Bitcoin (BTC -3.15%) has been one of the most exciting investments of the 2000s. One Bitcoin was worthless when it launched in 2009, but 15 years later, its price surpassed $100,000. Now, Bitcoin exchange-traded funds (ETFs) have made it easier to invest.

After years of waiting, the U.S. Securities and Exchange Commission (SEC) approved funds based on Bitcoin's spot price in 2024. The move increased Bitcoin's price and its appeal for institutional investors. Here's what you need to know and the best Bitcoin ETF options.

What are Bitcoin ETFs?

Bitcoin ETFs are funds that trade on a stock exchange and attempt to track the performance of Bitcoin. When you buy an ETF, you aren't buying the underlying investment directly. Rather, you're buying shares of a fund that either invests in or attempts to mimic the performance of a particular security or index -- Bitcoin, in this case.

Bitcoin vs. Bitcoin ETFs

Investing in Bitcoin directly is slightly more profitable than investing in a Bitcoin ETF. Even the best fund isn't going to perfectly track the crypto's price since there are fees built into ETFs to pay for management.

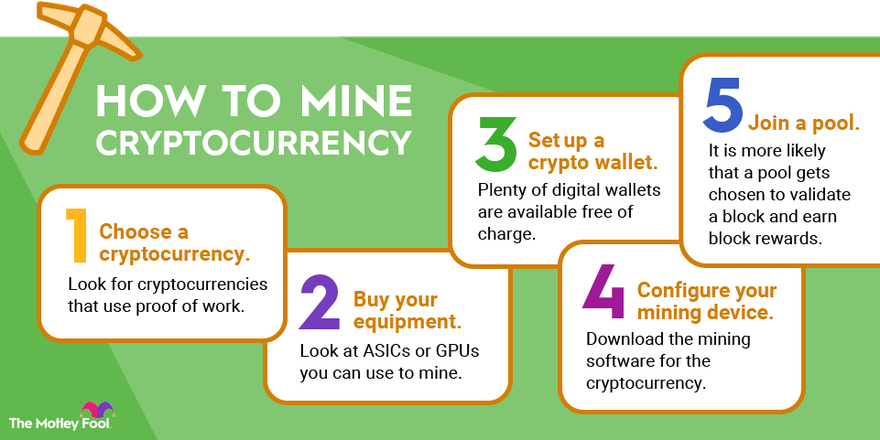

However, a direct investment in Bitcoin or other digital currencies requires extra work compared to investing in stocks, bonds, and the like. Many traditional brokerage firms don't support cryptocurrency trading. If yours doesn't, you'd need an account with a crypto trading exchange. And if you want to store your crypto yourself, you need a crypto wallet.

Bitcoin ETFs provide a workaround so your investment in Bitcoin can be held in the same account as your other stocks, bonds, and traditional investment securities. They also make it easier to get Bitcoin investment exposure in an individual retirement account (IRA) or Roth IRA. These retirement accounts offer tax advantages that you don't get if you invest in Bitcoin directly.

5 Bitcoin ETFs and funds for 2025

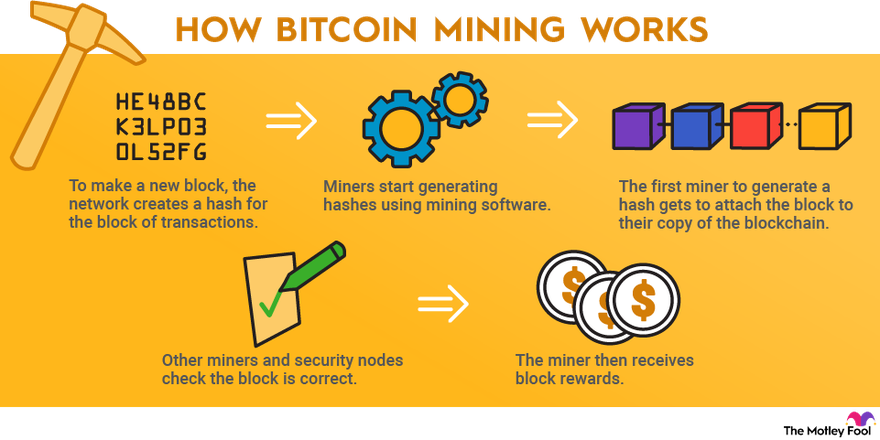

Before SEC approvals in January 2024, Bitcoin funds were only generally available using futures contracts in their portfolios. Bitcoin ETFs can now directly purchase Bitcoin and hold it in custody (or outsource the holding of the Bitcoin to a third party). Here are five options to consider:

| Name and ticker | Current price |

|---|---|

| iShares Bitcoin Trust (NASDAQ:IBIT) | $61.31 |

| Grayscale Bitcoin Mini Trust (NYSEMKT:BTC) | $47.81 |

| Fidelity Wise Origin Bitcoin Fund (NYSEMKT:FBTC) | $94.18 |

| Ark 21Shares Bitcoin ETF (NYSEMKT:ARKB) | $35.88 |

| Bitwise Bitcoin ETF Trust (NYSEMKT:BITB) | $58.73 |

Related investing topics

Why invest in Bitcoin ETFs?

Here's why you may want to invest in a Bitcoin ETF:

- You want to hold Bitcoin in an IRA or Roth IRA for the tax benefits.

- You don't want the complexity of buying and storing Bitcoin yourself or on a crypto exchange.

- You prefer the convenience of buying and selling shares in an ETF and having your broker calculate capital gains for you.

While most crypto enthusiasts are comfortable buying Bitcoin directly, ETFs are a good alternative for those who want a more traditional investment option.

Even if you're experienced with cryptocurrency, shares of a Bitcoin ETF could still make sense in a retirement account, particularly a Roth IRA. That way, your investment can grow tax-free and you can withdraw it tax-free in retirement.

How to choose the best Bitcoin ETFs

The main factors to consider in choosing a Bitcoin ETF are the fees, size, and reputation of the fund manager. Management fees cut into your returns, so a lower expense ratio is generally better. Larger Bitcoin ETFs tend to have more liquidity, making it easier to buy and sell shares. Finally, it's always important to invest with a reputable fund manager that you can trust to safely store its Bitcoin reserves.