Low-cost index funds are ETFs or mutual funds that pool investors' money to track a benchmark index. There's no specific fee level that defines an index fund as "low-cost," but an expense ratio that is significantly below the industry average is a characteristic.

Investors who focus on minimizing their investing costs can generate vastly superior returns over time.

Many investors prefer index funds in ETF, or exchange-traded fund (ETF) form, over mutual funds. They're easier to trade, have lower initial investment requirements, and often have lower expense ratios.

Exchange-Traded Fund (ETF)

In this article, we'll discuss how to choose low-cost index funds that are right for you. We'll also give 10 examples of our favorite low-cost index funds to help get your search started.

Choosing a low-cost index fund

Low-cost index funds can be divided into several categories. Understanding these different types can help you choose the best low-cost index fund for you:

- Total U.S. stock market funds: Total U.S. stock market funds, which track indexes that include all publicly traded U.S. companies, can be a smart way to get broad-based exposure to the U.S. stock market.

- Benchmark index funds: Funds that track the S&P 500 (^GSPC -0.43%) or the Nasdaq-100, just to name a couple of examples, allow you to match the performance of a specific benchmark over time.

- Index funds by market segment: Investing in ETFs by market segment is another way to structure your low-cost index fund portfolio. Index funds focused on large-cap, mid-cap, or small-cap companies are just a few examples.

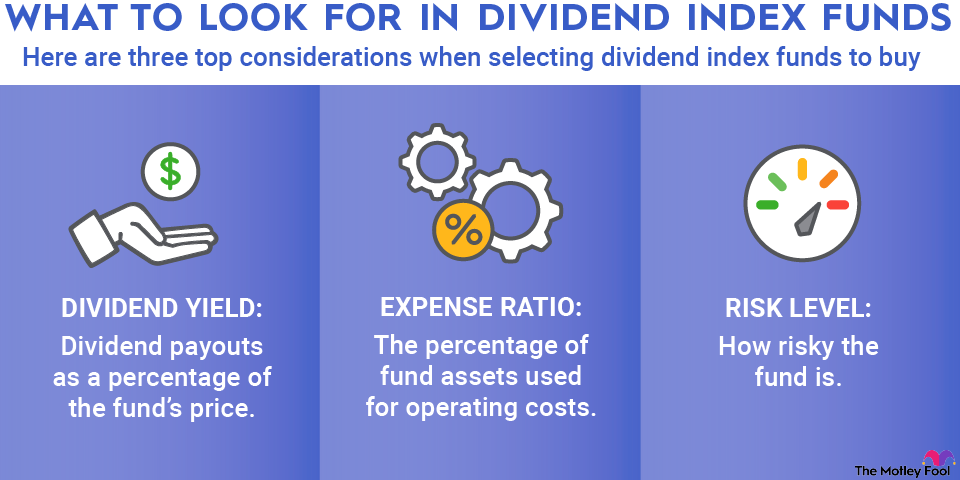

- Other index funds: There are many other index funds beyond the three categories already discussed. Some allow you to invest in a particular stock market sector, such as technology. Others allow you to invest in a particular type of stock, such as value stocks, growth stocks, or dividend stocks.

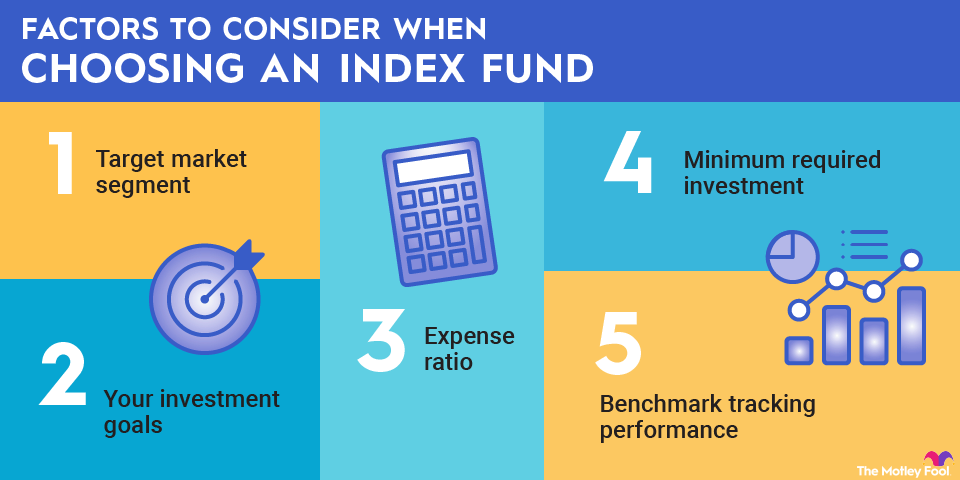

There are several factors to consider, in addition to the investment focus of the index fund, including:

- Expense ratio: An index fund's expense ratio tells you how much your investment fees will be, as a percentage of assets. With low-cost index funds, it can be smart to compare the expense ratios of several funds that track the same index. Even a seemingly small difference can have a big impact on your long-term performance.

- Total assets: How much investor money is in the fund? Some of the largest low-cost index funds have well over $1 trillion invested.

Ten best low-cost index funds to buy

Now, let's get to some examples.

These index funds have some of the lowest expense ratios and could be worth a closer look:

Index Fund | Expense Ratio | Assets Under Management |

|---|---|---|

Vanguard S&P 500 ETF (NYSEMKT:VOO) | 0.03% | $1.5 trillion |

Vanguard Large-Cap ETF (NYSEMKT:VV) | 0.04% | $68 billion |

Schwab U.S. Large-Cap ETF (NYSEMKT:SCHX) | 0.03% | $64 billion |

Vanguard Mid-Cap ETF (NYSEMKT:VO) | 0.04% | $200 billion |

Schwab U.S. Mid-Cap ETF (NYSEMKT:SCHM) | 0.04% | $13 billion |

Vanguard Small-Cap ETF (NYSEMKT:VB) | 0.05% | $163 billion |

iShares Core S&P Small-Cap ETF (NYSEMKT:IJR) | 0.06% | $91 billion |

Schwab U.S. Broad Market (NYSEMKT:SCHB) | 0.03% | $39 billion |

iShares Core S&P Total US Stock Market (NYSEMKT:ITOT) | 0.03% | $81 billion |

Vanguard Total Stock Market ETF (NYSEMKT:VTI) | 0.03% | $2.1 trillion* |

Let's take a deeper dive into a few of these low-cost index funds:

1. Vanguard Total Stock Market Index Fund ETF

NYSEMKT: VOO

Key Data Points

If you want to hold a single index fund ETF that invests in the total U.S. stock market and in the right proportions, the Vanguard Total Stock Market Index Fund ETF might be your best option.

Holding shares in this fund means you'll hold large-, mid-, and small-cap companies proportional to the broader market -- and at a bargain-basement 0.03% expense ratio.

For the set-it-and-forget-it investor, this investment strategy is very difficult to match from a time- and cost-efficiency perspective. Many fund management companies offer total market funds at similarly low costs.

2. Vanguard S&P 500 ETF

NYSEMKT: VV

Key Data Points

The Vanguard S&P 500 ETF tracks the S&P 500. The benchmark index is weighted by market capitalization and includes 500 of the largest U.S. companies. The fund's broad diversification is appealing to many investors.

The S&P 500 is "self-cleansing," meaning that when a particular company no longer meets the criteria for inclusion in the index, it is replaced by a growing company that deserves to be included. The formulaic nature of the inclusion process ensures that only high-quality companies are listed by the S&P and invested in by S&P 500 index funds, like the Vanguard S&P 500 ETF.

3. Vanguard Mid-Cap ETF

The Vanguard Mid-Cap ETF invests in companies with mid-range market capitalizations, with a median market capitalization of approximately $39 billion.

The mid-cap market segment includes companies with established businesses and reliable revenue streams, many of which have yet to grow to their full potential.

The ETF tracks the CRSP U.S. Mid-Cap index by aiming to hold the same stocks in the same proportion as the index. The fund's small expense ratio of 0.04% is competitive among mid-cap ETFs.

Revenue

4. Vanguard Small-Cap ETF

NYSEMKT: VO

Key Data Points

The Vanguard Small-Cap ETF is an attractive option for those seeking to invest in companies with the most growth potential. The fund tracks the CRSP U.S. Small-Cap Index, focusing on U.S. companies in the bottom 2% to 15% of the market capitalization range. The median market cap of the roughly 1,340 stocks in the ETF is $8.5 billion.

Investing in a low-cost, small-cap index fund ETF, such as the Vanguard Small-Cap ETF, can help boost your overall returns. However, due to its small-cap focus, the ETF's performance can be more volatile than that of other investments.

5. Vanguard Large-Cap ETF

NYSEMKT: VV

Key Data Points

As the name suggests, the Vanguard Large-Cap ETF tracks an index of large-cap stocks, specifically the CRSP US Large Cap Index. This index comprises 466 different stocks, and as you might expect, in practice, it is very close to the S&P 500. In fact, the fund's top holdings are the same as those of the Vanguard S&P 500 ETF, and in nearly identical weightings.

6. Schwab U.S. Large-Cap ETF

Unlike the Vanguard Large-Cap ETF, the Schwab U.S. Large-Cap ETF is a little broader than the S&P 500, focusing on the 750 largest U.S. companies by market cap. In short, it has the same top holdings as the other large-cap ETFs on this list, but because the fund has 250 additional stocks, the weights are slightly lower because capital is spread out more.

7. Schwab U.S. Mid-Cap ETF

NYSEMKT: SCHM

Key Data Points

The Schwab U.S. Mid-Cap ETF is an index fund that tracks the Dow Jones U.S. Mid-Cap Total Stock Market Index. It owns a total of 495 stocks, and all but one of its holdings make up less than 1% of the fund. Top positions include Robinhood (HOOD -1.74%), United Airlines (NYSE:UAL), and Interactive Brokers (IBKR -1.03%), just to give you an idea about the size of the companies that are included in the index.

8. iShares Core S&P Small-Cap ETF

NYSEMKT: IJR

Key Data Points

The iShares Core S&P Small-Cap ETF tracks an index of small-cap stocks, with 637 different holdings and a low 0.06% expense ratio. It's a narrower index than the commonly used Russell 2000 Small-Cap index, but even so, no stock makes up more than 1% of the fund's total weighting. To name a couple, top holdings include SanDisk (SNDK +6.85%) and BorgWarner (BWA -3.11%).

9. Schwab U.S. Broad Market ETF

NYSEMKT: SCHB

Key Data Points

The Schwab U.S. Broad Market ETF is somewhat between an S&P 500 index fund and a total market index fund. It tracks an index that includes the 2,500 largest publicly traded U.S. companies. However, it is a weighted fund, so it has the same top holdings as the S&P 500, just with slightly lower weights.

10. iShares Core S&P Total US Stock Market

NYSEMKT: ITOT

Key Data Points

The iShares Core S&P Total US Stock Market ETF is very similar to the Schwab Broad Market fund discussed earlier. It tracks the S&P Total Market Index, which contains about 2,500 companies ranging from mega-caps to small-caps. As you might expect, top holdings include companies such as Nvidia (NVDA -0.72%), Microsoft (MSFT -0.74%), and Apple (AAPL +0.62%). Because there are more stocks, the weights of each are slightly lower than those of an S&P 500 index fund.

Set it and forget it

The beauty of an index-based investing style is that you only need to buy and hold -- and be unwaveringly patient. Paying very little for such a strategy is not only possible but also the best way to ensure that you keep the majority of your investment returns over the long haul.

Is a low-cost index fund right for you?

With so many low-cost index funds available, there's little reason to pay more than the bare minimum in fees. But like any investment, there are pros and cons to consider:

Pros:

- Low fees - Keep more of your returns.

- Wealth creation - Index funds are virtually guaranteed to match the performance (net of fees) of the underlying index. This can be a great way to build wealth.

- Low maintenance - With a low-cost index fund, you can simply buy shares and let the fund do the hard work for you.

- Many choices - There are hundreds of excellent low-cost index funds to choose from.

Cons:

- You won't beat the market - By definition, an index fund won't deliver superior performance over time.

- Volatility - Just because index funds spread your money out doesn't mean they can't experience large price swings in short time periods.

Related investing topics

Building a portfolio with low-cost index funds

There's no perfect rule for asset allocation when it comes to low-cost index funds. However, a smart strategy is to invest in a diversified portfolio that fits your investment goals.

As an example, the index funds in my portfolio fall into five different categories:

- Large-cap stocks (or total market index funds).

- Small-cap stocks.

- International stocks.

- Fixed-income (bond) index funds.

- Real estate index funds.

Of my index fund holdings, I have roughly 50% in the first category, and the rest is split fairly equally between the other four. But that might not be ideal for you.

The best course of action if you're unsure of how to construct a portfolio of index funds is to seek the advice of a Certified Financial Planner or other investment professional who can evaluate your personal investment goals and risk tolerance.