401(k)s are incentivized plans to help Americans save for retirement. The government provides tax breaks to encourage you to contribute, but also enforces certain rules to discourage you from taking distributions before retirement. In some cases, taking distributions early can cost you a 10% penalty in addition to the ordinary income taxes you'll owe on withdrawn funds.

Let's look at all the approved ways you can take money out of a 401(k) and the penalties you'll incur if your early distributions don't fall within one of those exceptions.

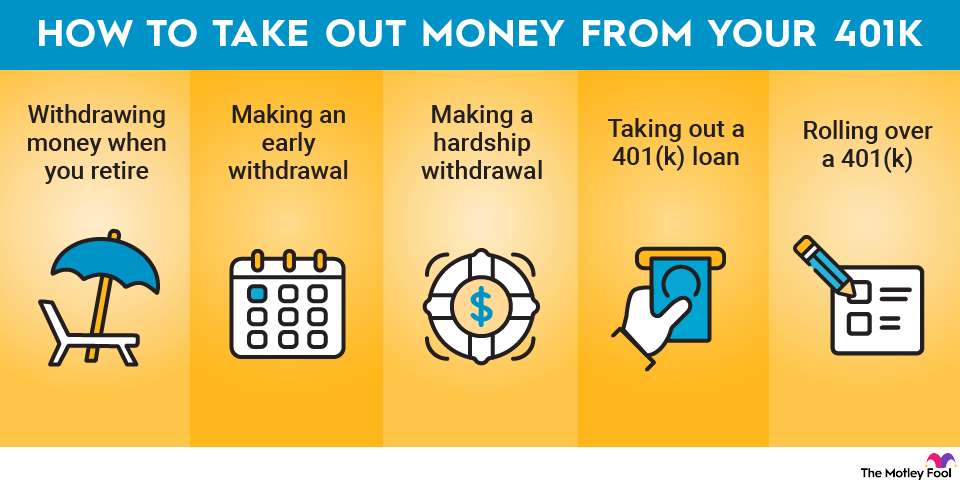

How to take money out of your 401(k)

There are many ways to take money out of a 401(k), including:

- Withdrawing money when you retire: Withdrawals you make after age 59 1/2 are penalty-free.

- Making an early withdrawal: These are withdrawals made before age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies for an exception.

- Making a hardship withdrawal: These are early withdrawals made due to an immediate financial need. However, hardship withdrawals are still penalized in some circumstances.

- Taking out a 401(k) loan: You can borrow against your 401(k) without incurring penalties as long as you repay the loan on schedule.

- Rolling over a 401(k): If you leave your job, you can move your 401(k) into another 401(k) or individual retirement account (IRA) without penalty as long as you put the funds in another retirement account within 60 days of your distribution.

Withdrawing when you retire

After you reach age 59 1/2, you may begin taking withdrawals from your 401(k). If you leave your job in the calendar year when you turn 55 or later, you can also begin taking penalty-free withdrawals from the 401(k) you had with that company. If you are a public safety worker, this rule takes effect at age 50.

Once you reach 73 (previously age 72), you're actually obligated to begin taking required minimum distributions (RMDs) from non-Roth accounts.

Early withdrawals

Any withdrawal you make before age 59 1/2 is considered an early withdrawal. In most cases, in addition to the ordinary income taxes you always owe when taking money out of a pretax 401(k), you are subject to a 10% penalty for any early withdrawal.

However, there are a few exceptions that enable you to avoid the 10% penalty (but not any applicable income taxes):

- Rule of 55: This applies if you leave your current employer in the calendar year you turn 55 or later and take money only from that company's 401(k).

- Substantially equal periodic payments: These require you to withdraw a certain amount from your account for at least five years or until you reach 59 1/2 (whichever is longer).

- Permanent disability: This applies if you meet your employer plan's definition of disabled.

- Qualifying medical expenses: If your medical expenses exceed a certain percentage of your adjusted gross income, you can withdraw funds penalty-free to cover them.

- Qualified domestic relations order: If a court orders you to give 401(k) funds to a spouse or dependent, you can withdraw the money penalty-free.

Adjusted Gross Income (AGI)

Hardship withdrawals

Some 401(k) plans allow you to take early withdrawals when you experience an "immediate and heavy financial need." Some examples include:

- Medical expenses

- Costs associated with purchasing a primary home

- Tuition payments or other qualifying educational expenses for the 401(k) owner, his or her spouse, or dependents

- Payments necessary to prevent eviction or foreclosure

- Burial or funeral expenses for a parent, spouse, child, or other dependent

Even if your employer's plan permits hardship withdrawals, you may still be subject to the 10% early withdrawal penalty unless you fall within one of the above exemptions.

401(k) loans

Some plans allow you to borrow up to 50% of your vested account balance, up to a maximum of $50,000, within a 12-month period. A 401(k) loan operates much like a standard loan: You must pay back the borrowed funds with interest. If you default on repayment, it will be considered a distribution, and you could be subject to the 10% penalty for early withdrawals.

Rolling over a 401(k)

If you leave your job or your plan terminates, you can roll over the 401(k) funds to another tax-advantaged retirement account. A direct rollover means the money moves from your 401(k) into your new tax-advantaged account and is usually recommended.

You can also do an indirect rollover, wherein you receive the funds directly and deposit them into your new account within 60 days to avoid treatment as a distribution. Your plan administrator will be required to withhold 20% of the amount you're rolling over for income taxes if you opt for an indirect rollover.

When you leave a job

When you leave a job, you generally have the option to:

- Leave your 401(k) with your current employer.

- Roll over the funds to an IRA.

- Roll over the funds to your new employer's 401(k).

If you choose any of those options, you will not owe taxes or a 10% penalty. You can also take this money as a distribution, but doing so will trigger early withdrawal penalties if you are younger than 59 1/2 (unless the Rule of 55 applies).

Roll over to an IRA

Rolling a 401(k) over into an individual retirement account (IRA) is often a good option when you leave your job or your plan terminates. You can open an IRA with any brokerage and generally have a wider choice of investment options. You may have the option of a direct or indirect rollover.

You must roll over a traditional 401(k) into a traditional IRA to avoid owing taxes. If you wish to do a Roth conversion instead, you'll need to pay taxes on the amount you convert.

Related retirement topics

401(k) early withdrawal penalties

If you withdraw money from a 401(k) before age 59 1/2 and don't roll the funds into another tax-advantaged plan or qualify for an exemption, such as the Rule of 55, you will face early withdrawal penalties. These penalties equal 10% of the amount withdrawn.

So, if you take $5,000 out of your 401(k) before retirement age, you would be faced with a $500 penalty. In addition, you will pay ordinary income tax on your withdrawn funds. With a $5,000 withdrawal, you would owe an extra $1,100 in taxes if your marginal tax rate is 22%.

These penalties add up. If you withdrew $5,000 and paid the 10% penalty and ordinary income taxes, you would be left with $3,400. Consider this major downside before withdrawing money from your 401(k) early.