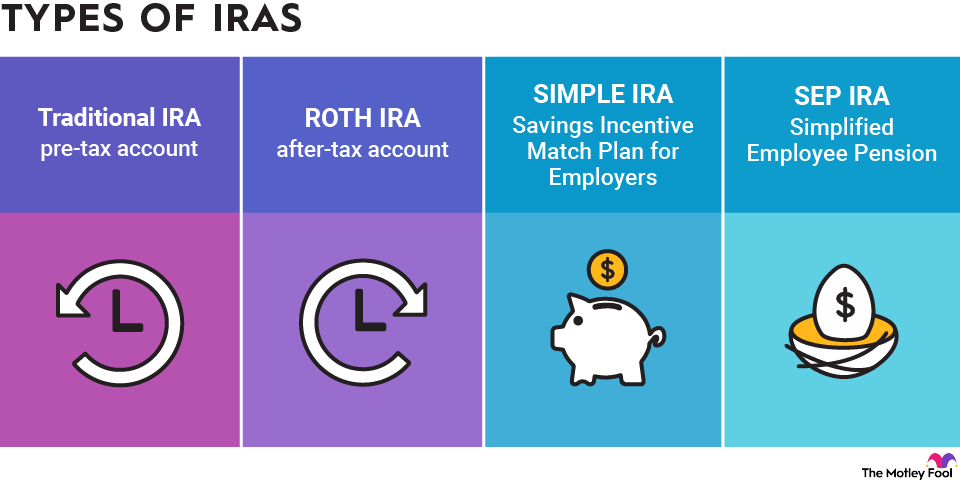

Individual retirement accounts (IRAs) provide tax benefits for retirement. However, there are annual IRA contribution limits, and exceeding them can carry consequences.

The combined annual contribution limit in 2026 for a traditional and Roth IRA is $7,500 for those younger than age 50 and $8,600 for those 50 and older (since the latter are eligible for up to $1,100 in catch-up contributions). These limits are higher than in 2025, when the maximum was $7,000 for those younger than 50 and $8,000 for those 50 and older.

SIMPLE IRAs and SEP-IRAs, which are used by small businesses and the self-employed, have larger annual contribution limits. Here's what you need to know about contribution limits for different types of IRAs.

Contribution limits for traditional and Roth IRAs

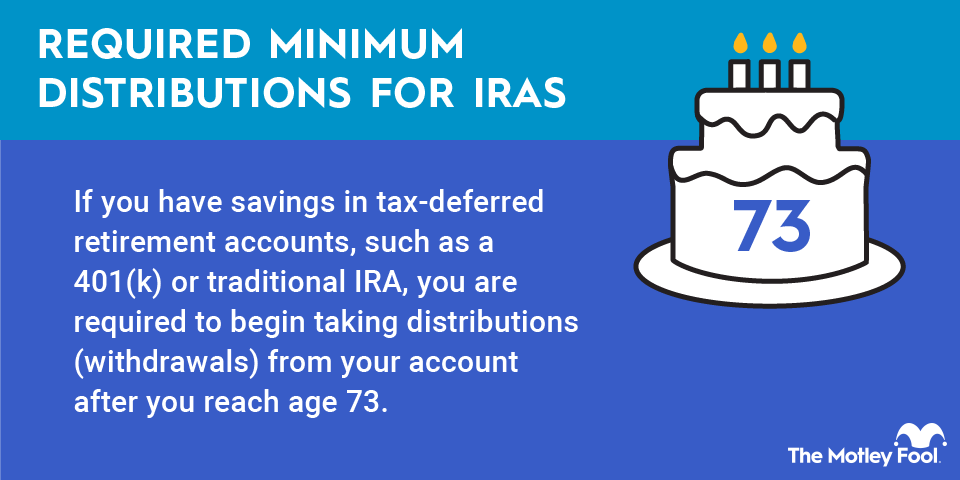

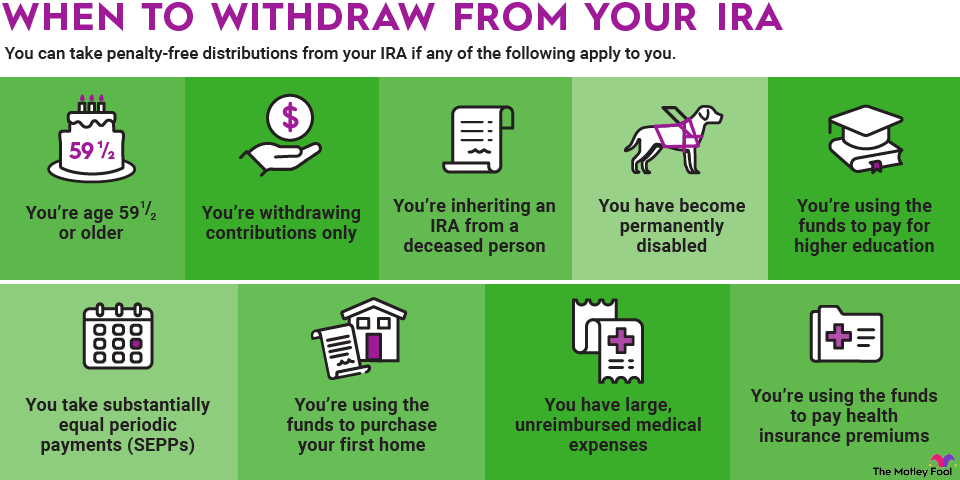

Contributions to traditional IRAs give you a tax deduction the year you make them, but you'll owe taxes on your withdrawals in retirement. Roth IRAs allow after-tax contributions only, but you're able to withdraw your money tax-free once you're at least age 59 1/2 and have had the account for at least five years.

There is an aggregate limit on the amount you can contribute to a traditional and Roth IRA. For 2026, the limit is $7,500 for individuals under 50, while catch-up contributions increase the limit to $8,600 for individuals 50 and older. The IRS raises the limit periodically due to inflation. In 2025, the limit was $7,000 for those under 50 and $8,000 for those 50 and older.

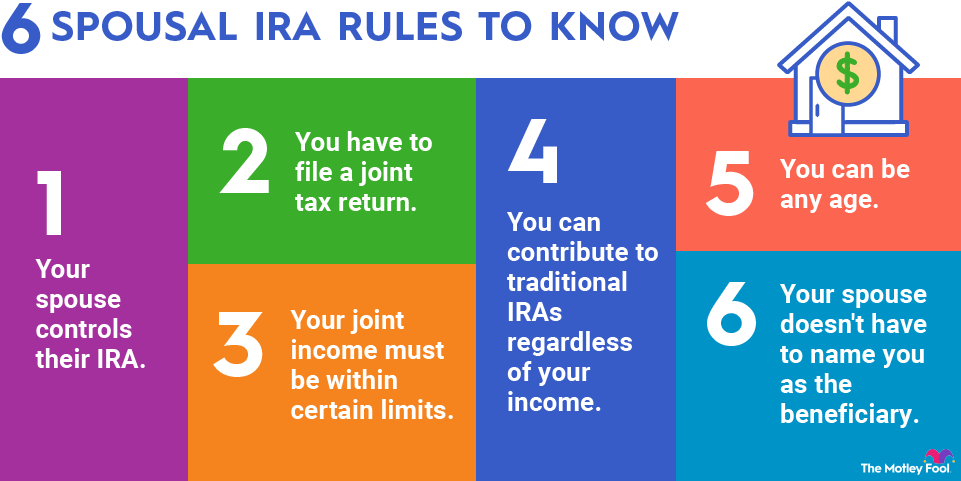

A nonworking person who files a joint tax return with their spouse also has the option to contribute to a spousal IRA as long as their spouse has earned enough taxable income to cover IRA contributions made for both. Spousal IRAs can be either traditional or Roth IRAs. Each spouse can contribute up to the annual limit, but total combined contributions can't exceed the taxable income reported on the joint tax return.

The IRS sets annual IRA contribution limits for both traditional and Roth IRAs. The table below shows the aggregate contribution limits for these two accounts by tax year for the past decade.

Tax Year | Basic Contribution Limit/Nonworking Spouse Contribution Limit | Catch-Up Contribution |

|---|---|---|

2017 | $5,500 | $1,000 |

2018 | $5,500 | $1,000 |

2019 | $6,000 | $1,000 |

2020 | $6,000 | $1,000 |

2021 | $6,000 | $1,000 |

2022 | $6,000 | $1,000 |

2023 | $6,500 | $1,000 |

2024 | $7,000 | $1,000 |

2025 | $7,000 | $1,000 |

2026 | $7,500 | $1,100 |

IRA eligibility

You are eligible to contribute to an IRA regardless of whether you also contribute to a 401(k), and 401(k) contributions do not affect limits on the IRA contributions listed above.

However, if either you or your spouse is covered by a workplace retirement plan, eligibility for deductible contributions to a traditional IRA begins to phase out at higher income levels. If your income is too high for you to make deductible contributions, you may still make nondeductible contributions up to the annual limit.

Higher earners are not eligible to make direct Roth IRA contributions at all. However, they can make backdoor Roth IRA contributions -- meaning they can make traditional IRA contributions and do a Roth IRA conversion in the same year. It gets you to the same place but requires you to jump through a few more hoops.

SEP-IRA contribution limits

Simplified Employee Pension (SEP) IRAs are created by employers, and self-employed people also have the option to create them. Only employers contribute to SEP-IRAs, with all contributions being made with pretax funds.

The SEP-IRA contribution limit is the smaller of:

- 25% of employee compensation

- $70,000 in 2025 and $72,000 in 2026

For self-employed workers, the 25% limit is based on net income. To calculate the maximum contribution, you must subtract any SEP-IRA contribution you plan to make, as well as the employer portion of payroll taxes, from gross income. Usually, you'll end up being able to contribute around 20% of gross income after doing this calculation.

You're not allowed to make catch-up contributions to a SEP-IRA, regardless of your age. However, contributions do not affect your ability to make regular contributions or catch-up contributions to a Roth IRA. You can also make deductible contributions to a traditional IRA as long as your income isn't too high for you to qualify.

SIMPLE IRA contribution limits

SIMPLE (Savings Incentive Match Plan for Employees) IRAs are also commonly used by small businesses and can receive contributions from employees and employers. Contributions are made with pre-tax funds, like traditional IRAs. Here's a rundown of SIMPLE IRA contribution limits:

- Employees are allowed to make contributions out of their salaries of up to $17,000 in 2026, up from $16,500 in 2025.

- Employees older than 50 are eligible to make catch-up contributions of up to $4,000 in 2026, up from $3,500 in 2025.

- Participants in plans offered by employers with no more than 25 employees can contribute up to $18,100 to SIMPLE IRAs in 2026 (up from $17,600 in 2025) with a catch-up contribution of $3,850 for participants 50 and older.

- These higher limits may also be available to SIMPLE plan participants if the company has 100 or fewer employees and provides either a 4% matching contribution or a 3% nonmatching employer contribution, instead of the 3% matching contribution or 2% nonmatching contribution outlined below.

- Adults aged 60 to 63 can make a higher catch-up contribution of up to $5,250 in 2025 and 2026.

Employee contributions are considered "elective deferrals," which count toward the combined annual limit that employees can contribute to all plans accepting elective deferrals, including 401(k) plans. This means that if you contribute to a SIMPLE IRA, you will reduce the amount you can contribute to a 401(k).

Matching contribution requirements for Simple IRAs

Employers are required to make matching contributions to SIMPLE IRAs using one of two approaches:

- They can make nonelective contributions of 2% of compensation up to a compensation limit of $360,000 in 2026 ($350,000 in 2025). This means employers must contribute to all workers' SIMPLE accounts, regardless of whether the workers contribute any funds of their own.

- They can match employees' salary-reduction contribution dollar for dollar up to 3% of compensation, which is not subject to the $360,000 compensation limit ($350,000 in 2025).

Employers are allowed to reduce the 3% matching contributions, but they may not reduce them below 1% -- and employers cannot reduce the contribution below 3% for more than two calendar years out of the five-year period ending in the calendar year the reduction is effective. Employers must also give employees a reasonable time to decide how much to contribute.

Do IRA rollovers count as contributions?

IRA rollovers occur when a worker rolls over money from a tax-advantaged retirement account into an IRA. For example, if you leave your job, you could roll over your 401(k) into your traditional IRA.

Rollovers do not count toward annual contribution limits or affect your ability to make contributions to your retirement accounts.

Related retirement topics

Making excess IRA contributions has consequences

Excess IRA contributions are subject to a 6% tax penalty. This penalty applies for each year in which the excess amount remains in your retirement plan.

To avoid being subject to this penalty, you must withdraw the excess contribution and any income earned from it by the due date of your individual income tax return, including extensions. During a typical tax year, you must withdraw the excess contribution by April 15, or Oct. 15 if you filed for an extension.

Keep an eye on changes to the IRA contribution limits over the years, particularly if you like to max yours out, if you're a high earner, or if you're contributing to multiple retirement accounts. This can help you avoid running into trouble with the IRS.