Choosing the right home for your retirement savings is as important as saving for retirement in the first place. Your retirement plan dictates how much you can contribute annually, how it's taxed, how withdrawals work, what you can invest in, and how much you pay in fees.

To help you decide which retirement plans work best for you, consider the following options:

- 401(k)

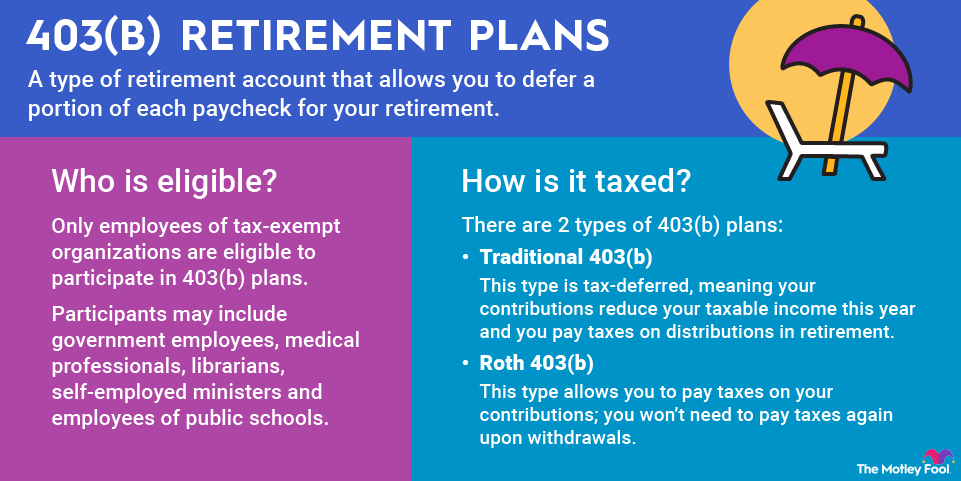

- 403(b)

- 457

- IRA

- Roth IRA

- Nondeductible IRA

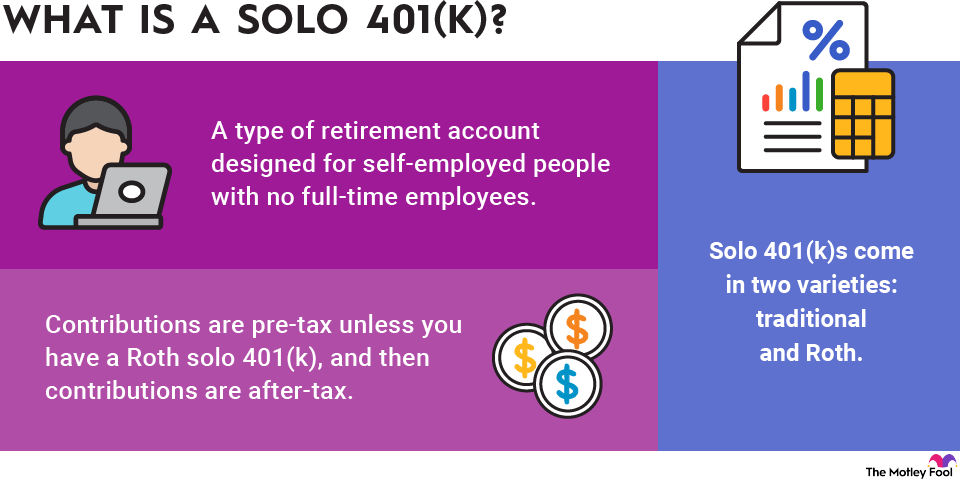

- Solo 401(k)

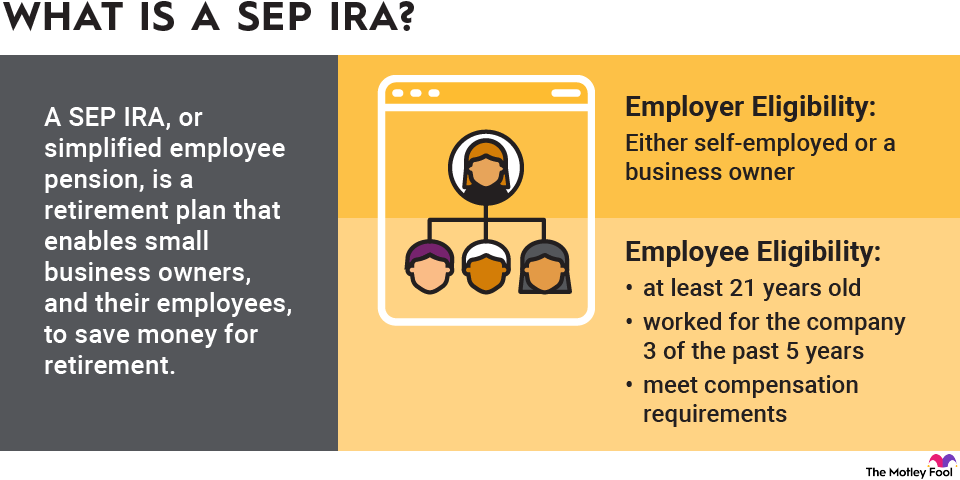

- SEP IRA

- SIMPLE IRA

- Keogh plan

We’ll cover employer-sponsored plans, individual retirement accounts, and plans for self-employed individuals and small business owners.

401(k)

A 401(k) is the most common type of employer-sponsored retirement plan. Your employer preselects a few investment choices and you defer a portion of each paycheck to the account. If you leave your job, you may take your 401(k) funds with you or leave them where they are.

In 2025, you can contribute up to $23,500 to a 401(k) if you're under age 50. Adults ages 50 to 59 and 64 or older may contribute up to $31,000 and those ages 60 to 63 may contribute up to $34,750.

The 2026 limit is $24,500 for people younger than 50. Workers ages 50 to 59 and 64 or older may contribute up to $32,500, while those ages 60 to 63 can contribute up to $35,750.

Some employers also match a portion of employee contributions. With few exceptions, you cannot withdraw funds from your 401(k) before age 59 1/2 without penalty.

401(k) pros | 401(k) cons |

|---|---|

High contribution limits | Limited investment options |

Tax savings | Fees can be high |

Employer matching | Early withdrawal penalties before 59 1/2 |

Loans available with some plans | Loans are taxed as early distribution if they aren’t paid back on time |

If you hope to get the most out of your 401(k), contribute as much as you are able to and choose your investments carefully to minimize fees. You should also claim any employer match that's available and watch out for your company's vesting schedule, which determines when you get to keep employer-matched funds.

- Tax benefits: Most 401(k)s are tax-deferred, which means your contributions reduce your taxable income this year but you pay taxes on your distributions. This is usually smart if you believe you'll be in a lower tax bracket in retirement than you are today.

But Roth 401(k)s are also growing in popularity. Contributions to these accounts don't reduce your taxable income for the year, but distributions are tax-free. You'll save more in taxes with a Roth 401(k) if you're in the same or a lower tax bracket today than you'll be in once you retire. - 401(k) loans: Some plans allow 401(k) loans. This enables you to borrow against your retirement savings and pay back that money with interest over time. But if you fail to pay back everything by the end of the loan term, the government taxes the outstanding balance as a distribution.

Other employer-sponsored retirement plans

403(b) and 457 plans are other types of employer-sponsored retirement plans you may come across.

IRA

An IRA is a retirement account anyone may open and contribute to, as long as they are earning income during the year or are married to someone who is.

The greater variety of options, coupled with the fact that you can open an IRA with any broker, means you may be able to keep your fees lower with an IRA than you could with the plans listed above.

IRA pros | IRA cons |

|---|---|

Wide variety of investment options | Low contribution limits |

Almost anyone can contribute | High-income earners cannot contribute to Roth IRAs |

Tax savings | Early withdrawal penalties before 59 1/2 |

Fees can be lower than with employer-sponsored plans | No employer matching |

Getting the most out of your IRA involves choosing your broker and investments carefully to minimize fees, while keeping your investments diverse and well-matched to your risk tolerance. You should also choose the right type of IRA -- traditional or Roth -- based on which you think will give you the greatest tax advantages, then contribute as much as you can each year.

You may contribute to an employer-sponsored retirement plan and an IRA in the same year.

- Tax savings: Traditional IRAs are tax-deferred -- your contributions are pre-tax, so they lower your taxable income for the year and you pay taxes on distributions. Roth IRAs use after-tax dollars, so your contributions have no effect on your taxes this year, but you can then withdraw your savings tax-free in retirement.

- Contribution limits: You can only contribute up to $7,000 to an IRA in 2025, and $7,500 in 2026. If you're 50 or older, you can contribute an extra $1,000 in 2025, and an additional $1,100 in 2026. You may contribute to tax-deferred and Roth accounts at the same time, but you can't make more than the annual contribution limit in combined traditional and Roth IRA contributions for the same tax year. So if you're younger than 50, your combined traditional and Roth contributions can't exceed $7,500 in 2026.

Types of IRAs

There are several types of IRAs to consider. Here are a few key alternatives.

- Traditional IRA. Traditional IRAs are funded with pre-tax money, but withdrawals are taxable as ordinary income. You may be able to deduct your traditional IRA contributions for tax purposes, depending on your income and whether you or your spouse has a workplace retirement account.

- Roth IRA. A Roth IRA is funded with after-tax money, but withdrawals are tax- and penalty-free once you're age 59 1/2 and the account is at least five years old. You can withdraw your contributions at any time without incurring a penalty or tax bill.

- Nondeductible IRA. High-income earners who also have an employer-sponsored retirement plan may not deduct their traditional IRA contributions from their taxes, so they end up with a nondeductible IRA.

Retirement plans for the self-employed and small business owners

Self-employed individuals and small business owners may contribute to an IRA, but there are also several special retirement plans available just for them that let them contribute more money per year, since they don't receive the benefit of an employer-sponsored retirement plan. Here's a look at some of the most common retirement plans for small business owners and the self-employed.

Expert Q&A on retirement plans

The Motley Fool touched base with retirement expert Jialu Streeter, Ph.D., a Research Scholar at the Stanford Center on Longevity. Jialu’s research primarily focuses on the economics of aging, retirement security, and financial security and mental wellbeing of older adults.