You may wonder what makes cryptocurrency valuable, given that it's notoriously volatile. It's not uncommon for Bitcoin (BTC -4.40%) to increase or decrease in price by 5% or even 10% on any given day. Smaller cryptocurrencies can have even wider price swings.

After reading this article, you'll have a better understanding of what makes cryptocurrency valuable and why the price might swing violently within a single day.

Understanding the value of a cryptocurrency

Cryptocurrencies usually aren't backed by any central authority in the same fashion as fiat currencies or another government-sanctioned medium of exchange. Government backing can improve faith in the value of a currency among consumers, and it provides a big spender and collector of the currency. (Try paying your taxes in Bitcoin.) But since cryptocurrencies are generally decentralized, they derive their value from other sources, including:

- Supply and demand

- Cost of production

- Availability on exchanges

- Competition

- Governance

- Regulations

Law of Supply and Demand

Cryptocurrency supply and demand

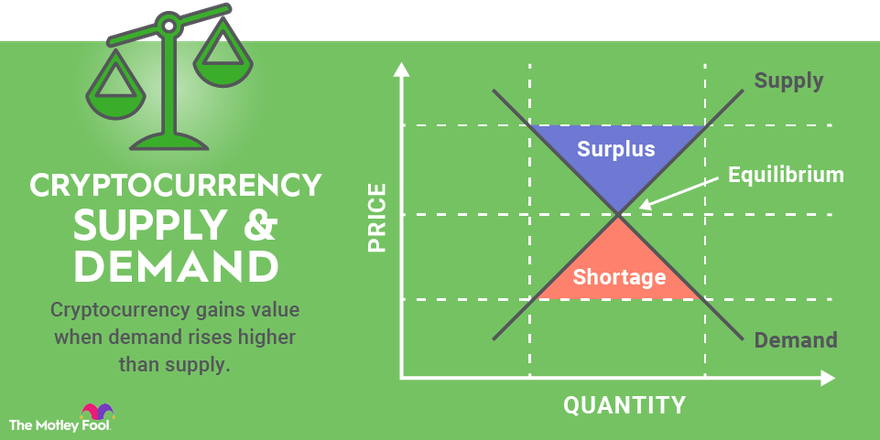

The value of cryptocurrency is determined by supply and demand, just like anything else. If demand increases faster than supply, the price goes up. For example, if there's a drought, the price of grain and produce increases if demand doesn't change. The same supply and demand principle applies to cryptocurrencies. Cryptocurrency gains value when demand rises higher than supply.

The supply mechanism of a cryptocurrency is always known; each crypto publishes its token minting and burning plans. Some, such as Bitcoin, have a fixed maximum supply; we know that there will only ever be 21 million Bitcoins.

Others, like Ether (ETH -4.56%), have no cap on supply. Some cryptocurrencies have mechanisms that "burn" existing tokens to prevent the circulating supply from growing too large and slowing inflation. Burning a token means sending them to an unrecoverable address on the blockchain.

The monetary policy of each cryptocurrency is different. Bitcoin supply increases by a fixed amount with each new block mined on the blockchain. Ethereum offers a fixed reward per block mined, but it also pays out for including "uncle blocks" in the new block, which helps facilitate the efficiency of the blockchain. As a result, the supply increase isn't as fixed.

Some cryptocurrency supplies are dictated entirely by the team in charge of a project, which can opt to release more of a token to the public or burn tokens to manage the money supply.

Demand can increase as awareness of a project grows or as utility increases. Broader adoption of a cryptocurrency as an investment also increases demand while effectively limiting the circulating supply. For example, when institutional investors started buying and holding Bitcoin in early 2021, the price of Bitcoin increased significantly as demand outstripped the pace at which new coins were created, effectively decreasing the total available supply of Bitcoin.

Likewise, as more decentralized finance (DeFi) projects launch on the Ethereum blockchain, the demand for Ether increases. Ether is required to perform transactions on the blockchain regardless of what cryptocurrency you're transacting with. Or, if a DeFi project takes off itself, its own token will become more useful, thereby increasing demand.

Cost of production

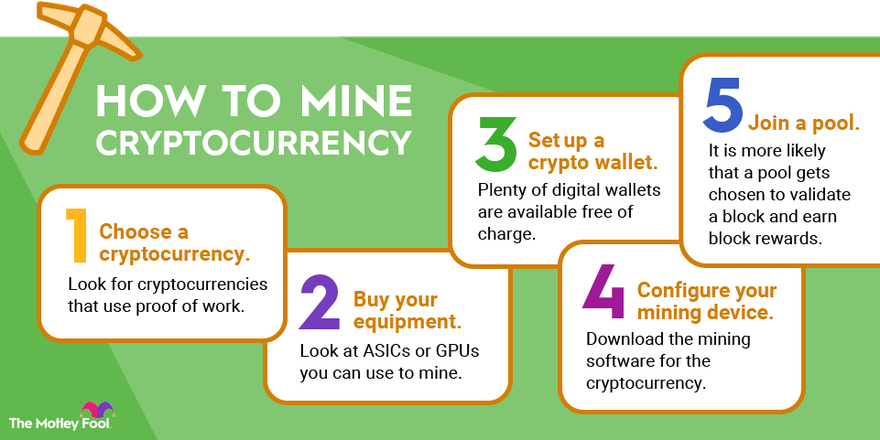

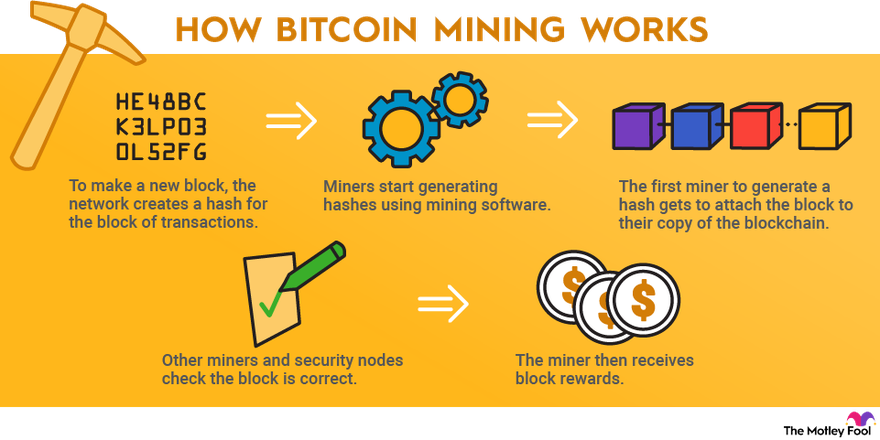

New cryptocurrency tokens are produced through a process called "mining." Mining for cryptocurrency involves using a computer to verify the next block on the blockchain. The decentralized network of miners is what allows cryptocurrency to work as it does. In exchange, the protocol produces a reward in the form of cryptocurrency tokens, in addition to any fees paid by the exchanging parties to the miners.

Verifying the blockchain requires computing power. Participants invest in expensive equipment and electricity in order to mine cryptocurrency. In a proof-of-work system, like those used by Bitcoin and Ethereum, the more competition there is for mining a certain cryptocurrency, the more difficult it is to mine. That's because miners essentially race each other to solve a complex math problem in order to verify a block. As such, the cost to mine increases as more powerful equipment is needed to successfully mine.

As mining costs increase, it necessitates an increased value of the cryptocurrency. Miners won't mine if the value of the currency they're mining isn't high enough to offset their costs. And, since miners are essential to making the blockchain function, as long as there's demand for using the blockchain, the price will have to go up.

Liquidity Mining

Cryptocurrency exchanges

Mainstream cryptocurrencies such as Bitcoin and Ether trade on multiple exchanges. Just about any cryptocurrency exchange will list the most popular tokens.

But some smaller tokens may only be available on select exchanges, thus limiting access for some investors. Some wallet providers will aggregate quotes for swapping any set of cryptocurrencies across several exchanges, but they'll take a fee for doing so, increasing the cost of investing. Furthermore, if a cryptocurrency is thinly traded on a small exchange, the spread the exchange takes may be too big for some investors.

If a cryptocurrency gets listed on more exchanges, it can increase the number of investors willing and able to buy it, thus increasing demand. And, all else being equal, as demand increases, the price goes up.

Competition

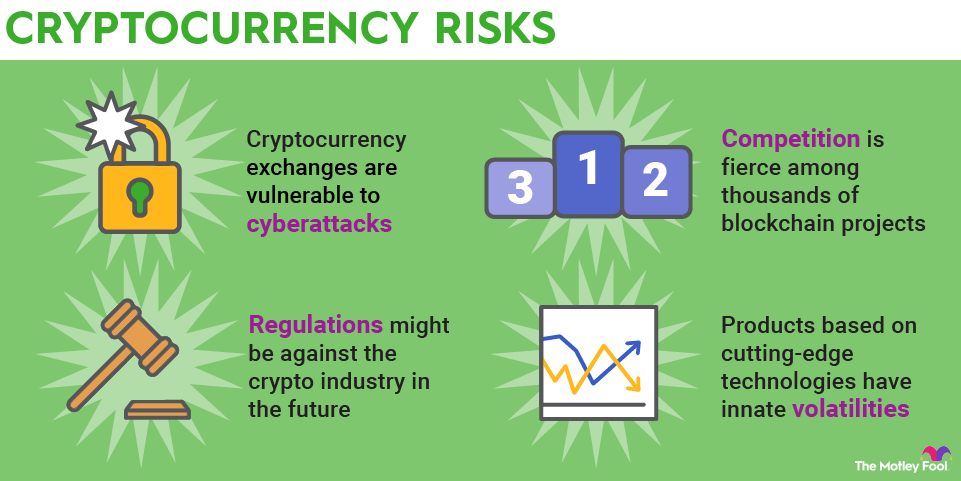

There are thousands of different cryptocurrencies in existence, with new projects and tokens launching every day. The barrier to entry is relatively low for new competitors, but creating a viable cryptocurrency also relies on building a network of users of that cryptocurrency.

A useful application on the blockchain can quickly build a network, especially if it improves upon a limitation of a competing application. If a new competitor gains momentum, it takes value from the existing competition, thus sending the price of the incumbent down as the new competitor's token sees its price move higher.

Internal governance

Cryptocurrency networks rarely abide by a static set of rules. Developers adapt projects based on the community that uses them. Some tokens -- called governance tokens -- give their holders a say in the future of a project, including how a token is mined or used. In order to make any changes to the governance of a token, there needs to be consensus among stakeholders.

For example, Ethereum is working to update its network from a proof-of-work system to a proof-of-stake system, effectively rendering much of the expensive mining equipment in data centers or people's basements useless. That will undoubtedly have an impact on the value of Ether.

Generally speaking, investors like stable governance. Even if there are flaws in the way a cryptocurrency operates, investors prefer the devil they know to the devil they don't. As such, stable governance where things are relatively hard to change can be of value by providing more stable pricing.

On the other hand, the slow process of updating software to improve protocols can limit the upside of cryptocurrency values. If an update would unlock value for cryptocurrency holders but takes months to execute, it hurts the current stakeholders.

Regulations and legal requirements

There's some confusion about who should regulate the exchange of cryptocurrencies. The Securities and Exchange Commission (SEC) says cryptocurrencies are securities like stocks and bonds, while the Commodity Futures Trading Commission (CFTC) says they're commodities like coffee or gold.

Both can't claim regulatory authority over cryptocurrency exchanges. A determining ruling could provide greater clarity and improve cryptocurrency values while opening the door for more widely traded crypto-related financial products.

Regulation is required to allow for easier ways to trade cryptocurrency. Products such as exchange traded funds (ETFs) or futures contracts provide more access to cryptocurrency for investors, increasing its value. Additionally, regulation could enable investors to take short positions or bet against the price of cryptocurrencies with futures contracts or options. That should produce better price discovery and reduce the volatility of cryptocurrency pricing.

Regulations could also negatively impact demand for cryptocurrency. If a governing body changes the rules to disfavor cryptocurrency investment or use, it could send the price of cryptocurrencies lower.

Related crypto topics

Finding value in cryptocurrency

If you understand supply and demand (the core principle behind what gives cryptocurrency value) and the factors influencing them, you can make better cryptocurrency investment decisions. If you believe demand is going to increase for reasons X, Y, and Z and don't think supply will keep up, that cryptocurrency could be a good investment.

But be aware that governments still don't have best practices for regulating cryptocurrency, which makes it a particularly risky and volatile investment no matter what.