Apple (AAPL +0.31%) is one of the world’s largest and most profitable companies. It designs consumer technology products, including the iPhone, iPad, Mac, and Apple Watch, and pairs them with a growing ecosystem of software and services.

While hardware still generates most revenue, Apple’s services segment (iCloud, Apple Music, Apple TV+, App Store, payments, and advertising) is growing faster and carries higher margins. That recurring revenue helps smooth results when product sales slow.

Apple continues to invest heavily in new technology, including spatial computing (Apple Vision Pro) and artificial intelligence (Apple Intelligence, with outside AI partnerships supporting Siri).

Here's a step-by-step guide on buying shares of Apple and some factors to consider before investing in the technology stock.

How to buy Apple stock

All you have to do is follow these simple steps:

- Open your brokerage account: Log in to your brokerage account where you handle your investments. If you don't have one yet, take a look at our favorite brokers and trading platforms to find the right one for you.

- Search for Apple: Enter the ticker "APPL" into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in Apple?

Before investing in Apple, you need to determine whether the company's stock is a good fit for your portfolio.

Here are some reasons why you might want to consider buying Apple stock:

- You love Apple's products and want to invest in the company that makes them.

- You believe Apple's shares can continue to outperform the S&P 500.

- You understand how Apple makes money.

- You think Apple can continue developing innovative products that increase its revenue, income, and free cash flow at a healthy rate.

- You believe Apple can continue growing its higher-margin services offerings at a strong pace.

- You want to invest in a financially strong company.

- You want to earn some dividend income and believe Apple can continue growing its payout.

- You think Apple does a great job allocating its copious cash flows to increase shareholder value, including its preference for share repurchases.

- You believe Apple's strategic investments in digital content, payment processing, cloud services, and advertising will accelerate growth.

- You have faith that CEO Tim Cook can continue growing shareholder value.

- You understand the risks of investing in Apple stock, including that it could lose value.

On the other hand, here are some factors to think about that might lead you to decide against buying Apple stock:

- You're not a fan of Apple's products.

- You're not sure Apple can outperform the market.

- You think Apple's days of product innovation are in the rearview mirror.

- You need a higher dividend yield than Apple currently offers.

- You are a younger investor and want to invest in a company earlier in its growth cycle than Apple.

- You're worried about the economy and think a recession could affect demand for Apple products.

- You're concerned that a competitor could start eating into Apple's dominant share of the smartphone market.

- You don't think Apple's VR headset will move the needle for the company's earnings or stock price.

- You're concerned about the AI industry and its future.

NASDAQ: AAPL

Key Data Points

Is Apple profitable?

Apple is an extremely profitable company. It recorded $416 billion in revenue and $84.5 billion in net income during the first nine months of its 2025 fiscal year. While revenue was only up about $7 billion compared to the prior-year period, earnings per share grew by more than 13%.

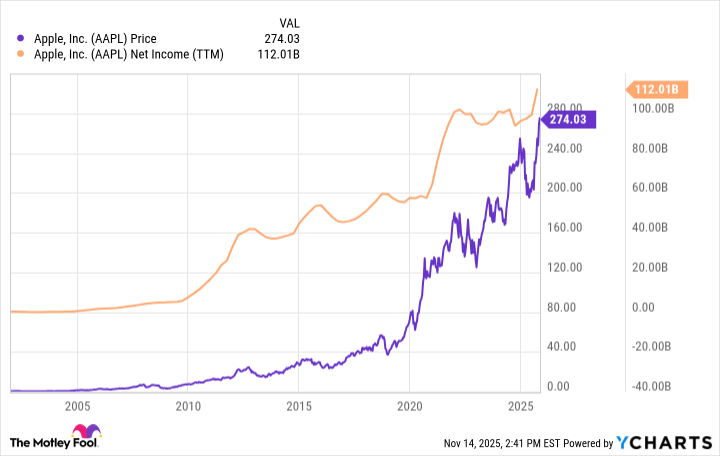

The company posted record revenue in its fiscal third quarter of 2025. The tech titan noted that the installed base of its active devices had reached 2.35 billion by October 2025. Apple's steadily rising profits have helped drive its stock price skyward over the years:

Apple generates most of its revenue from selling products (74% in the first nine months of fiscal year 2025). However, services are an important profit-growth driver. Services revenue is growing faster than product revenue (25% versus an almost 2% decline in the first nine months of fiscal 2025).

Apple's income should continue to rise. The technology giant invests heavily in developing innovative products (like the Apple Vision Pro and Apple Intelligence) that could become major growth drivers. It also continues expanding its service offerings, providing the company with more recurring revenue.

Does Apple pay a dividend?

Yes. Apple reinstated its dividend in 2012 and has increased it every year since.

In the first nine months of fiscal 2025, Apple paid $11.5 billion in dividends and spent over $70 billion buying back its own shares. Buybacks steadily reduce the share count, boosting per-share results over time.

How to invest in Apple through ETFs

You don’t have to buy Apple stock directly to own it. Because of its massive market value, Apple is a top holding in many exchange-traded funds (ETFs).

Exchange-Traded Fund (ETF)

According to ETF.com, 601 ETFs held 2.2 billion shares of Apple as of late 2025. The ETFs with the most shares were:

Exchange-Traded Fund (ETF) | Market Value | Apple Shares Held | Fund Weighting | Position Ranking in ETF |

|---|---|---|---|---|

Vanguard Total Stock Market ETF (NYSEMKT:VTI) | $118.9 billion | 466.9 million | 5.87% | Third |

Vanguard S&P 500 ETF (NYSEMKT:VOO) | $93.12 billion | 365.7 million | 6.59% | Third |

iShares Core S&P 500 (NYSEMKT:IVV) | $50.24 billion | 183.72 million | 6.93% | Second |

SPDR S&P 500 ETF Trust (NYSEMKT:SPY) | $48.77 | 178.32 million | 6.94% | Second |

Vanguard Growth ETF (NYSEMKT:VUG) | $35.83 billion | 140.7 million | 10.47% | Third |

An honorable mention with an even higher portfolio weighting to Apple stock is the Vanguard Information Technology ETF (VGT -0.14%). At 13.3% of the fund's holdings, this gives investors even greater exposure to Apple stock.

Will Apple stock split again?

As of mid-2025, Apple had yet to announce an upcoming stock split. Here's a snapshot of Apple's stock split history:

Date | Type of Stock Split |

|---|---|

August 2020 | 4-for-1 |

June 2014 | 7-for 1 |

February 2005 | 2-for-1 |

June 2000 | 2-for-1 |

June 1987 | 2-for-1 |

Apple's stock price was around $500 per share right before its last stock split. As of late 2025, shares were around $270 each. The price point suggests Apple stock could have much higher to rise before the company considers another stock split.

The bottom line

Apple is a mature, highly profitable business with unmatched brand loyalty and a growing base of recurring revenue from services. While it may not deliver explosive growth, it continues to generate enormous cash flow and return capital to shareholders.

For long-term investors seeking stability, scale, and consistent shareholder returns, Apple remains a stock worth serious consideration.

Related investing topics

FAQ

About the Author

Matt DiLallo has positions in Apple and has the following options: short January 2026 $265 calls on Apple. The Motley Fool has positions in and recommends Apple, Vanguard Index Funds - Vanguard Growth ETF, Vanguard S&P 500 ETF, and Vanguard Total Stock Market ETF. The Motley Fool has a disclosure policy.