Prioritizing student loans vs. auto loans is a challenge many young adults face when deciding to pay down debt. The decision isn't always obvious since federal student loans offer many different repayment options and the potential for debt forgiveness. Here's everything you should consider in your quest to get rid of your debt.

Federal student loans vs. auto loans

Federal student loans have a lot of benefits over auto loans. As such, it can make sense to focus on paying down your auto loan first.

- You can pause payments on student loans without penalty. If you return to school, you can defer payment on your existing student loans. And if you meet criteria determining you're financially unable to afford payments right now, you can go into forbearance on the loan. Keep in mind interest will continue to accrue (unless it's subsidized), but you won't get penalized on your credit report for failure to pay. On the other hand, if you fail to pay your auto loan, the lender will repossess your car.

- Flexible repayment options. Federal student loans offer several income-based repayment options, which adjust your monthly payment based on your annual income. If your income falls, your monthly payment will fall. If these payments don't fully cover the interest accrued on the loan, the government may subsidize the loan payment to ensure the balance doesn't increase. Auto loans usually have a fixed monthly payment.

- Loan forgiveness. Federal student loans are eligible for loan forgiveness in several instances, including 20 or 25 years of income-based repayments. If employed by the government or a nonprofit, you may be eligible for the Public Service Loan Forgiveness program, which will forgive your student debt after 10 years of payments.

- Tax deductible. Student loan interest is tax deductible for people earning less than a certain threshold. The government won't give you a tax deduction on your auto loan.

Not all these benefits will apply to every borrower. If you're on a fixed payment plan for your student loans and the interest rate is higher than the auto loan, paying down your federal student loan may make sense. In most cases, however, the increased flexibility of federal student loans makes them a reasonable debt to carry over a car loan.

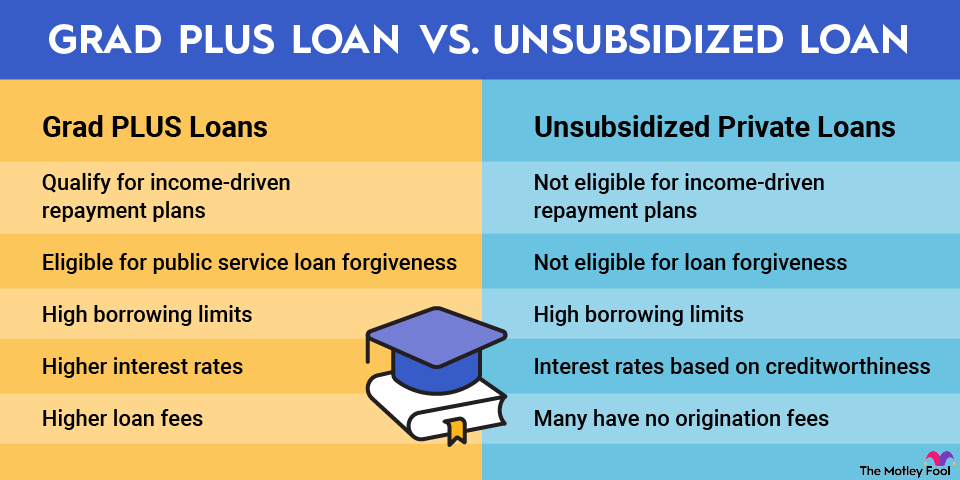

Private student loans vs. auto loans

The benefits of private student loans are far fewer than federal student loans. So deciding between paying down a private student loan and an auto loan typically comes down to just a few factors.

The biggest factor is the interest rate. In most cases, paying down the loan with the highest interest rate makes more sense. If the interest rates are the same, you should prioritize paying down the auto loan, as you may be eligible for the student loan interest tax deduction.

It's also important to consider that your auto loan is secured by the automobile. If you total the car, you'll still be responsible for paying down the loan, even if your insurance doesn't cover the full balance of the loan. That can be the case when you're underwater on an auto loan, and the lender may require gap insurance to make up the difference.

Some factors still favor paying down the student loan, though.

- You can defer payments on the student loan if you return to school.

- The interest paid may be tax-deductible.

- If you declare bankruptcy, it'll be much more difficult to remove the student loan debt than the auto loan.

You should consider the likelihood of those events and the impact they could have on your finances. If you don't plan on returning to school and already have a steady career, paying down the loan with the higher interest rate will help you reach debt-free status sooner.

The bottom line on student debt vs. auto debt

Deciding to pay down your student debt versus auto debt will come down to several factors. One of the biggest is whether you have a private student loan or a federal student loan, which comes with a lot more benefits.

Consider how likely you are to lean on the flexibility of student loans and the added benefit of tax-deductible interest. If those factors aren't worth very much to you in your personal financial situation, it's likely best to pay down the debt with the highest interest rate.

That said, if the interest rates on both loans are extremely low, you may be better off keeping the payments to a minimum and holding cash in a savings account. That could improve your net worth even more than paying down debt.

And if you have a stable career and you're confident you'll pay down the debt over time, you may take some of your savings and invest in stocks for the long run.

Savings Account

Ultimately, it comes down to how much appetite you have for risk. If you're dead set on paying down your debt, use the above information to make an informed financial decision and start tackling your loans.