Terms like "conglomerate" pop up frequently in the business world. The word is often accompanied by hefty figures and complex corporate structures.

But what exactly is a conglomerate?

Let's strip down the complexity of a familiar term to find a clear definition. You'll also see the role conglomerates play in the local and global economy and how this understanding can aid your investment strategies.

What is a conglomerate?

A conglomerate is a large corporation comprising diverse companies operating in various industries under one umbrella. Unlike focused firms that stick to one line of business, conglomerates spread their wings across multiple sectors, including everything from manufacturing to media.

This diversified business plan helps reduce risks since myriad interests shield the entity from sector-specific downturns. Ideally, combining several distinct operations can lead to synergies and cross-selling opportunities, too.

A conglomerate is somewhat similar to the Japanese keiretsu concept, where several separate companies intertwine their operations and management structures over time, such as the Mitsui (OTC:MITS.Y) keiretsu, which includes industries ranging from real estate to energy utilities.

Automaker giant Toyota (NASDAQ:TM), with its sprawling network of component manufacturers, operates a similarly interconnected group but maintains a unique, more independent structure than a traditional keiretsu. Toyota collaborates closely with the Mitsui keiretsu, standing apart from the other leading groups.

Just across the Sea of Japan, South Korean businesses are often grouped under large family-controlled conglomerates known as chaebols, which are similar in their diversity but different in their governance. Leading chaebols, like Samsung (SSNL.F +56.02%), LG (LPL +1.88%), and Hyundai (OTC:HYMTF), have operations in various sectors, such as electronics manufacturing, financial services, and healthcare.

Why does it matter?

Diversification is the heart of a conglomerate's appeal.

By having fingers in multiple pies, conglomerates can stabilize their revenue streams, balancing out the losses in one area with gains in another. For investors, this can translate to steadier returns in tumultuous markets.

However, managing such a complex and diversified portfolio is no small feat. The efficiency of capital allocation and the challenge of keeping a vast empire profitable raise pertinent questions about the agility and focus of conglomerates compared to more specialized companies.

And it usually takes a long time to build a proper conglomerate. Even the largest, most diverse conglomerates on the market started with a single business idea and a tight focus. The ability to expand from a simple success story to a sector-spanning business empire hints at a flexible management structure that can adapt to profound market changes.

History speaks

Historically, the concept of a conglomerate has evolved from mere business expansions and mergers to strategic diversifications driven by opportunities in new markets. The mid-20th century saw a surge in conglomerates as companies aimed to capitalize on booming post-war economies and acquired unrelated businesses to broaden their market reach.

History also shows that not all conglomerate structures are built to last.

For example, General Electric (GE +1.62%) was the world's most valuable company at the turn of the century, with operations ranging from aircraft engines and plastics to home appliances, financial services, and the NBC television network.

By 2024, the former giant had simplified its business structure by a radical degree, eventually splitting its last few divisions into three separate companies -- GE Aerospace (GE +1.62%), GE Vernova (GEV +6.12%), and GE Healthcare Technologies (GEHC -0.92%).

Sector-spanning business empires don't magically solve every business problem. Sometimes, the right answer may be several individual companies pursuing their long-term goals independently.

How should investors treat conglomerates?

For investors, understanding conglomerates' strengths and weaknesses is crucial. Here's what you can do with this knowledge:

- Assess stability versus innovation: Conglomerates often boast financial robustness due to diversified revenue sources. However, their large size can hinder rapid innovation, unlike more focused firms that can pivot quickly in response to industry changes.

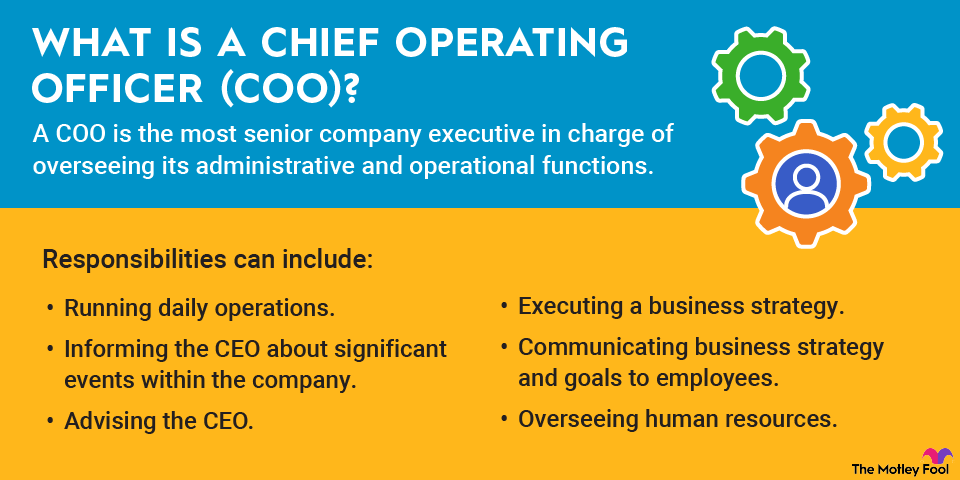

- Consider the management quality: Effective management is critical in steering the colossal ship of a conglomerate. Investors should look at the track record of the company's leadership in managing its diverse businesses.

- Diversification in your portfolio: Investing in conglomerates can be a strategic decision for diversifying one's portfolio, but the portfolio should be balanced with investments in companies with high innovation potential. Yes, you can even diversify your actual diversification bets.

A familiar success story: Berkshire Hathaway

Warren Buffett's Berkshire Hathaway (BRK.A +0.28%) (BRK.B +0.14%) is a textbook example of a successful conglomerate.

What started as a small textile manufacturer in Rhode Island became the basis of a multi-industry business empire under Buffett's control. The master investor turned Berkshire's failing textile business around, using its cash profits to acquire the National Indemnity insurance company in 1967.

A handful of smaller buyouts followed in the retail industry and various manufacturing businesses. And, of course, Buffett picked up several insurance operations along the way, the crown jewel being the auto insurer we now know as GEICO. Berkshire closed down its last textile operations in 1985 in the middle of a furious buyout binge.

Related investing topics

The Berkshire Hathaway you see today has very little in common with the old textile mill owner. With operations ranging from consumer goods and major railroads to home construction and fast food, Berkshire Hathaway built its gigantic market footprint around the investing genius of Buffett and longtime partner Charlie Munger.

The company also makes large investments without taking full control of the target company. Its largest noncontrolling investment, by far, is a $156 billion stake in Apple (AAPL -0.93%).

You can't get much more diverse than Berkshire Hathaway's brand portfolio, and the resulting conglomerate was one of the most valuable stocks on the U.S. market in 2024.