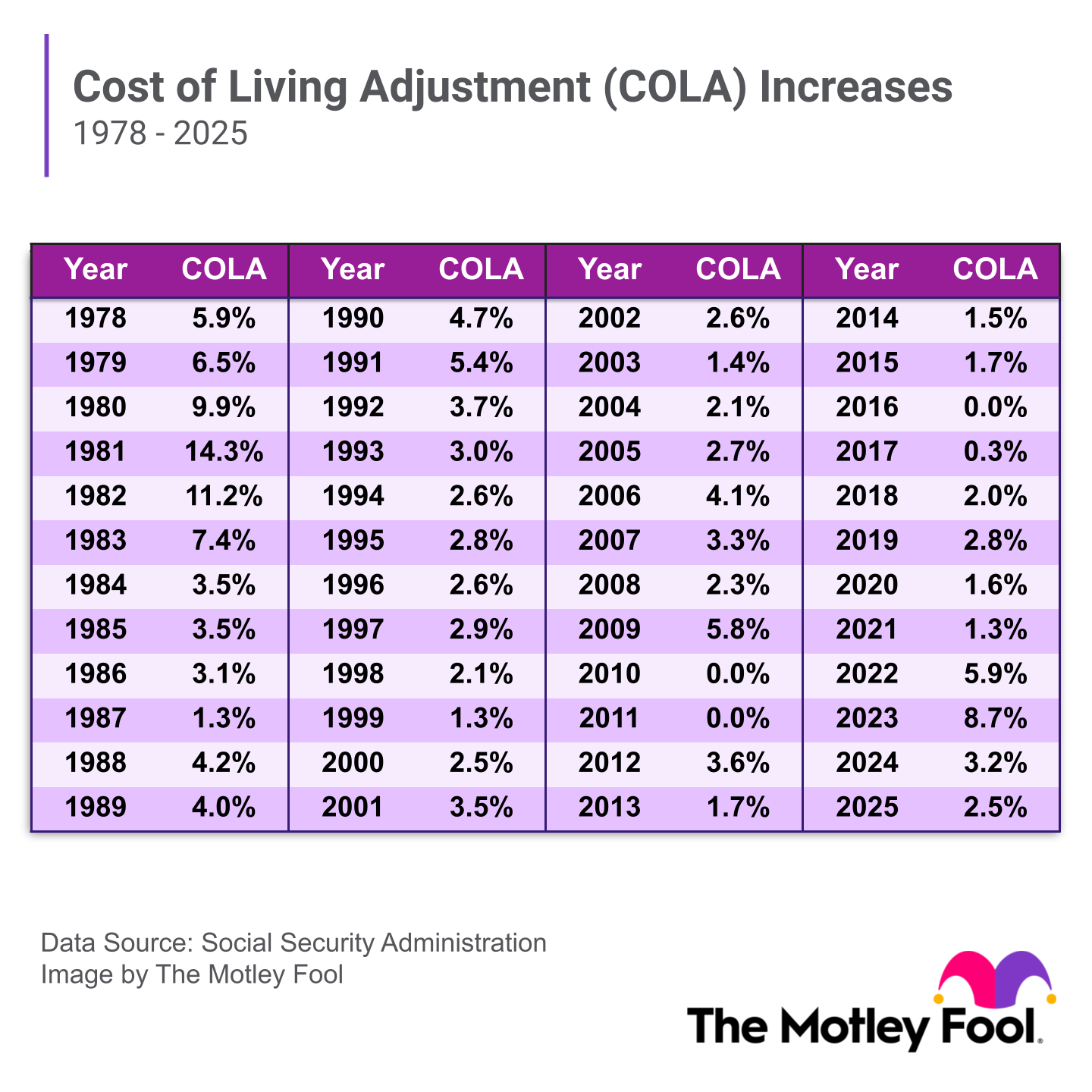

A quick word on cost-of-living adjustments (COLAs)

Every year, the government administers a cost-of-living adjustment (COLA) to help seniors' Social Security checks keep up with inflation. But it doesn't add the COLA to your take-home check. It adds it to your PIA.

If you want to calculate the size of your checks for next year, look at your PIA for the current year and add the COLA. For example, the 2025 COLA was 2.5%, so you'd take your 2024 PIA and multiply it by 1.025 to get your 2025 PIA. Then you proceed with Steps 5 to 7 above to determine your new take-home benefit for the next year.

Why is the Social Security benefits formula important?

Once you understand how the government calculates your Social Security benefit, you can use this information to boost your own benefit. For example, if you didn't know that the government bases your benefit on your 35 highest-earning years, you might have retired before you worked that long. That would have resulted in zero-income years being included in your benefit calculation.

Understanding how your FRA plays into your benefit calculation can also help you choose the best time to sign up. This depends on your life expectancy and financial circumstances.

You can use the steps above to calculate your benefit at various claiming ages. Then multiply each of these monthly benefits by 12 to get your estimated annual benefit. You then multiply this figure by the number of years you expect to claim to get your estimated lifetime benefit. For example, if you expect a $2,000 monthly check at your FRA of 67 and believe you'll live to 87, you'd have an estimated lifetime benefit of $480,000.

Related investing topics