Valuation expansion is an important concept that, if used correctly, can enable investors to achieve superior returns and avoid overpaying for a stock. Unfortunately, it's easy to underestimate its importance because it can appear to be an esoteric concern, so I'll try to keep things straightforward.

What is valuation expansion?

Simply put, valuation expansion occurs when the market assigns a higher multiple to a company's earnings, cash flows, or any other valuation metric you might choose to use. For example, before a valuation expansion, a stock with $10 in earnings might trade for 10 times its earnings, so its share price would be $100.

Fast forward one year; the company has generated $15 in earnings, and the market has decided to expand the valuation multiple on the stock (valuation expansion) to 20 times earnings, so the stock now trades at $300. In other words, it's tripled in value.

It's essential to pause and understand that if the valuation expansion hadn't occurred, the valuation would have been 10 times the $15, so $150. In addition, note that if its earnings had stayed at $10, but the market had still granted the stock a valuation expansion to 15 times earnings, the new valuation would be $150.

As such, valuation expansions are significant for returns and can produce excellent returns even if earnings stay the same.

What causes valuation expansion?

There are three leading causes of valuation expansion:

- A fundamental increase in one of its key metrics, such as profit margins or cash flow generation.

- A change in industry trends or end market dynamics.

- A shift in market sentiment towards a stock or a sector in general.

Fundamental changes

Company fundamentals change constantly, and if you can identify a positive and lasting trend in one of them in a company, it could lead to the market granting the stock a valuation premium.

For example, consider Trimble (TRMB +1.50%), a workflow and positioning company. Although the company's roots lie in positioning hardware, its long-term software and services revenue is growing, which comes with higher margins and cash flow. As such, when Trimble starts demonstrating that it can increase its profit margins and cash flow generation, the market might be willing to give it a higher valuation multiple (based on near-term metrics) to reflect the step change in its long-term earnings potential.

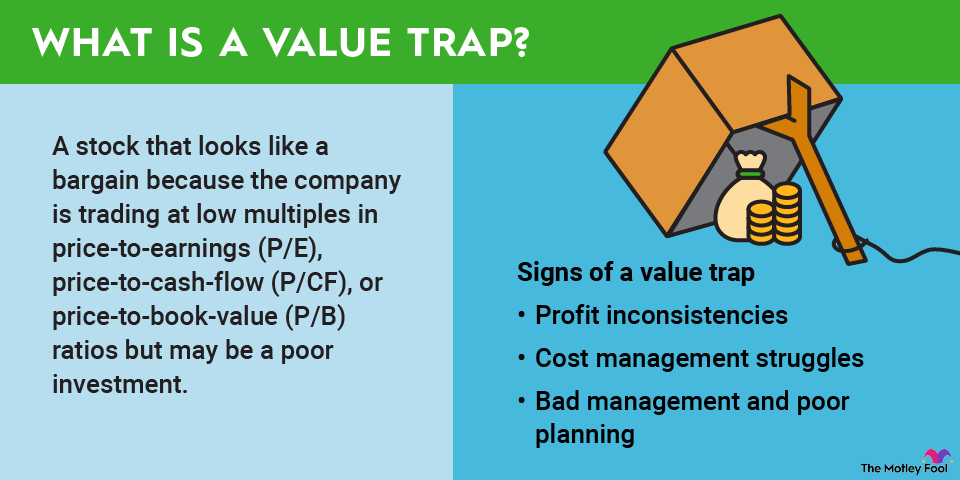

On the other hand, some companies experience short-term improvements in metrics that don't prove sustainable, even as the market has priced them on a higher valuation multiple. In this scenario, the ensuing drop in margins and correction in the valuation multiple can lead to disappointing share price performance.

A change in industry trends and end markets

An example of a change in industry trends and end markets comes from technological or regulatory change significantly improving the company's prospects.

One example of a technological change comes from the increasing use of Internet of Things (IoT) applications and digital technology in the industrial sector. As more companies adopt digital technology and industrial software, the adjacent market for automation solutions will benefit. Simply put, the benefit of using automation is magnified when powered by digital technology and advanced AI-powered analytics.

An example of regulatory change comes from the global regulatory environment favoring hybrid and electrical vehicle (EV) adoption and renewable energy technologies. Investors see these trends in copper mining companies as a net positive because they imply more demand for electrification and copper wiring used in EVs and electricity transmission and distribution networks.

Of course, these trends can change, and caution is needed before firmly concluding they are here to stay.

Related investing topics

Using valuation expansion in investing

The examples above illustrate how investors might identify an aspect of a company's fundamentals, industry trends, or market sentiment that will result in the market pricing in a valuation expansion for the stock. This is a useful tool in any investor's arsenal, and utilizing it can lead to good returns.