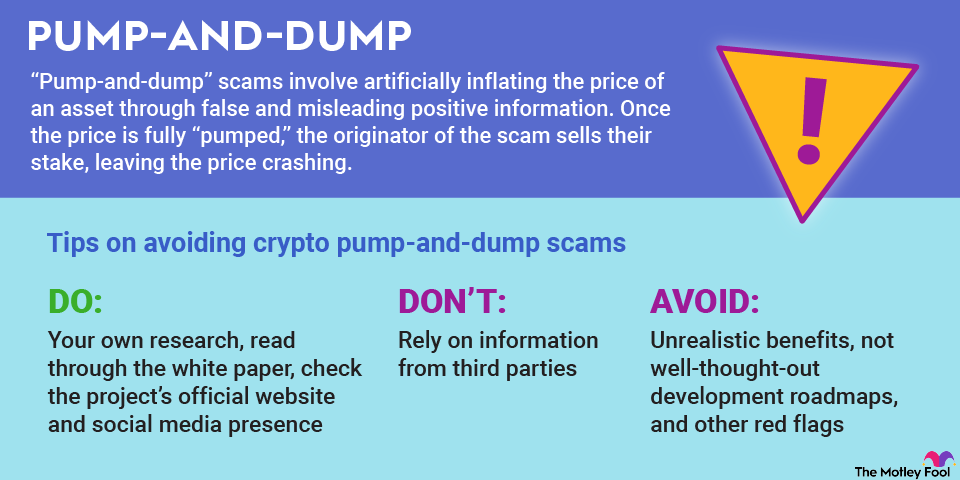

If the token has been around for a while but development on the project seems to have disappeared, it's best to avoid it. If the project has no clear purpose, it purports benefits that seem unrealistic, its development roadmap isn't well thought out, or it's associated with previous bad actors, those are all red flags, too.

Think critically

If you don't typically follow influencers in the finance space, specifically cryptocurrency experts, but all of a sudden the people you follow are talking about a cryptocurrency, that's another big red flag. Ask yourself why this fashion influencer you follow is talking about some cryptocurrency.

If you do discover a potential crypto investment on social media, it's best to check out whether the project has its own website and social media presence. Go straight to the source instead of relying on information from third parties.

Check the exchange

If you don't find any red flags in the documentation or in how the investment is being promoted, take a look at how the cryptocurrency trades. If it's on a well-regarded exchange, it's more likely to be a safer investment. If you have to dig into some unknown decentralized finance (DeFi) exchange, you'll want to dig deeper into the order book.

Most exchanges will show you all the open orders for an asset, as well as the order history. Check the pattern on trading volume; if it's spiked recently and volume appears to be trending higher, be cautious. If you see big walls of the crypto asset on the buy side, there could be a big group making sure the coin doesn't fall below a certain price. Likewise, you may see big walls of sellers to make sure the price doesn't pump too fast as the organizers pile into the coin.

When to blow the whistle

If you suspect a cryptocurrency is undergoing a pump-and-dump scam, it's best to avoid it. It's impossible to know without inside information when the organizers plan to sell. If you do have inside information, though, you're probably better off contacting the Commodity Futures Trading Commission (CFTC) and providing the information to them.

The CFTC put out an advisory in late 2019 to warn investors about potential pump-and-dump scams. It's offering bounties to any whistleblowers. That means you don't have to do anything illegal, and you might make more money by being an informant.

Once more, remember that there is no such thing as total safety from scams in crypto investing. Be extremely careful how you engage with crypto, regardless of how well-regarded your crypto or exchange is.