Sometimes, the best time to invest in a relatively new market is after the initial euphoria has evaporated. That could very well be the case with investing in CBD, an abbreviation for a chemical found in the cannabis plant called cannabidiol. CBD stocks are shares of publicly traded companies that are involved in the processing and distribution of CBD or provide tools and services to other companies in the CBD industry.

The U.S. legalized hemp-derived CBD at the federal level with the 2018 farm bill. The mere anticipation of the passage of this legislation stoked investors' interest in the stocks of companies involved in the CBD industry.

Although federal legalization served as a key milestone, the U.S. Food and Drug Administration (FDA) chose to exclude CBD from food supplements. As a result, the CBD opportunity in the U.S. hasn't delivered on investors' lofty ambitions.

The CBD industry faces another big challenge in 2026. A continuing resolution passed by the U.S. Congress in November 2025 made significant changes to federal hemp product regulations.

Although the CBD market isn't as attractive as it once was due to the uncertainties created by these changes, investors may still want to consider four CBD stocks:

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Cresco Labs (OTC:CRLBF) | $443.5 million | 0.00% | Pharmaceuticals |

| Green Thumb Industries (OTC:GTBIF) | $1.9 billion | 0.00% | Pharmaceuticals |

| Jazz Pharmaceuticals Plc (NASDAQ:JAZZ) | $9.8 billion | 0.00% | Pharmaceuticals |

| Trulieve Cannabis (OTC:TCNNF) | $1.7 billion | 0.00% | Pharmaceuticals |

1. Cresco Labs

OTC: CRLBF

Key Data Points

2. Green Thumb Industries

OTC: GTBIF

Key Data Points

Like Cresco Labs, Green Thumb Industries (GTBIF -1.46%) is a U.S. cannabis operator based in Illinois. The company has retail stores in 14 states, including California, Florida, Ohio, Pennsylvania, and New York. Green Thumb markets multiple brands in its Rise dispensaries, and its Rythm brand features a lineup of products containing CBD.

The company is profitable and generates positive cash flow. It continues to grow, expanding into Minnesota in 2025.

3. Jazz Pharmaceuticals

NASDAQ: JAZZ

Key Data Points

You might be surprised to find a pharmaceutical stock listed among the top CBD stocks to consider. But Jazz Pharmaceuticals (JAZZ +0.55%) has a direct and important connection with CBD. In 2018, the company's Epidiolex became the first CBD product made from the cannabis plant to win FDA approval.

Jazz actually didn't own Epidiolex at that time. It acquired GW Pharmaceuticals, which developed the CBD drug to treat epileptic seizures, for $6.7 billion in 2021. Epidiolex is not too far from generating annual sales of $1 billion or more, as some analysts projected after it was first approved in the U.S. Sales continue to pick up, as the drug is now approved in more than 35 countries outside the U.S.

Jazz also has other growth drivers in its lineup. Sleep disorder drug Xywav is gaining momentum. The company also launched its biliary tract cancer drug Ziihera in December 2024, and its newest product, Modeyso, which is used to treat diffuse midline glioma, was granted FDA approval in August 2025.

4. Trulieve Cannabis

OTC: TCNNF

Key Data Points

Trulieve Cannabis (TCNNF -0.46%) is a Florida-based cannabis operator. It has retail dispensaries in nine states and cultivation and processing facilities in seven states. The company is especially dominant in its home state's medical cannabis market. Roughly 70% of Trulieve's retail locations are in Florida. Trulieve also has leading market positions in Arizona and Pennsylvania.

Like Cresco Labs and Green Thumb Industries, Trulieve generates most of its revenue from cannabis sales. However, it also markets CBD products, including tinctures.

Tips for successful CBD stock investing

Below are some practical tips for investing in CBD stocks:

- Understand the regulatory landscape.

- Thoroughly examine the financial positions of CBD companies.

- Make sure CBD stocks' valuations are reasonable relative to their growth prospects.

- Diversify your investments to reduce risk.

- Focus on the long term.

Related investing topics

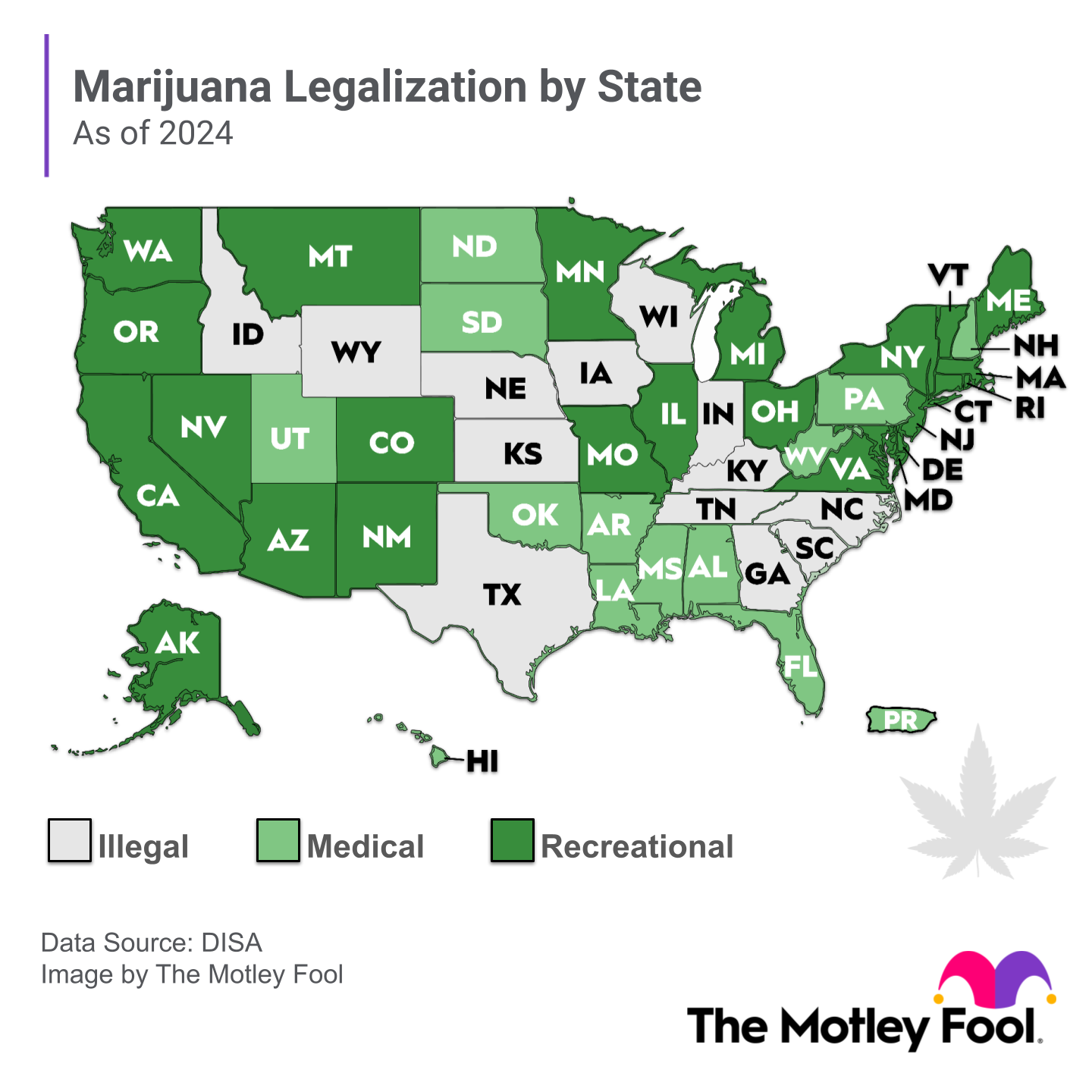

Trulieve experienced a setback when Florida voters rejected a constitutional amendment in November 2024 that would have legalized recreational marijuana. The amendment required a 60% approval to pass, but it only received around 56%.

However, supporters plan to continue pushing for the legalization of recreational marijuana. Trulieve could still have a major growth opportunity in its home state in the future.