Calculating the weights of stocks you own can be useful to your investment strategy. For example, if your investment goal is to allocate no more than 15% of your portfolio to any single stock, determining the weights of the stocks in your portfolio can tell you whether or not you need to make any changes. Here's how to calculate the weights of stocks, what this information means to you, and an example of how you can use this.

Calculating the weights of stocks

Basically, to determine the weights of each of your stocks, you'll need two pieces of information. First, you'll need the cash values of each of the individual stocks for which you want to find the weight.

You'll also need your total portfolio value. If you want to determine the weights of your stock portfolio, simply add up the cash value of all of your stock positions. If you want to calculate the weights of your stocks as a portion of your entire portfolio, take your entire account's value -- including stocks, bonds, cash, and any other investments.

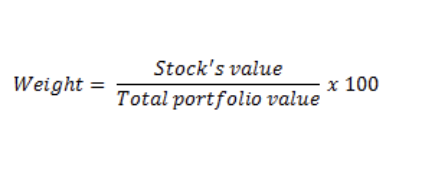

The calculation is simple enough. Simply divide each of your stock position's cash value by your total portfolio value, and then multiply by 100 to convert to a percentage.

Weight = (Stock’s value / Total portfolio value) × 100

What the weights tell you

These weights tell you how dependent your portfolio's performance is on each of your individual stocks. For example, your portfolio's day-to-day fluctuations will depend much more on a stock that makes up 20% of the total than one that only makes up 5%.

So, when your heavily weighted stocks do well, your portfolio can go up quickly. For example, if a stock with a 20% weight in a $50,000 portfolio doubles, it would mean a $10,000 gain. On the other hand, if a stock only makes up 2% of your portfolio, your gain would only be $1,000, even though the stock itself was a home run.

Conversely, heavily weighted stocks can drag your portfolio down during tough times, while lower-weighted stocks will have a smaller effect.

Related investing topics

STOCK | CASH VALUE | WEIGHT |

|---|---|---|

Microsoft | $2,000 | 17.4% |

Wal-Mart | $3,000 | 26.1% |

Wells Fargo | $2,500 | 21.7% |

Johnson & Johnson | $4,000 | 34.8% |

In this example, Johnson & Johnson carries twice the weight of Microsoft; therefore, a big move in J&J will have double the effect on your overall portfolio than the same move in Microsoft would.