The Global X U.S. Infrastructure Development ETF (PAVE +1.51%) is a Morningstar five-star rated exchange-traded fund (ETF) that ranks among the highest for historical risk-adjusted returns in a peer group of 79 competitors.

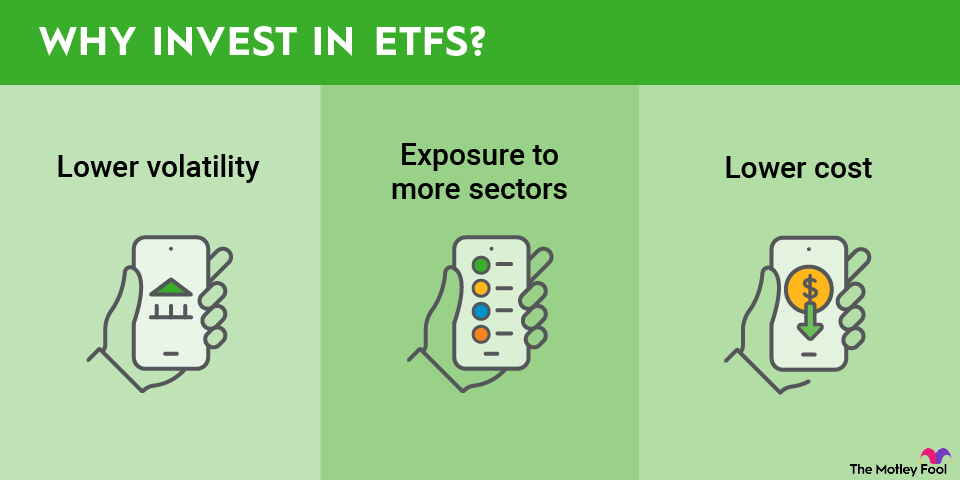

Exchange-Traded Fund (ETF)

But past performance alone shouldn't drive your decision. To understand whether Global X U.S. Infrastructure Development ETF fits your portfolio, you'll want to look at how it selects stocks, what sectors it emphasizes, and its key strengths and weaknesses, especially if you're a beginner investor.

What is the Global X U.S. Infrastructure Development ETF (PAVE)?

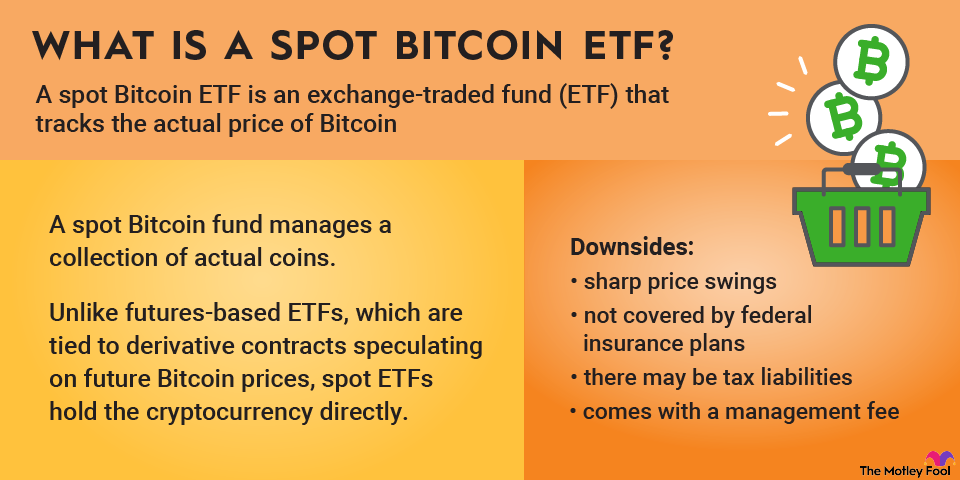

Global X U.S. Infrastructure Development ETF is a passive ETF that seeks to replicate the performance of the Indxx U.S. Infrastructure Development Index. The fund places less emphasis on companies that own and operate infrastructure, such as utilities, toll road operators, and pipeline firms, though some of these names are still included.

Instead, it focuses on the "development" side of the equation, targeting businesses that enable infrastructure expansion and revitalization. That means more exposure to raw materials, heavy equipment makers, engineering firms, and construction companies.

Launched in March 2017, Global X U.S. Infrastructure Development ETF has grown into one of Global X's most popular ETFs, with $9.32 billion in assets under management. It also trades with a 30-day median bid-ask spread of just 0.02%, meaning it's highly liquid.

How to buy Global X U.S. Infrastructure Development ETF (PAVE)

- Step 1: Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Step 2: Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Step 3: Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Step 4: Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Step 5: Submit your order: Confirm the details and submit your buy order.

- Step 6: Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings of Global X U.S. Infrastructure Development ETF (PAVE)

Infrastructure is not one of the 11 official stock market sectors. Instead, it is a cross-sector theme, and Global X U.S. Infrastructure Development ETF reflects that by concentrating most of its exposure in industrials. As of September 2025, the portfolio is made up of about 73% industrials, 21% materials, and smaller allocations of 3.1% in utilities and 2.1% in information technology.

On a fundamentals basis, the ETF's portfolio has an average return on equity of 14%. It trades at around 25 times forward earnings, and carries a price-to-book ratio of 3.35. It's a relatively volatile fund, with a beta of 1.24 versus the S&P 500 and a 22.9% standard deviation, which is not surprising given the cyclical nature of infrastructure development.

Expense Ratio

Historical Performance of Global X U.S. Infrastructure Development ETF (PAVE)

Metric | 1-Year | 3-Year | 5-Year |

|---|---|---|---|

Net asset value | 18.67% | 22.90% | 22.99% |

Market price | 18.69% | 22.90% | 22.99% |

Related investiing topics

The bottom line on Global X U.S. Infrastructure Development ETF (PAVE)

Global X U.S. Infrastructure Development ETF isn't a pure play on infrastructure ownership. It leans into the development side, giving you exposure to companies that make the raw materials, equipment, and engineering services needed to build and modernize infrastructure. That tilt makes it more cyclical and volatile but also better positioned to benefit if government or private-sector spending ramps up.

The fund's track record and size speak to its popularity, though the dividend is minimal, and the expense ratio is middle-of-the-road for a thematic ETF. If you want steady, utility-like cash flows, this isn't the right fit. If you're looking to participate in the growth of U.S. infrastructure investment, it's a credible option.