It's not the most exciting part of cryptocurrency investing, but if you invest in a digital currency, you need to know how crypto taxes work. The IRS is working hard to enforce crypto tax compliance, with centralized exchanges required to report crypto purchases and sales.

You can end up owing taxes on crypto in a number of ways, and even trading one cryptocurrency for another can be a taxable event. You'll also need to pay taxes if you realize a gain on other digital assets, such as non-fungible tokens (NFTs).

If you don't keep accurate records, it can be hard to piece together your gains and losses at tax time. And if you don't pay your crypto taxes -- even if it's an honest mistake -- you could end up paying costly penalties.

This guide will explain everything you need to know about taxes on crypto trading and income. You'll learn about crypto tax rates, how to file crypto taxes, and other important details about this complex subject.

Do you pay taxes on crypto in the U.S.?

You're required to pay taxes on crypto. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law, just like transactions related to any other property.

Taxes are due when you sell, trade, or dispose of cryptocurrency in any way and recognize a gain. For example, if you buy $1,000 of crypto and sell it later for $1,500, you would need to report and pay taxes on the profit of $500. If you dispose of cryptocurrency and recognize a loss, you can deduct that on your taxes.

Buying crypto on its own isn't a taxable event. You can buy and hold digital currency without incurring taxes, even if the value increases. There needs to be a taxable event first, such as a sale of the cryptocurrency.

The IRS has been taking steps to ensure crypto investors pay their taxes, and it developed a tax form, 1099-DA, specifically for cryptocurrencies and digital assets. Any platform offering digital assets, including centralized crypto exchanges, must report crypto activity through Form 1099-DA starting with the 2025 tax year.

A rule was put in place in 2024 that decentralized crypto exchanges would also be required to do this starting in 2027, but that rule was overturned in mid-2025.

Crypto tax rates for 2024

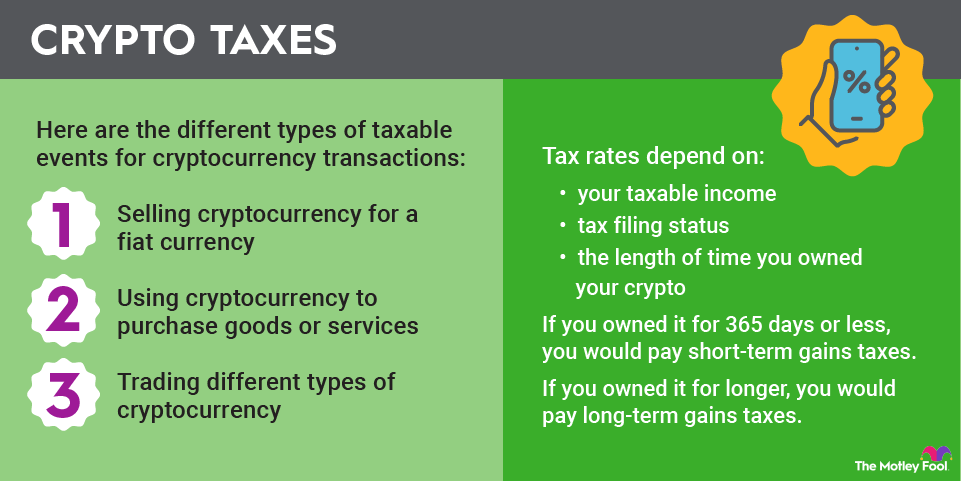

Cryptocurrency tax rates depend on your taxable income, tax filing status, and the length of time you owned your crypto before selling it. If you owned it for 365 days or less, you would pay short-term gains taxes, which are equal to income taxes. If you owned it for longer, you would pay long-term gains taxes.

Here are the cryptocurrency tax rates on long-term gains for the 2024 tax year.

Tax Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

0% | $0 to $47,025 | $0 to $94,050 | $0 to $63,000 |

15% | $47,026 to $518,900 | $94,051 to $583,750 | $63,001 to $551,350 |

20% | >$518,900 | >$583,750 | >$551,350 |

Short-term gains are taxed as ordinary income. Here are the crypto tax brackets on these short-term gains for the 2024 tax year:

Tax Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

10% | $0 to $11,600 | $0 to $23,200 | $0 to $16,550 |

12% | $11,601 to $47,150 | $23,201 to $94,300 | $16,551 to $63,100 |

22% | $47,151 to $100,525 | $94,301 to $201,050 | $63,101 to $100,500 |

24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,501 to $191,950 |

32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,700 |

35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,701 to $609,350 |

37% | >$609,350 | >$731,200 | >$609,350 |

You can sell older coins first to pay the lower long-term gains tax rates. Imagine you've been buying Bitcoin (BTC -0.49%) regularly for the past two years, and now you've decided to sell some. If you sell Bitcoin you've had for over a year, it will be considered a long-term gain, and you'll pay a lower crypto tax rate on it.

Crypto tax rates for 2025

Here are the long-term cryptocurrency tax rates that will apply when you file your 2025 tax return.

Tax Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

0% | $0 to $48,350 | $0 to $96,700 | $0 to $64,750 |

15% | $48,351 to $533,400 | $96,701 to $600,050 | $64,751 to $566,700 |

20% | >$533,400 | >$600,050 | >$566,700 |

As previously noted, the IRS taxes short-term crypto gains as ordinary income. Here are the 2025 income tax rates that will apply to gains on crypto you held for 365 days or less.

Tax Rate | Single | Married Filing Jointly | Head of Household |

|---|---|---|---|

10% | $0 to $11,925 | $0 to $23,850 | $0 to $17,000 |

12% | $11,926 to $48,475 | $23,851 to $96,950 | $17,001 to $64,850 |

22% | $48,476 to $103,350 | $96,951 to $206,700 | $64,851 to $103,350 |

24% | $103,351 to $197,300 | $206,701 to $394,600 | $103,351 to $197,300 |

32% | $197,301 to $250,525 | $394,601 to $501,050 | $197,301 to $250,500 |

35% | $250,526 to $626,350 | $501,051 to $751,600 | $250,501 to $626,350 |

37% | >$626,350 | >$751,600 | >$626,351 |

How to determine whether you owe crypto taxes

You owe crypto taxes if you spend your crypto and it has increased in value from when you bought it. Here are the different types of taxable events for cryptocurrency transactions:

- Selling cryptocurrency for a fiat currency.

- Using cryptocurrency to purchase goods or services.

- Trading different types of cryptocurrency.

These are only taxable events if the value of your crypto has increased. To determine whether you owe crypto taxes, you need the cost basis, which is the total amount you paid to acquire your crypto. Then, you compare that to the sales price or proceeds when you used the crypto.

Let's say you previously bought one Bitcoin for $20,000. Here are some examples of taxable events you could encounter:

- If you sell one Bitcoin for $100,000, you'd report $80,000 in gains.

- If you use one Bitcoin to purchase an $80,000 car, you'd report $60,000 in gains.

- If you trade one Bitcoin for $90,000 of another cryptocurrency, you'd report $70,000 in gains.

Trades between coins are where crypto taxes get complicated. A crypto trade is a taxable event. If you trade one cryptocurrency for another, you're required to report any gains in U.S. dollars on your tax return.

Every time you trade cryptocurrencies, you need to keep track of your gains and losses in U.S. dollars so that you can accurately report them. If you'd rather keep it simple, cryptocurrency stocks could make tracking gains and losses simpler than buying and selling specific coins.

NFT taxes work the same way as crypto taxes. If you realize a gain from selling an NFT, you owe taxes on those gains.

Keep in mind that if you mint an NFT and pay a gas fee in crypto, this is considered purchasing a service with your crypto, meaning it's a taxable event. If the value of the cryptocurrency you used for the gas fee were to increase after you bought it, you would owe taxes on the amount of the gains.

How to report crypto on taxes

Crypto gains and losses are reported on Form 8949. To fill out this form, provide the following information about your crypto trades:

- Name of the cryptocurrency

- Date you acquired it

- Date you sold, traded, or otherwise disposed of it

- Proceeds or sales price

- Cost basis

- Total gain or loss

Repeat this process with every taxable crypto event you had for the year.

How is crypto income taxed?

Crypto income is taxed as ordinary income at its fair market value on the date the taxpayer receives it. Here are the most common examples of what is considered crypto income:

- Receiving crypto as payment for providing a service

- Mining crypto and earning rewards

- Staking crypto and earning rewards

- Lending crypto and receiving interest payments

Related investing topics

Do you pay capital gains on crypto?

Crypto is taxed like stocks and other types of property. When you realize a gain after selling or disposing of crypto, you're required to pay taxes on the amount of the gain. The tax rates for crypto gains are the same as capital gains taxes for stocks.

Part of investing in crypto is recording your gains and losses, accurately reporting them, and paying your taxes. Like every investor, you want to keep this tax burden to a minimum.

In closing, let's look at a few effective ways to minimize crypto taxes:

- Hold successful crypto investments for more than a year before selling or using them. Tax rates on these long-term gains are lower than rates on short-term gains.

- Use tax loss harvesting. If you've had gains and losses on different types of cryptocurrency, you can sell both and use the losers to offset your gains.

- Consider investing in crypto through an individual retirement account (IRA) for tax benefits. While you typically can't buy cryptocurrencies directly with an IRA, you could buy cryptocurrency stocks or exchange-traded funds (ETFs) -- there are now quite a few Bitcoin ETFs and Ethereum (ETH -0.63%) ETFs available.