Three tips for building a diversified portfolio

Building a diversified portfolio can seem like a daunting task since there are so many investment options. Here are three tips to make it easy for beginners to diversify.

1. Buy at least 25 stocks across various industries (or buy an index fund)

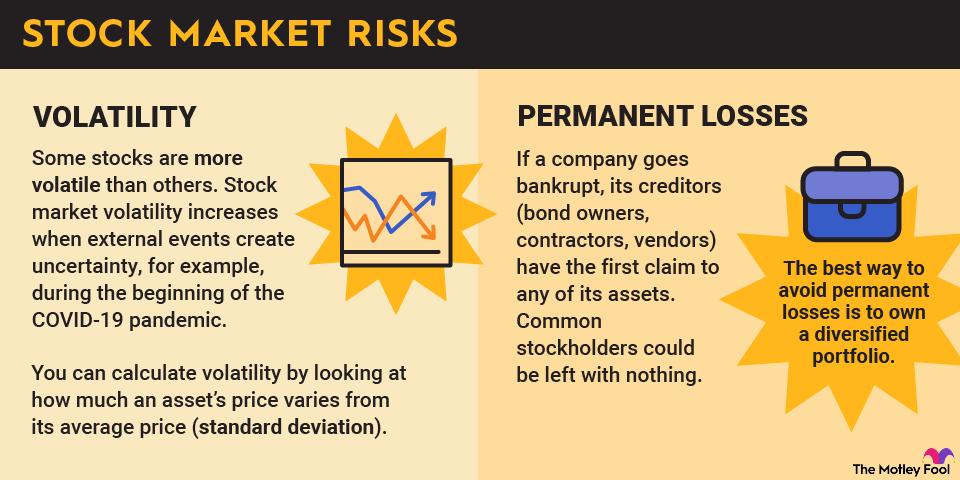

One of the quickest ways to build a diversified portfolio is to invest in several stocks. A good rule of thumb is to own at least 25 different companies.

However, it's important that they also be from a variety of industries. Although it might be tempting to purchase shares of a dozen well-known tech giants and call it a day, that's not proper diversification. If tech spending takes a hit due to an economic slowdown or new government regulations, all those companies' shares could decline in unison. Investors should make sure they spread their investment dollars around several industries.

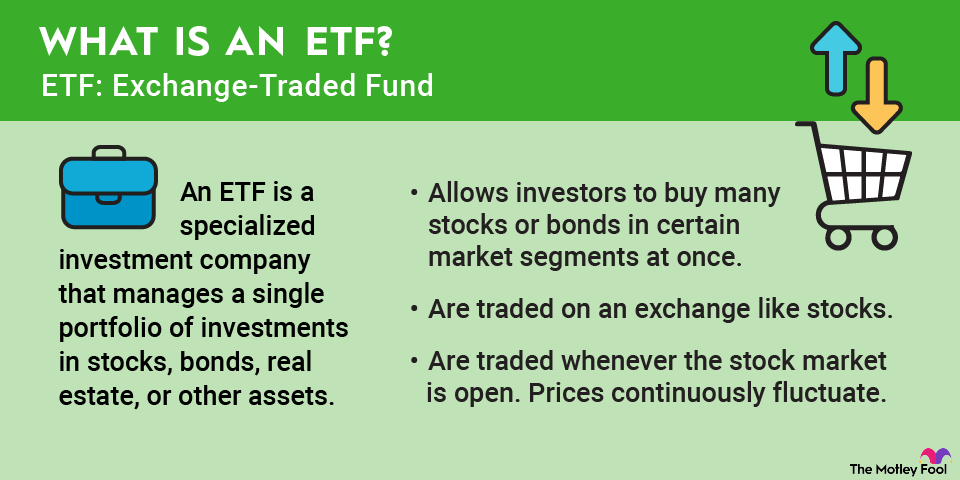

One quick way to do that for those who don't have the time to research stocks is to buy an index fund. For example, an S&P 500 index fund will aim to match the S&P 500's performance. The benefit of index funds is that they take a lot of guesswork out of investing while offering instant diversification. For example, with an S&P 500 index fund, you're buying shares of a single fund that gives you exposure to 500 of the largest public U.S. companies.

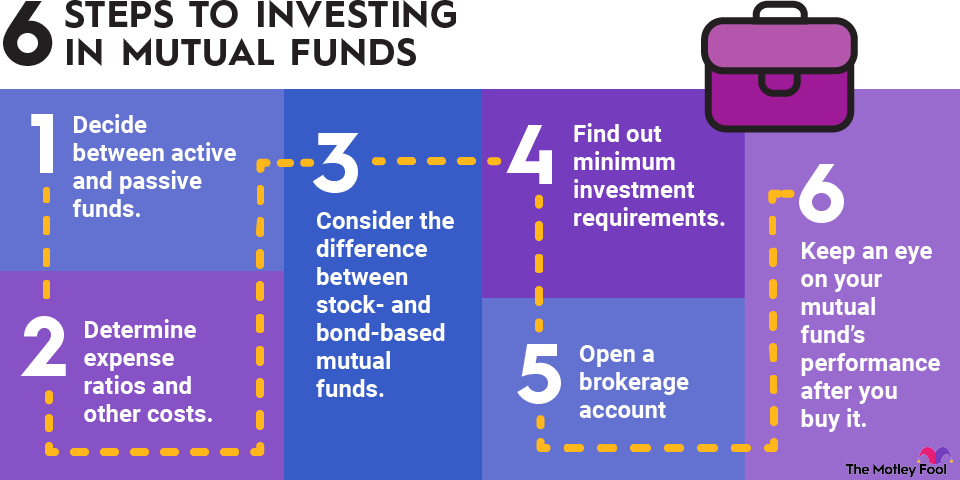

Another great thing about index funds is that their fees -- known as expense ratios -- are very low. That's because, with the best index funds, you're not paying for the expertise of a fund manager who's going to research and hand-pick investments for you.