I say "inventory," and you probably think of goods on a store shelf. That's correct, but only partly, and understanding inventory is really important to being a successful investor. A fuller definition: Inventory is the accounting of finished goods, component parts, and raw materials that a company either sells or uses in the production of products that it sells. As a result, the actual assets a company holds as inventory can be very different.

Keep reading for a better understanding of inventory that will help you find the best companies to invest in -- and identify the ones best avoided.

What is inventory?

As described above, inventory is the catch-all line on the balance sheet where a company includes the value of all assets that are either finished goods for sale, the parts and raw materials it uses to make those finished goods, or work in progress of being converted from parts and materials into finished goods.

As an accounting term, inventory is considered a "current" asset, meaning either a highly liquid asset such as cash or something that can be quickly turned into cash -- exactly what companies want to do with inventory and usually as quickly as possible. Therefore, inventory is also a really important component of working capital, which is those current assets minus current liabilities, which is essentially money owed to other parties in the next 12 months.

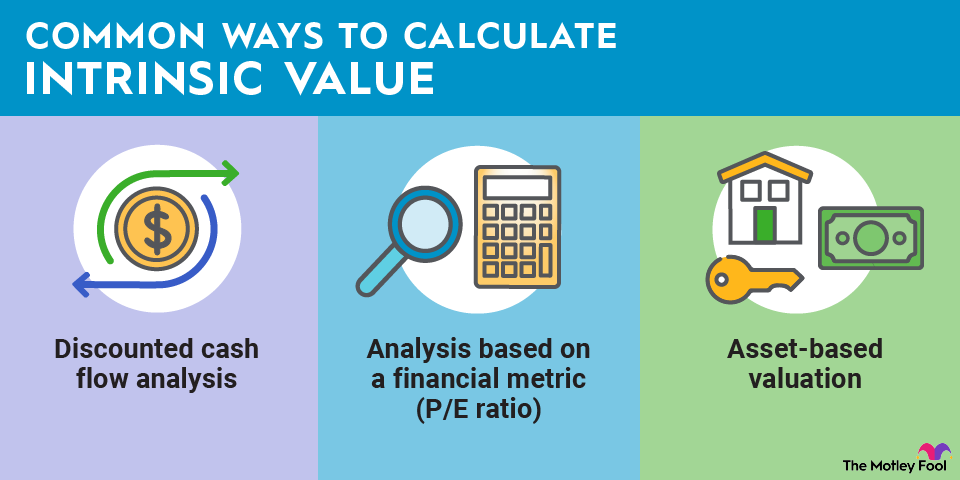

Related investing topics

Using inventory to invest better

The next step is applying that knowledge of a company's inventory patterns to see potential opportunities and risks. Let's use Target as a recent example of inventory management gone wrong. In 2020 and 2021, Target was an enormous beneficiary of the COVID-19 pandemic, as management acted quickly to accelerate its e-commerce business, including shipping and same-day in-store pickup. Millions of people were able to get goods more quickly as a result, and Target's profits skyrocketed.

Then came 2022, and Target found itself with significant excess inventory, much of which included apparel and other items that it had to deeply discount to unload. The discounting significantly cut into the company's margins and profits.

Target's inventory was up a massive 40% at the beginning of 2022 from the year-before levels, and 30% higher at the beginning of the second quarter. Even for a retailer of Target's size, it was a massive increase in goods that set a very high bar for sales growth to avoid ending up with excess inventory that it would need to discount to unload.

From the 2021 peak through mid-2023, Target's stock fell by half, in large part because of its aggressive moves to fill its shelves with goods that it struggled to sell.

Admittedly, we are applying some hindsight bias here. But a savvy analyst who understands retail could have seen a potential problem in the making for Target, and seen it as a stock to avoid. On the other side of the coin, that same savvy analyst might look at Target today, and see a company that's gotten this issue under control, while the stock is still discounted as a result of something that's no longer a threat to profits.