Silver exchange-traded funds (ETFs) are funds that invest in silver mining stocks or hold silver bars. They enable anyone to invest in the precious metal through a straightforward investment, positioning them to profit from the potential rise in the price of silver in the future.

A big catalyst for silver demand is the energy transition to a low-carbon economy. Silver is an excellent conductor of electricity. It's a key material used in manufacturing electric vehicles and solar panels.

Like other precious metals, silver also has investment properties. Investors use it to diversify their portfolios and provide protection against inflation, geopolitical risks, and financial market downturns.

Silver ETFs allow investors to gain exposure to silver without owning the physical precious metal or trying to pick the best silver stock. Here's a closer look at the best silver-focused ETFs to consider.

Best silver ETFs

About a dozen ETFs focus on silver. Half of them concentrate on providing direct exposure to the price of silver. The rest have a strategic focus on investing in companies involved in the silver mining industry. Here's a snapshot of the best silver ETFs to consider buying:

Silver ETF | Expense Ratio | Assets Under Management (AUM) | ETF Description |

|---|---|---|---|

iShares Silver Trust (NYSEMKT:SLV) | 0.50% | $29.6 billion | This ETF provides investors with exposure to physical silver. |

Global X Silver Miners ETF (NYSEMKT:SIL) | 0.65% | $4.2 billion | This ETF owns a basket of silver mining stocks. |

Amplify Junior Silver Miners ETF (NYSEMKT:SILJ) | 0.69% | $3.3 billion | This ETF focuses on smaller-cap silver mining stocks. |

NYSEMKT: SLV

Key Data Points

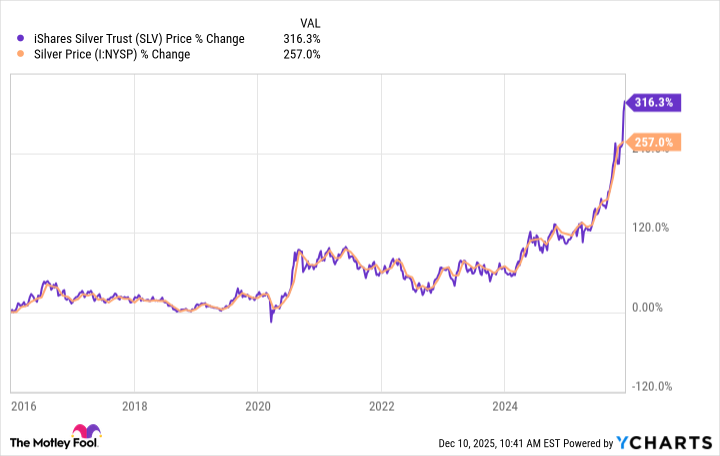

The iShares Silver Trust ETF provides investors with exposure to the price movement of silver. It has done a solid job tracking silver's price over the long term:

The iShares Silver Trust is a great investment vehicle for those who want direct exposure to physical silver without the costs, risks, and hassles of owning the metal. Physical silver helps investors with portfolio diversification and hedging against inflation.

This ETF provides those benefits at a relatively low cost, given its reasonable ETF expense ratio of 0.5%, which may be cheaper than the expense of insuring and storing physical silver coins and bars.

Another benefit of using an ETF to invest in silver is that they are very liquid investments. Investors can buy and sell an ETF like any stock (and with zero commission at most online brokerages). These factors make the iShares Silver Trust an ideal way to invest in silver to directly capture the potential rise in its price.

Global X Silver Miners ETF

The Global X Silver Miners ETF provides investors with targeted exposure to silver mining stocks. It allows investors to participate in the potential upside of silver prices and production growth. Those features position the ETF to outperform the price of silver over the long term since the underlying mining companies can increase their profits faster than prices rise.

NYSEMKT: SIL

Key Data Points

The ETF provides investors with broad exposure to smaller mining companies around the world. It owns shares of mining companies headquartered in the following countries:

- Canada: 55.5%

- U.S.: 31.6%

- Peru: 4.1%

- Sweden: 3.9%

- Poland: 2.8%

- Mexico: 1.6%

- Australia: 0.5%

Although the focus is on silver, many of these companies also mine other metals and basic materials. For example, First Majestic Silver is the purest silver producer in the industry, getting a peer-leading 57% of its revenue from silver and 90% from precious metals overall. Hecla Mining -- the largest silver producer in the U.S. and Canada and third-largest in the world -- is second-purest, at 44% of its revenue.

Meanwhile, the key difference between the Amplify Junior Silver Miners ETF and the Global X Silver Miners ETF is that the Amplify fund concentrates on smaller mining companies, whose small scale makes them riskier. Many early-stage exploration companies need outside capital to help develop their mines, increasing the risk of cost overruns or high debt burdens affecting their investment returns.

Given the risks, the Amplify Junior Silver Miners ETF is best for investors seeking a higher return potential. Investors are paying a reasonable fee for this upside opportunity, considering the ETF's relatively modest expense ratio of 0.69%.

Are silver ETFs right for you?

Silver ETFs allow anyone to easily add some silver market exposure to their portfolio. Physical silver ETFs are low-cost and highly liquid, making them potentially better options than owning coins and bars.

Similarly, silver mining ETFs provide benefits over investing directly in a single silver mining company by spreading the risk over dozens of silver stocks. These factors make silver ETFs a great way to start investing in silver for people who want exposure to the metal's investment properties or upside potential.

However, silver isn't for everyone. Investors need to firmly believe that its price will rise enough in the future to justify the risks of investing in the sector.

How to choose silver ETFs

Investors should evaluate several factors when choosing a silver ETF, including:

- Investment focus: Some silver ETFs focus on holding the physical metal, while others invest in silver mining companies.

- ETF Expense ratio: Investors need to consider whether an ETF's cost is in line with other funds.

- Assets under management (AUM): Larger silver ETFs are less susceptible to potential manipulation.

Related investing topics

How to invest in silver ETFs

Anyone can add a silver ETF to their portfolio. Here's a step-by-step guide on how to invest in them:

- Open your brokerage app: Log in to your brokerage account where you handle your investments.

- Search for the stock: Enter the ticker or company name into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.