How would you like to own shares of 500 of the biggest companies traded on U.S. stock exchanges in one fell swoop? That's what you get when you invest in the S&P 500 index, which tracks the performance of 500 of the largest stocks weighted by market cap that trade on the Nasdaq and the New York Stock Exchange (NYSE). And you can profit handsomely from such an investment; the average annual return for the S&P 500 is close to 10% over the long term.

The performance of the S&P 500 index is better in some years than it is in others, though. Here's how the S&P 500 index has performed in recent decades -- and why it's an attractive option for many investors.

S&P 500 annual returns

Since 1957, the S&P 500 index has delivered an average annual return of 10.33%.

Year | S&P 500 Return |

|---|---|

1995 | 37.58% |

1996 | 22.96% |

1997 | 33.36% |

1998 | 28.58% |

1999 | 21.04% |

2000 | -9.10% |

2001 | -11.89% |

2002 | -22.10% |

2003 | 28.68% |

2004 | 10.88% |

2005 | 4.91% |

2006 | 15.79% |

2007 | 5.49% |

2008 | -37% |

2009 | 26.46% |

2010 | 15.06% |

2011 | 2.11% |

2012 | 16% |

2013 | 32.39% |

2014 | 13.69% |

2015 | 1.38% |

2016 | 11.96% |

2017 | 21.83% |

2018 | -4.38% |

2019 | 31.49% |

2020 | 18.40% |

2021 | 28.71% |

2022 | -18.11% |

2023 | 26.29% |

2024 | 25.02% |

2025 | 8.69% |

This table underscores one issue with relying on average annual returns: The performance of the S&P 500 index in most years was far from its average return during the period. Throughout most of the 1990s, for example, the S&P 500 delivered returns that were well above its historical long-term average return. On the other hand, during the first decade of the 21st century, the index underperformed its long-term average return.

However, the table also points to why investing in the S&P 500 index over the long run can be rewarding. The index delivered negative annual returns in only six years during the past three decades. In 13 of those years, the S&P 500 index generated annual returns of more than 20%.

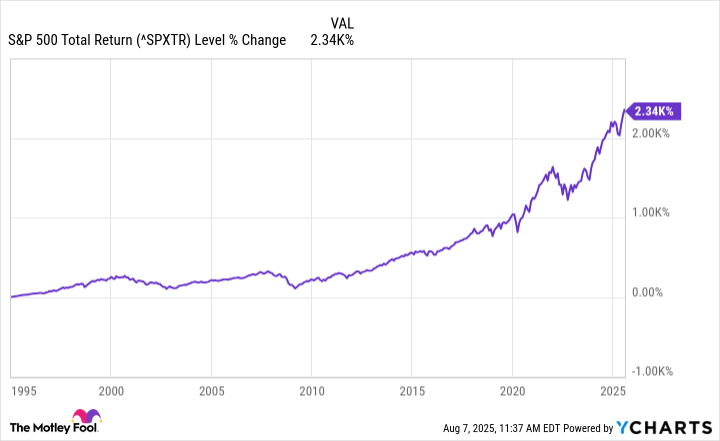

Buying and holding the S&P 500 index over the long run pays off. The following chart shows just how much it's done so over the past 30 years.

If you had invested $10,000 in the S&P 500 index in 1995, you'd now have more than $190,000. Market volatility in a given year could cause this return to decline somewhat. However, the index has proven to be a winner over the long term.

How can you invest in the S&P 500 index?

There are three ways to invest in the S&P 500 index:

- Buy shares of all 500 individual stocks.

- Buy a mutual fund that tracks the S&P 500 index.

- Buy an exchange-traded fund (ETF) that tracks the S&P 500 index.

Investing in each S&P 500 stock individually isn't a very practical approach. That was especially the case before the rise of online brokerages that didn't charge for stock trades. For a long time, buying low-cost mutual funds was the best way for investors to track the performance of the S&P 500 index.

Today, several S&P 500 ETFs are available that have very low annual expense ratios (the percentage of the fund's assets that go toward annual fees). The most widely traded of these ETFs include:

ETF | Expense Ratio |

|---|---|

iShares Core S&P 500 ETF (NYSEMKT:IVV) | 0.03% |

SPDR S&P 500 ETF Trust (NYSEMKT:SPY) | 0.09% |

Vanguard S&P 500 ETF (NYSEMKT:VOO) | 0.03% |

The main difference between buying S&P 500 ETFs vs. mutual funds is that ETFs trade like a stock. You can buy or sell an ETF instantly through a brokerage at the then-current price. Mutual funds are priced daily, and your purchase or sale isn't instantaneous.

Warren Buffett's favorite investment

Billionaire investor Warren Buffett has said that an S&P 500 index fund is the best investment most people can make. In fact, he stated that he wants the majority of the money he'll leave to his wife to be invested in such a fund after he's gone. This investment advice might seem a bit surprising since Buffett is well-known for his stock-picking ability.

First of all, he isn't necessarily saying that it's a bad idea to buy individual stocks if and only if you have the time, knowledge, and desire to do it right. However, most investors don't.

Related index fund topics

Buying a mutual fund or an ETF that tracks the S&P 500 is simple; it doesn't require the research that investing in stocks with solid growth prospects demands. Investing in an S&P 500 fund (either a low-cost mutual fund or an ETF) guarantees that you'll do as well as the stock market over time. And, over the long term, that performance has been quite good.