Cryptocurrencies and blockchain technology aim to shake up the status quo of money, the finance industry, and the very foundation of how business is conducted. With a decentralized structure and lower fees, crypto could help make the world a more efficient place.

However, lower fees doesn't mean no fees at all. Whenever work is being done, and money changes hands, someone is being compensated. Enter gas fees.

What are crypto gas fees?

A gas fee is the term used for a transaction fee charged by a blockchain network. Gas fees are charged for any function on a blockchain that requires validation, such as transferring cryptocurrency. They're the fuel that keeps the blockchain network running, hence the term "gas fee."

Not all blockchains use this terminology. Ethereum (ETH +0.08%) was the first cryptocurrency to popularize it. Other types of cryptocurrency may call these transaction fees, miner fees, or something similar.

How gas fees work

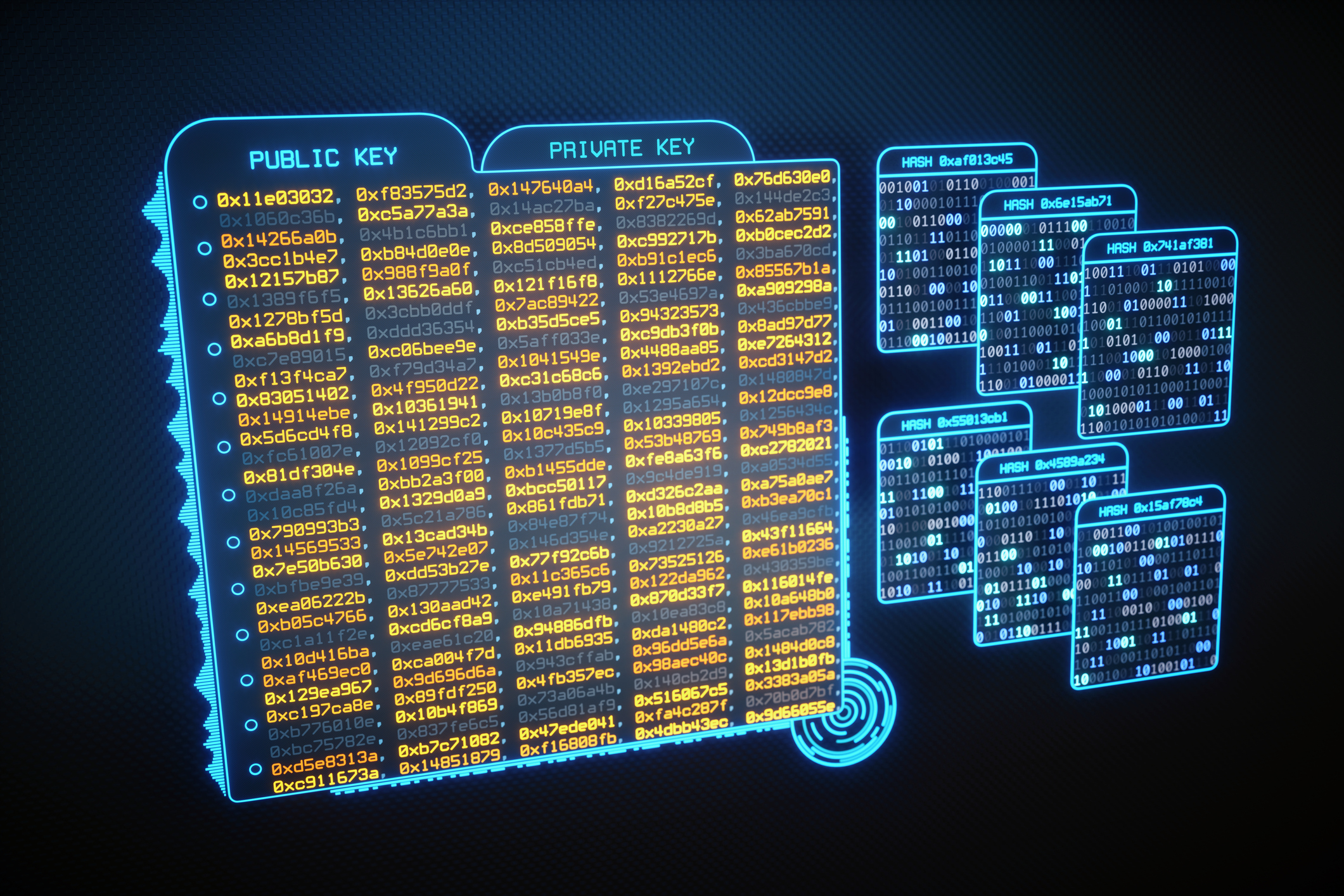

Cryptos such as Ethereum operate on a blockchain, a digital ledger of transactions distributed to a large and decentralized network of computers that manage the blockchain. This is in contrast to cloud computing, which is a centrally managed computing process (usually via a company's data center). Gas is paid to the decentralized network of computers for performing the work -- in this case, the computing power -- needed to execute and record operations on Ethereum.

The gas fees go to the validators who verify and add blocks of transactions to the blockchain. For blockchains that use crypto mining, gas fees go to miners. For blockchains that use a proof-of-stake system, gas fees go to validators who have staked their cryptocurrency.

What generates a gas fee?

All transactions carry a variable gas fee that's based on the size and complexity of the operation. A payment or transfer from one account to another (for an online purchase or reimbursing a friend for a payment) is one of the simplest and cheapest transactions. Other operations that generate gas fees include creating a non-fungible token (NFT) or creating and executing a smart contract.

Why are gas fees necessary?

A basic concept in economics is that all work requires compensation. In a blockchain network, computers use electricity to compute and verify transactions taking place. Electricity -- and the computer that uses it -- costs money. The people who pay for the lights (and the computer) to stay on should be compensated for their efforts to keep the network functioning properly and to prevent unauthorized tampering with the blockchain or theft.

Related investing topics

Gas fees can work in favor of investors

The cryptocurrency industry is rapidly developing. That can cause some extreme swings in crypto prices, which veteran crypto investors have seen several times over the years. Although the crypto space can be viewed as highly speculative and should be approached with caution, gas fees offer a reason to keep currencies such as Ethereum on your radar. Owners of Ethereum can stake their holdings and earn passive income from gas fees.

Granted, that passive income will also be highly variable over time, as will the value of your crypto holdings. Again, exercise caution and make any crypto investment (if you choose to make one at all) part of a diversified portfolio investment strategy, including other assets such as stocks and bonds.