The Motley Fool has a disclosure policy.

Understanding 457 Plans

Key Points

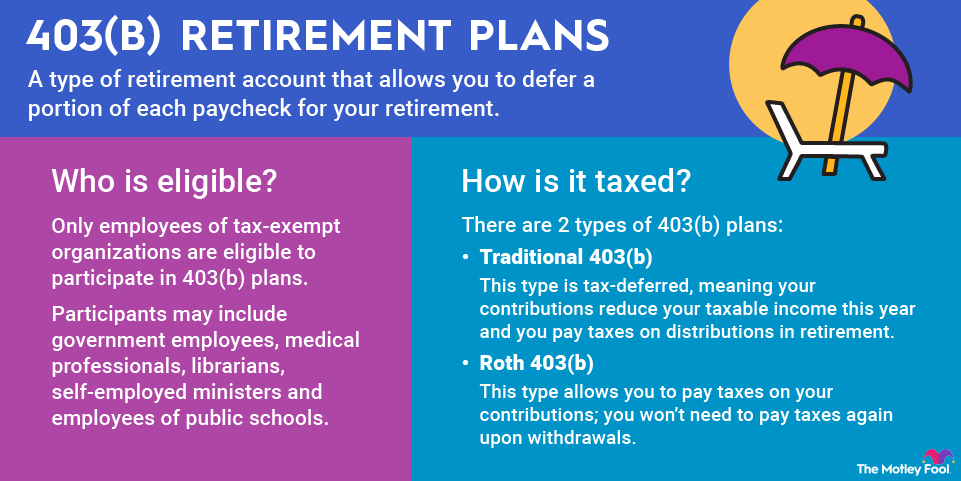

- 457(b) plans are tax-advantaged, employer-sponsored retirement accounts for certain employees.

- Contributions to a 457(b) don't affect the amount you can contribute to a 401(k) or 403(b).

- Withdrawals from a 457(b) are possible at any time without early withdrawal penalties.