You don't need to be ultra-wealthy to start a trust fund. There are plenty of reasons it may make sense for you to set up a trust fund for your children or grandchildren.

You may want to exercise more control over how your assets are passed on after your death. You may want to use a trust to pay for a loved one's college education. Or maybe you want to reduce your liabilities and potential taxes on your estate. You can set up a trust fund to achieve any one of those goals and more.

In this article, you'll learn:

- The benefits of using a trust fund to transfer assets to loved ones

- The different types of trust funds and how they're structured

- The role of trust funds in estate planning

- Alternative options to provide for your heirs' education or big life expenses

- Whether or not setting up a trust fund is appropriate for you

What is a trust fund?

A trust fund is a legal entity typically used in estate planning. Trust funds can contain financial assets and other property, including heirlooms and artwork. Here's how trust funds work:

- The grantor places assets in a trust fund.

- The trustee manages those assets, including disbursement.

- Beneficiaries receive those assets, but they may need to meet certain conditions stipulated by the trust.

A trust fund is part of creating a trust, which is a legal agreement specifying how someone's assets are to be managed and distributed to beneficiaries. The trust fund is the entity that holds the assets once the trust is created. Because they go hand in hand, a trust fund is often referred to as a trust itself.

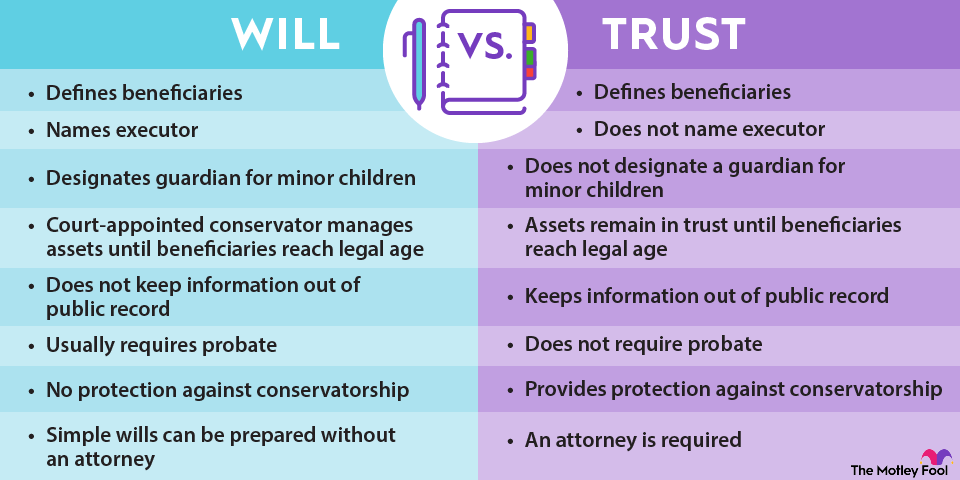

A trust is often an appealing alternative to a last will and testament. The latter goes through the probate process, which is a public court proceeding that can be drawn out. A trust, meanwhile, automatically executes upon meeting certain criteria, such as the grantor's death.

A trust fund is also more flexible than a will. Trusts can specify how the assets in a trust fund are disbursed, while a will provides a lump sum to the beneficiaries.

Operation and structure

There are two main types of trusts: revocable and irrevocable.

A revocable trust, as the name suggests, can be revoked for any reason outlined in the creation of the entity. It may exist for a limited term, or the grantor may simply retain the right to terminate the trust for any reason. For example, a public official may create a trust to manage their stock portfolio while in office to avoid conflicts of interest.

In a revocable trust, the grantor keeps control of all the assets in the trust fund. They might manage the funds themselves or have an unrelated third party manage the account. The latter is known as a blind trust.

With a revocable trust, the grantor is liable for taxes on the trust's earnings. Additionally, creditors may pursue the trust's assets.

An irrevocable trust requires the grantor to permanently transfer assets to the trust fund. Those funds are later disbursed to beneficiaries per the terms outlined in the trust agreement. Irrevocable trusts are more commonly used to gift an estate to children and grandchildren or help pay for education.

Since the grantor permanently transfers assets to the trust fund entity, they're not liable for taxes on earnings generated within the trust fund. Additionally, creditors cannot pursue funds in an irrevocable trust fund, and the beneficiary's creditors cannot go after trust fund money until it's disbursed.

Managing the trust fund

A trust fund is managed by the trustee, which may be an individual or a trust department at a financial institution. The trustee's role is to execute everything laid out in the trust agreement. That may include acting as a fiduciary by making investments in the best interest of the beneficiaries.

The trustee is also responsible for reinvesting income generated by the trust and managing disbursements. Disbursements can occur on a fixed schedule -- every month or year, for example -- or they can be triggered by an event, such as the grantor's death or the beneficiary attending college.

The trustee is also responsible for recordkeeping, filing necessary tax forms, and paying any taxes due. The type and structure of the trust determine who pays taxes on the trust's income, and the burden could fall to the grantor, the beneficiaries, or the trust itself.

For all that work, the trustee is paid a fee. The fee may be a flat annual price, an hourly rate, or a percentage of assets under management. Trust departments at financial institutions typically charge between 1% and 2% of the trust's value.

How estate planning and trusts impact beneficiaries

Trust funds are a great tool for estate planning and minimizing tax liability. If your estate is valued above the estate tax threshold ($13.99 million per individual in 2025) or you expect it will be after appreciation, you can set up an irrevocable trust and move assets into a trust fund to protect your heirs from having to pay the estate tax.

For any income distributed from the trust, beneficiaries (usually children) will pay taxes at their income tax rates according to their modified adjusted gross income. Oftentimes, that's lower than the tax rate the grantor would have paid or the tax rate a trust pays.

Other options for education

Families often consider a trust fund to help save for college on behalf of a child or grandchild. But most people have better options than a trust fund.

One of the most popular education savings accounts is a 529 plan. This tax-advantaged savings account may provide a state income tax deduction for contributions. The earnings on your investment grow tax-free, and withdrawals for qualifying education expenses don't incur income tax.

While there are fees for a 529 plan, they can be much lower than those related to setting up and managing a trust fund. The downsides of a 529 plan over a trust fund are that investment options are limited, and there are limitations on what you can spend the money on.

That said, there are some 529 plans with great investment options, and 529 rules have become increasingly flexible. You can use funds to pay off up to $10,000 in student loans, and as of 2024, you could roll over as much as $35,000 in a lifetime to a Roth IRA.

Another education savings option is a Coverdell Education Savings Account (ESA). The Coverdell allows up to $2,000 in annual contributions per beneficiary. While there's no tax deduction for the contribution, investments grow tax-free, and there's no income tax on distributions for qualifying education expenses.

Coverdells allow tax-free withdrawals for a wider breadth of education expenses than a 529 plan. But they have their own rules that can make them harder to use, including contribution limits and a requirement that all funds be withdrawn by the time the beneficiary reaches age 30.

Some families use Uniform Gifts to Minors Act (UGMA) or Uniform Transfers to Minors Act (UTMA) accounts to help children pay for their education expenses. Both can benefit from taxing earnings at the lower "kiddie tax" rate, which usually saves money compared to what the grantor would pay. They can transfer assets very similarly to a trust fund, without the added expenses of management and legal fees.

Related investing topics

Should I set up a trust fund?

A trust fund can be a very useful tool in estate and retirement planning and for helping loved ones pay for big expenses, such as college tuition, but it's not always the most practical solution. Be sure you explore all the options at your disposal to ensure that the expenses required to set up and manage a trust fund are worth the price.

Depending on your personal financial position and goals, a trust fund could be exactly what you need, or you may be better off with a simpler, less expensive option.