Dividend index funds are investment funds that track an index made up of dividend-paying stocks and pass that income on to investors. They are typically offered as exchange-traded funds (ETFs) or mutual funds and are designed to provide diversified exposure to companies that return cash to shareholders through regular dividends.

Rather than picking individual dividend stocks, these funds follow rules-based benchmarks that select and weight multiple dividend payers. The result is a hands-off way to generate income without having to manage or monitor individual companies.

Dividend index funds are not ideal for every investor. They generally prioritize income over rapid growth. However, for investors focused on steady cash flow, simplicity, and diversification, they can be an effective solution.

Eight top dividend index funds to buy

Here are eight dividend index funds (in no particular order) that have relatively low expense ratios but varying dividend yields and risk levels.

Fund | Dividend Yield | Expense Ratio | Risk Level |

|---|---|---|---|

Invesco S&P 500 High Dividend Low Volatility ETF (NYSEMKT:SPHD) | 4.61% | 0.30% | Below average |

iShares Core High Dividend ETF (NYSEMKT:HDV) | 3.36% | 0.08% | Average |

ProShares S&P 500 Dividend Aristocrats ETF (NYSEMKT:NOBL) | 2.14% | 0.35% | Average |

Schwab U.S. Dividend Equity ETF (NYSEMKT:SCHD) | 3.71% | 0.06% | Average |

Vanguard High Dividend Yield ETF (NYSEMKT:VYM) | 2.45% | 0.06% | Average |

Vanguard Dividend Appreciation ETF (NYSEMKT:VIG) | 1.58% | 0.05% | Average |

iShares Core Dividend Growth ETF (NYSEMKT:DGRO) | 2.14% | 0.08% | Average |

WisdomTree U.S. Quality Dividend Growth Fund (NASDAQ:DGRW) | 1.30% | 0.28% | Average |

1. Invesco S&P 500 High Dividend Low Volatility ETF

NYSEMKT: SPHD

Key Data Points

The Invesco S&P 500 High Dividend Low Volatility ETF (SPHD +1.78%) tracks the S&P 500 Low Volatility High Dividend Index. It isolates the highest-yielding stocks in the index and then selects the 50 with the lowest volatility. One thing to note with this ETF is that it pays monthly dividends.

2. iShares Core High Dividend ETF

NYSEMKT: HDV

Key Data Points

The iShares Core High Dividend ETF (HDV +0.74%) is benchmarked to the Morningstar Dividend Yield Focus Index. It holds about 75 U.S. high-yielding dividend stocks with overweights in the energy, consumer staples, and healthcare sectors.

Exchange-Traded Fund (ETF)

3. ProShares S&P 500 Dividend Aristocrats ETF

NYSEMKT: NOBL

Key Data Points

The ProShares S&P 500 Dividend Aristocrats ETF (NOBL +1.46%) tracks the performance of Dividend Aristocrats® -- S&P 500 members that have increased their dividends for at least 25 consecutive years. (The term Dividend Aristocrats® is a registered trademark of Standard & Poor's Financial Services LLC.) The focus here is not on high yields but rather on companies that have consistently increased their dividends. The index is equal-weighted.

4. Schwab U.S. Dividend Equity ETF

NYSEMKT: SCHD

Key Data Points

The Schwab U.S. Dividend Equity ETF (SCHD +1.54%) seeks to track the total return of the Dow Jones U.S. Dividend 100 index. This index uses a composite score that screens for a minimum of 10 years of dividend payments, along with a composite metric that assesses free cash flow to total debt, return on equity, dividend yield, and a five-year dividend growth rate.

5. Vanguard High Dividend Yield ETF

NYSEMKT: VYM

Key Data Points

The Vanguard High Dividend Yield ETF (VYM +0.22%) tracks the performance of the FTSE High Dividend Yield Index, which selects a market cap-weighted portfolio including 55% of the highest-yielding stocks on a forward-looking basis from a broader universe of U.S. equities. However, it excludes real estate investment trusts (REITs).

6. Vanguard Dividend Appreciation ETF

7. iShares Core Dividend Growth ETF

8. WisdomTree U.S. Quality Dividend Growth Fund

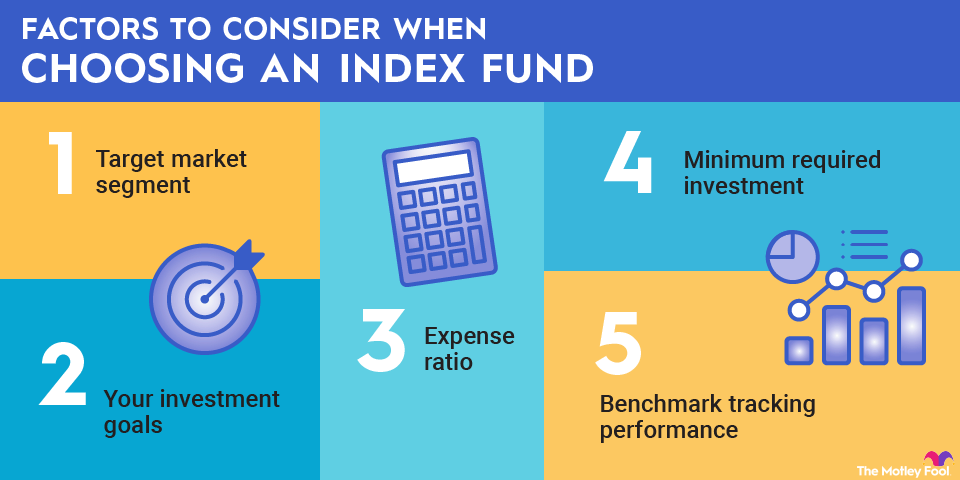

What to look for in dividend index funds

A good first step is to determine your overall asset allocation and, as a follow-up, the amount of money you have to invest in stocks and/or equity index funds.

Once you've done the pre-work, you can visit any of the major online discount brokerages, such as Vanguard, Fidelity, or Charles Schwab, all of which offer free (or very low-cost) ETF trading.

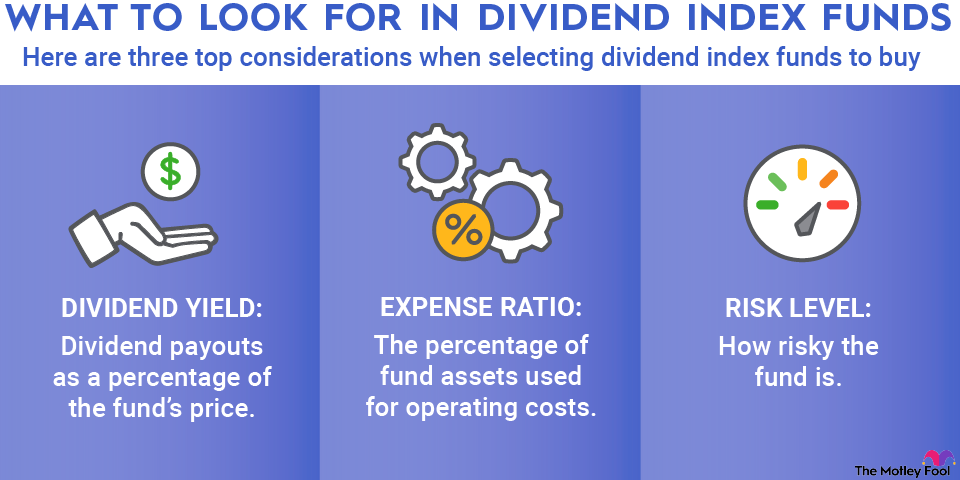

Here are three top considerations when selecting dividend index funds to buy:

- Dividend yield: Dividend payouts as a percentage of the fund's price.

- Expense ratio: The percentage of fund assets used for operating costs.

- Risk level: The riskiness of the fund based on historical volatility.

To some extent, there's a trade-off between dividend yield and risk level. Generally speaking, higher yields are associated with higher risk, but higher expense ratios don't necessarily translate to higher dividend yields or lower risk levels.

It's also important to remember that dividend yield alone does not act as a perfect indicator of future performance.

Focusing only on companies paying dividends leaves out many that derive their growth from price appreciation, such as those in big tech.

Make sure you construct a diversified portfolio that covers a wide population of underlying firms with different capital strategies.

Dividend index funds are long-term investments

The stock market can be volatile in the short term. So, it's important to keep in mind that dividend index funds are meant to be held for the long run.

First, the longer you hold your index funds, the better performance you're likely to see. Longer holding periods lend themselves to more compounding, which enables your money to grow rapidly in later years.

Second, short-term market movements tend to be unreliable when it comes to successful investing. As we've seen this year, short-term market swings can be erratic both in direction and magnitude.

However, longer-term investment horizons have reliably trended upward, especially when it comes to dividend-paying blue chip stocks.

Finally, longer holding periods also make your portfolio more tax-efficient. If you keep your dividend index funds for longer than a designated holding period, you'll be eligible for qualified dividends, which are taxed at a lower capital gains rate when earned.

If you do choose to allocate a portion of your portfolio to dividend index funds, know that short-term price movements are entirely normal. A long-term focus has historically been a preferable strategy.

Related investing topics

Why invest in dividend index funds?

Benefits:

- Provide a steady income for investors seeking regular cash flow.

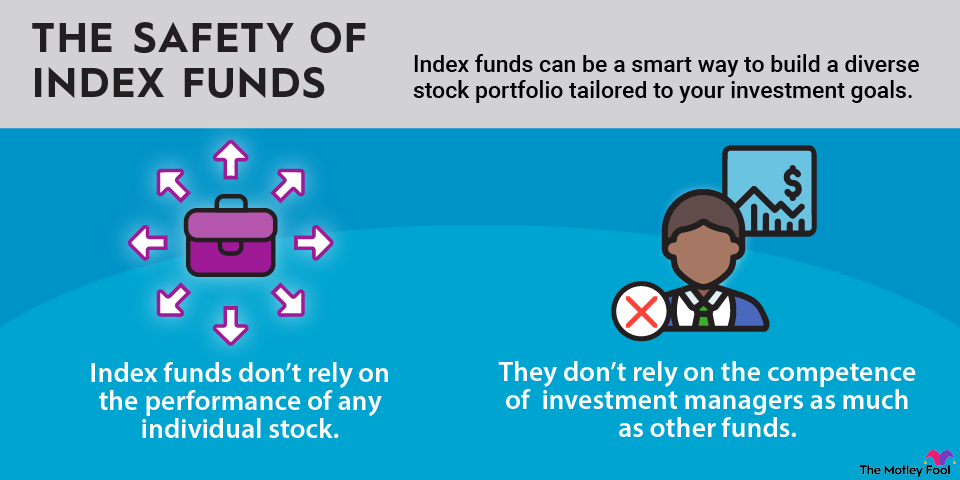

- Offer diversification across many dividend-paying companies, reducing the risk of owning individual stocks.

- Help identify value-oriented companies through high-yield dividend strategies.

- Dividend growth funds focus on firms with strong balance sheets and consistent payout increases, signaling quality.

- Typically have low fees and offer an easy, passive way to gain exposure to income-generating stocks.

Risks:

- Dividend cuts can occur during market downturns or recessions.

- High-yield funds may include riskier or slower-growing companies.

- Interest rate changes can affect investor demand for dividend funds, affecting prices.

- Dividend index funds may underperform growth-oriented ETFs during bull markets led by high-growth sectors like tech.

Tips for investing in dividend index funds

Check distribution frequency: Some dividend index funds pay monthly, while others pay quarterly. Monthly distributions can be more practical for income planning, while quarterly payouts may suit long-term reinvestment strategies just as well.

Prioritize tax-sheltered accounts: Dividend income compounds most efficiently inside accounts like a Roth IRA, where distributions are not immediately taxed. This is especially important for higher-yield funds.

Use a DRIP if income is not needed: If you do not need the cash flow, setting up a dividend reinvestment plan helps compound returns automatically and removes the temptation to time reinvestments manually.

FAQ

Dividend index funds FAQ

Tony Dong has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends ProShares S&P 500 Dividend Aristocrats ETF, Vanguard Dividend Appreciation ETF, and Vanguard Whitehall Funds - Vanguard High Dividend Yield ETF. The Motley Fool has a disclosure policy.