Stocks are easy to trade but only give you ownership in one company. Mutual funds provide diversification and flexibility with professionally managed portfolios but are saddled with clumsier trading processes and potentially higher tax bills.

An exchange-traded fund (ETF) delivers the best of both worlds. With ETFs, you get access to large, diversified stock portfolios through a single ticker that behaves like a simple stock in many ways.

What is it?

What is an ETF?

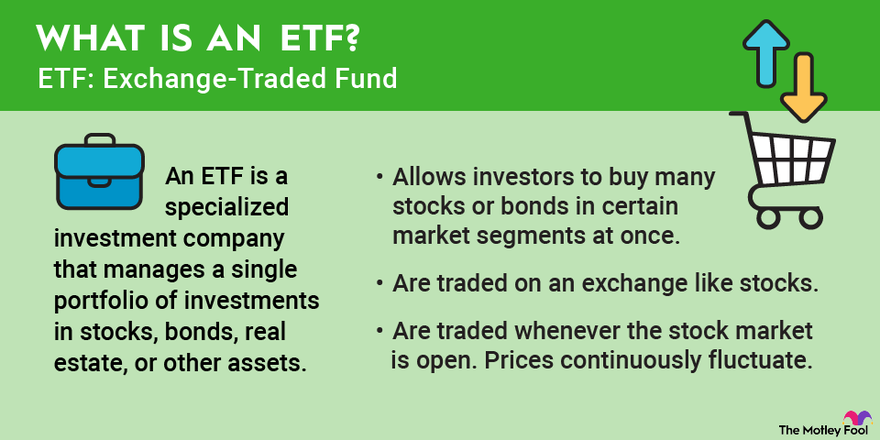

An ETF is a specialized investment company that manages a single portfolio of investments in stocks, bonds, real estate, cryptocurrencies, or other assets. This company is then registered on the stock market, much like any other business. You can buy or sell shares of an ETF at any time during a normal market day, and the share price reacts in real time to shifting buyer demand and supply-side sells.

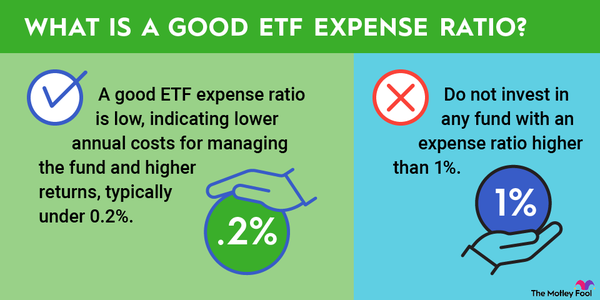

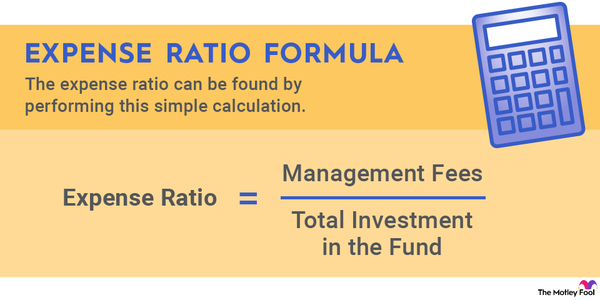

Most ETFs are passively managed, set up to simply mirror the composition and performance of a specific market index. Others are actively managed by professional fund advisors attempting to beat the market through human expertise. In most cases, you're better off with a passive index-tracking ETF's predictable, long-term performance, which also comes with lower management fees.

What's unique?

What's so special about ETFs?

At first glance, an ETF looks a lot like a mutual fund. You use a single ticker to trade ownership in a curated list of stocks (or other assets) and reap the rewards of instant diversification. In some cases, the investment firm behind the scenes offers a mutual fund version and an ETF alternative tracking the same market index. The results of owning either one are effectively the same in the long run.

However, there are some significant differences between ETFs and mutual funds:

- Mutual funds change hands only once per day after the market closes, while ETFs are available whenever the stock market is open.

- The tax-reporting paperwork for a mutual fund is quite different, and you may end up paying taxes on individual stock transactions made by the fund. With an ETF, the day-to-day stock trading is handled by the fund manager. Your only tax liability is based on buying and selling the actual ETF.

- Passive index trackers are far more popular in the ETF world than among mutual funds. According to Charles Schwab (SCHW -0.4%), about 500 index-tracking mutual funds are on the market today, but 2,000 ETFs are in the same category. Therefore, it's easier to find an ETF that matches your investing style and sector focus.

How to use them

How to use ETFs

An ETF is a cost-effective way to inject a diversified group of stocks into your portfolio without complicating the trading and tax reporting experience. Many investors take advantage of these flexible funds by mirroring the stock market as a whole through funds tracking the S&P 500 (SNPINDEX:^GSPC) or Russell 3000 indexes.

Popular funds tracking the S&P 500 include the Vanguard 500 Index Fund ETF (VOO 0.02%) and the SPDR S&P 500 ETF Trust (SPY 0.0%). Warren Buffett's Berkshire Hathaway (BRK.A 0.12%)(BRK.B -0.05%) has large holdings in both.

For the ultra-broad Russell 3000 index, you could use the iShares Russell 3000 ETF (IWV 0.23%) or the Vanguard Russell 3000 ETF (VTHR 0.21%). These funds offer immediate exposure to hundreds or even thousands of stocks across every conceivable industry, with robust liquidity and minimal management fees.

How to invest

How to invest in ETFs

Investing in ETFs is very similar to investing in stocks. You may gain exposure to a long list of stocks and other assets, but it's done through a single ticker symbol, and your new investment is managed just like a stock. If you know how to buy a stock, you also know how to buy an ETF.

Stock Ticker

ETFs update their prices during each market day, and your order to buy or sell them can be executed right away. This is different from mutual funds, whose share price and transactions are updated only after the closing bell.

So, you probably know the drill already: Open and fund a brokerage account (if you didn't already have that essential puzzle piece), research your options, and pick the best ETF for your purposes. At this point, you're almost done. Set your budget for this ETF investment, figure out how many shares you can buy for that amount, and place your order. Before you know it, the targeted ETF will be part of your portfolio.

The job doesn't end there, of course. Just like any stock, you should keep an eye on your ETF and be ready to take action if your investment thesis changes.

Related investing topics

If an index-tracking ETF is the only investment you'll ever make, that's a perfectly reasonable strategy that puts your financial management efforts far ahead of most people's. It can also be a stepping stone to picking market-beating individual stocks someday, supported by the robust, long-term gains of a simple index-based platform.

FAQ

FAQ about exchange-traded funds

What are ETFs, and how do they work?

ETFs, or exchange-traded funds, are investment funds traded on stock exchanges just like individual stocks. They hold a collection of assets such as stocks, bonds, or commodities. Investors buy shares of the ETF, which represent a portion of the fund's holdings. ETFs offer diversification, lower fees, and flexibility in trading.

Is an ETF better than a stock?

ETFs and stocks serve different purposes. ETFs offer diversification, spreading risk across multiple assets, which can be safer for beginners. Stocks can offer higher returns but come with higher risk. It depends on your investment goals and risk tolerance.

What is better: ETFs or mutual funds?

ETFs are often better for lower costs, flexibility in trading, and tax efficiency. Mutual funds are better for automatic investments and not needing to actively manage trades. The best choice depends on your investing style and preferences.