Index fund investing has become far more popular recently, as many investors have started to recognize their long-term wealth-building potential and are wary of picking individual stocks. In this article, we'll discuss what an index fund is, how it works, whether you should buy index funds, and offer a few examples of popular index funds you might want to put on your radar.

What is an index fund?

An index fund is a type of investment vehicle that is designed to track a certain benchmark index. For example, an S&P 500 index fund aims to match the long-term total returns of the S&P 500. A Russell 2000 ETF aims to match the performance of the Russell 2000 index.

There are index funds that track broad-based stock market indexes, as well as sector-specific and narrowly focused indexes. For example, there are index funds that can be used to invest in the financial sector or in artificial intelligence stocks, just to name a couple of examples.

Index funds can come in the forms of both exchange-traded funds (ETFs) and mutual funds. Index funds are also referred to as passive funds, meaning that the fund's managers don't choose investments -- they simply try to replicate an index. This contrasts with actively managed funds, where managers choose investments with the goal of delivering superior performance over time. In short, an actively managed fund aims to beat the index, while an index fund simply aims to match the index.

Why invest in index funds?

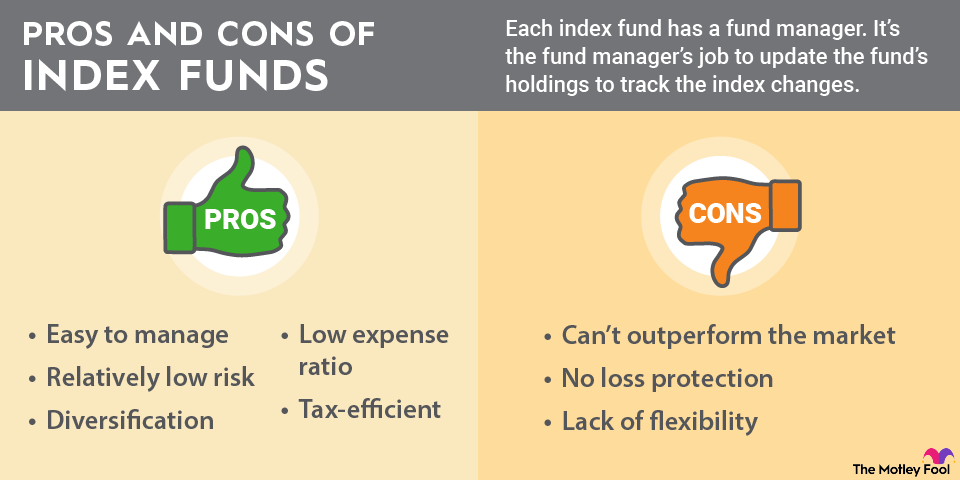

In a nutshell, index funds remove the need to do investment research and diversify your exposure instead of relying on one company's performance. For example, if you want exposure to AI in your portfolio but don't know which companies will be the biggest beneficiaries of this tech trend, an AI-focused index fund could be the way to go. If AI technology continues to expand, you'll likely benefit from it regardless of what businesses end up on top.

Index funds can be a great way to create long-term wealth, and that's even true with seemingly boring index funds, like those that track the S&P 500. In fact, the S&P 500 has delivered 10.2% annualized total returns since 1965. For context, this level of performance could have turned a $10,000 investment into more than $180,000 over a 30-year period.

Index funds are also more cost-effective than actively managed funds. For example, the Vanguard S&P 500 ETF (VOO +0.41%) has a 0.03% expense ratio, which means that just $3 of every $10,000 in fund assets will go towards fees annually. Actively managed funds often have expense ratios of 0.50% to 1%, so this can be a much more efficient way to invest. To be clear, this isn't a fee you directly pay; it will simply be reflected in the fund's performance over time.

Are index funds right for you?

Index funds can be solid investments for individuals of all experience levels and investment styles. If you don't have the time, knowledge, and desire to research and invest in individual stocks, index funds can be a great way to create a diversified investment portfolio that requires little attention or maintenance.

On the other hand, even if you have a portfolio of individual stocks that you believe can beat the market over time, index funds can form a backbone to your portfolio that can give you peace of mind and reduce your company-specific risk.

Related investing topics

Top examples of real-world index funds

There are hundreds, if not thousands, of index funds you can invest in. But just to name a few, here are some of the most popular examples:

- Vanguard S&P 500 ETF: an ultra-cheap index fund that aims to track the long-term performance of the S&P 500 benchmark index.

- Invesco QQQ Trust (QQQ +0.91%): This tracks the tech-heavy Nasdaq-100 index. This fund is so popular that you might hear someone describe the Nasdaq's performance by referencing "QQQ."

- Schwab High Dividend ETF (SCHD +0.65%): an index fund that focuses on stocks with above-average dividend yields.

- Vanguard Russell 2000 ETF (VTWO +0.29%): The Russell 2000 is the most popular benchmark index for small-cap stocks, and this is a low-cost index fund that tracks its performance.