If you keep up with cryptocurrency at all, it won't take long to hear about coin burning, a method of cutting a coin's supply that became popular around 2017. As you often see in cryptocurrency, it has been copied almost endlessly since then.

With coins large and small, there's news about how the developers burned millions, billions, or even trillions of tokens. In this article, you'll learn exactly what cryptocurrency burning is and why developers do it.

What coins are able to be burned?

Every cryptocurrency can be burned. All cryptocurrencies can be sent to a burn address, which means it's possible to burn cryptocurrency with any of them.

Here are a few notable digital currency tokens that have been burned and the circumstances surrounding these events:

- Cryptocurrency exchange Binance started holding quarterly burns of its Binance Coin in 2017. The exchange has committed to doing this until 50% of the total Binance Coin supply is removed from circulation.

- The Stellar Development Foundation burned more than half of the Stellar supply (55 billion XLM tokens) in 2019.

- In what was likely an attempt to get attention, the developers of Shiba Inu (SHIB -1.03%) gave half the supply to Vitalik Buterin, co-founder of Ethereum (ETH -0.08%), in 2021. He promptly burned 90% of those tokens and donated the rest.

What is proof of burn?

Proof of burn is a consensus algorithm that blockchains can use to validate and add transactions. It's used to prevent fraud and ensure that only valid transactions go through.

A blockchain is a record of a cryptocurrency's transactions, and its consensus algorithm is the way that it confirms transactions. The two most popular consensus algorithms are proof of work and proof of stake; proof of burn is a newer alternative.

With proof of burn, crypto miners need to burn their own tokens to earn the right to mine new blocks of transactions. The more tokens they burn, the more they can mine. In return, participants receive rewards in the cryptocurrency they're mining.

Some proof-of-burn cryptocurrencies require that miners burn the same currency that they're mining. There are also some that let miners burn other types of crypto.

The advantage of proof of burn is that it's an efficient way to validate transactions and doesn't have the energy requirements of the proof-of-work model.

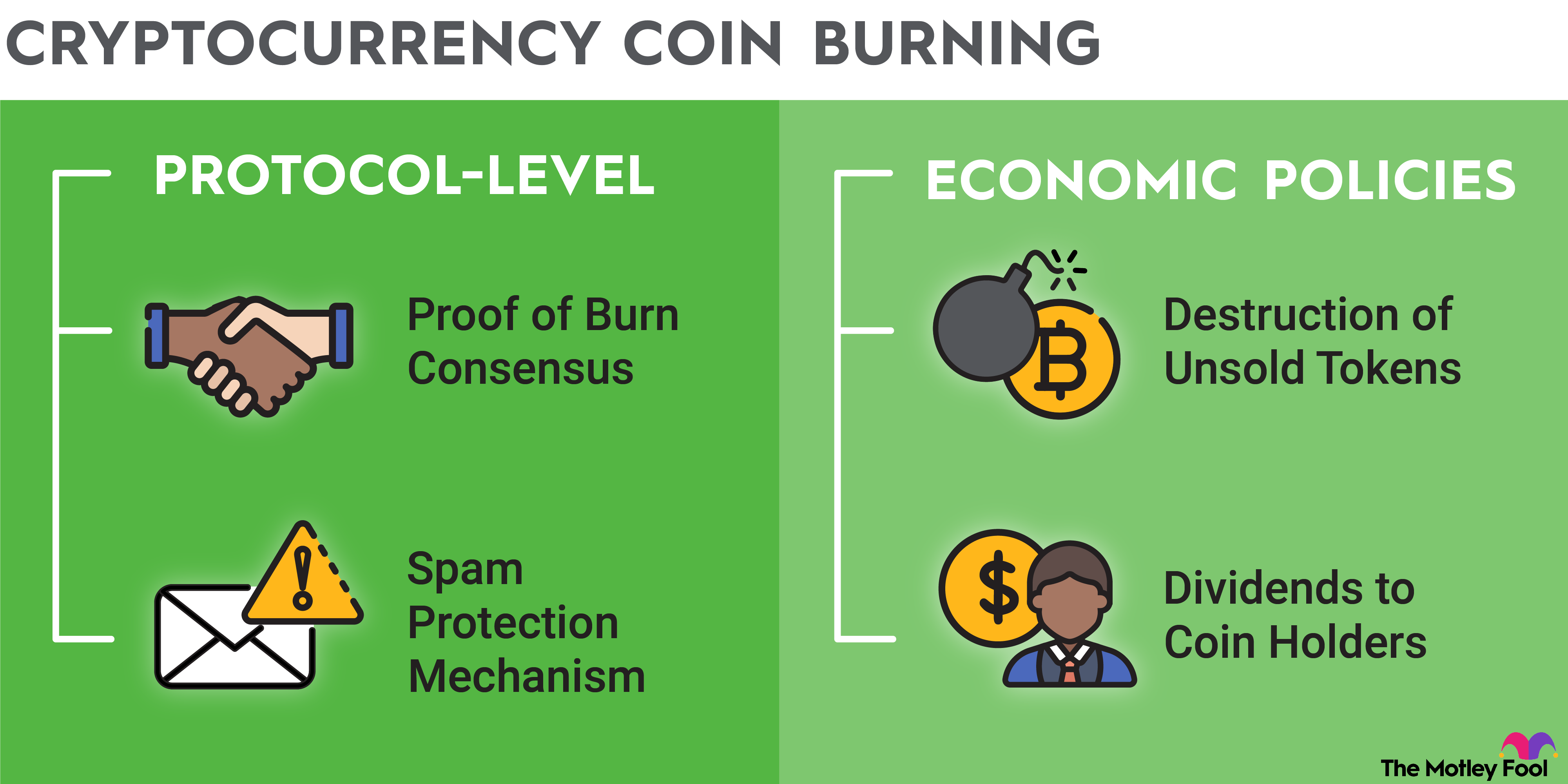

Applications for coin burning

Here are the main applications for coin burning:

- It can help the cryptocurrency rise in value. Although this is far from a sure thing, some cryptos have seen positive price movements after tokens are burned.

- If a cryptocurrency has a high inflation rate, burning tokens can curb the increase.

- It's a way for participants to add new blocks of transactions to a blockchain with proof-of-burn cryptos.

Coin burning on its own doesn't tell you whether a cryptocurrency is a good investment. There are both good and bad cryptocurrencies that burn tokens. By knowing how coin burning works, you can better understand the cryptocurrencies that use it.