Traditional IRAs are tax-advantaged retirement savings accounts. Money invested in a traditional IRA can grow tax-free until you begin making withdrawals as a retiree. You'll pay ordinary income taxes on your distributions.

Many, but not all, Americans can invest in a traditional IRA with pretax funds, claiming a deduction for their contribution in the year it is made. However, if a workplace retirement plan covers either you or your spouse, there are income limits for making tax-deductible contributions to traditional IRAs. If you exceed the income limits, you will not be eligible to contribute to your account with pretax funds, but you can still make nondeductible contributions and benefit from tax-free growth. On a related note, there are limits to your IRA contribution as well.

Here's what you need to know about traditional IRA income limits in 2025 and 2026.

Is there a traditional IRA income limit?

No, there is no maximum traditional IRA income limit. Anyone can contribute to a traditional IRA. While a Roth IRA has a strict income limit and those with earnings above it cannot contribute at all, no such rule applies to a traditional IRA.

This doesn't mean your income doesn't matter at all, though. While you can make nondeductible contributions to a traditional IRA no matter how much money you earn, you are subject to an income limit for deductible contributions if either you or your spouse has access to a workplace retirement plan. These limits vary depending on which of you has a retirement plan at work.

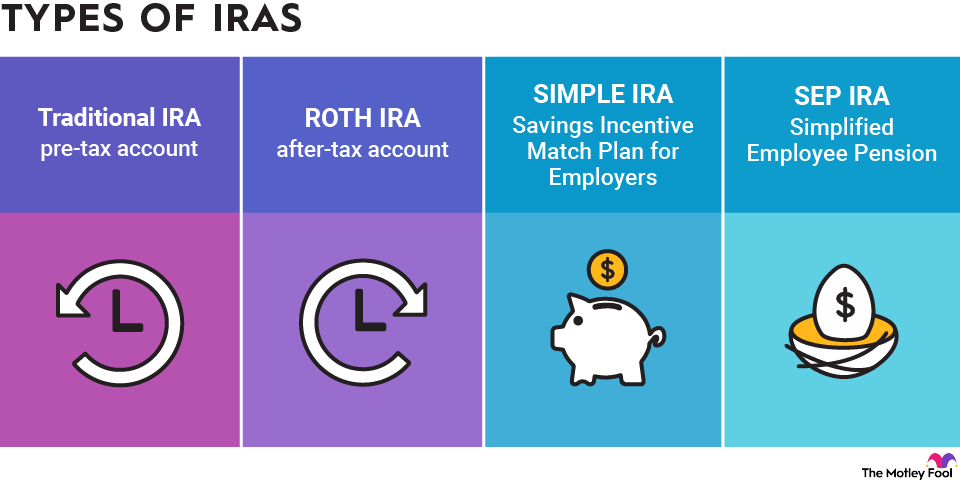

Income limits for other types of IRAs

A Roth IRA is the only IRA that has a strict income limit for eligibility to make contributions. While there are ways to "backdoor" money into a Roth IRA, such as by contributing to a traditional IRA and doing a Roth conversion, you can't put money directly into a Roth if your income exceeds the annual cap.

Traditional IRAs don't have this rule -- nor do other types of IRAs, such as SEP-IRAs and SIMPLE IRAs, which self-employed people and small business owners commonly use. You can contribute to a SIMPLE or SEP-IRA no matter how high your income is, provided you meet the eligibility requirements for these account types.

IRA tax deduction limit

Although there is no overall income limit for contributing to a traditional IRA, there are income limits on tax-deductible contributions.

In other words, if you want to claim a tax deduction equaling the amount of your contribution in the year you invest the funds in your traditional IRA, your income must be below a certain threshold. The table below shows the limit for making tax-deductible IRA contributions in 2025 and 2026 if you are covered by a workplace retirement plan such as a 401(k).

If Your Tax Filing Status Is: | Your Deduction Begins to Phase Out with an Adjusted Gross Income Of: | And You Cannot Make Deductible Contributions at All Once Your Income Exceeds: |

|---|---|---|

Single or head of household | $79,000 (2025); $81,000 (2026) | $89,000 (2025); $91,000 (2026) |

Married filing jointly | $126,000 (2025); $129,000 (2026) | $146,000 (2025); $149,000 (2026) |

Married filing separately | $0 | $10,000 (2025 and 2026) |

If your spouse is covered by a plan at work, there is also a limit on the amount of tax-deductible contributions you're eligible to make to your traditional IRA each year. The table below shows the income limits when your spouse is covered by a retirement plan at work.

If Your Tax Filing Status Is: | Your Deduction Begins to Phase Out with an Adjusted Gross Income Of: | And You Cannot Make Deductible Contributions at All Once Your Income Exceeds: |

|---|---|---|

Married filing jointly | $236,000 (2025); $242,000 (2026) | $246,000 (2025); $252,000 (2026) |

Married filing separately | $0 | $10,000 (2025 and 2026) |

Can I contribute to an IRA if I'm over the IRA income limit?

If your income exceeds these limits, you are still allowed to contribute money to a traditional IRA. However, the contribution that you make will not be tax-deductible.

You may still wish to make a nondeductible contribution, either because you would prefer to allow your investments to grow tax-free and to defer taxes on gains or because you want to make a backdoor Roth IRA contribution by contributing to your traditional IRA and then converting it to a Roth account.

Remember, you are also not subject to these income limits when you make contributions to either a SIMPLE IRA or a SEP-IRA -- options available only if your employer offers them, if you own a small business, or if you are self-employed and can open one for yourself.

The ability to make nondeductible contributions, regardless of income level, makes a traditional IRA a valuable retirement savings account, as it allows for the conversion into a backdoor Roth IRA. Alternatively, some high earners may simply prefer to wait and pay taxes on investment gains in their retirement years, rather than owing the IRS as investments are sold throughout their career.