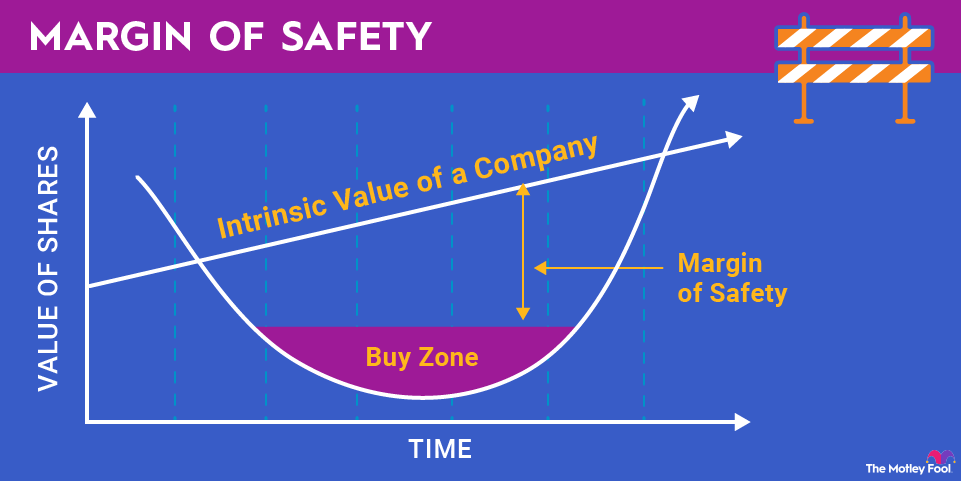

A margin of safety shows you how much room you have between the stock’s current price and its intrinsic value. Margin of safety is a key concept for investors of all types. Value investors lean on it the most, but growth investors, income-focused investors, and even derivative and option investors should use the concept.

How do you calculate a margin of safety? And how should you use it? We’ll go over both and use a few examples below.

What is a margin of safety?

The margin of safety is the percent difference between the intrinsic value of a stock and the current price. The wider your margin of safety is, the better chance that overly optimistic valuation inputs won’t doom your investment.

If the intrinsic value is $10 per share and the current price is $7.50 per share, then there is a margin of safety of 25%. It’s worth noting that intrinsic value is not a concrete objective number. It is the sum of the subjective inputs and therefore could vary widely depending on the analyst.

The higher the margin of safety, the less risk in the investment. A stock with a 50% margin of safety will theoretically fall less than a stock with a slim margin of safety or none at all. A stock that is undervalued has most potential bad news priced in already.

An overvalued stock, with a huge negative margin of safety, is priced for perfection. Any slip-up could cause the stock to collapse.

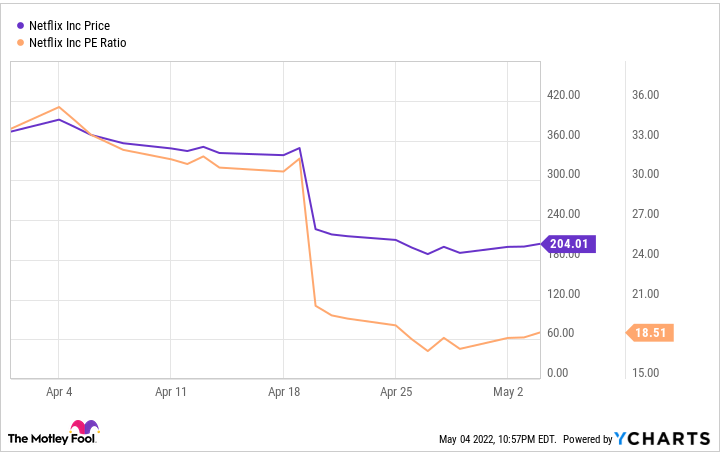

Netflix is a technology growth stock and traded at a price-to-earnings ratio (P/E) of close to 33. By comparison, the S&P 500 P/E was around 24. When Netflix reported that it had lost subscribers, the stock price tanked, falling from $360 to just over $200 in a few weeks.

The subscriber loss could be entirely blamed on closing down Russian subscriptions during the war with Ukraine. But the stock still fell more than 40% because there was no margin of safety.

Margin of safety is also an accounting term. It is equal to the gap between current revenue and break-even revenue. Managers use it to determine how much budgeted security they have before the company would lose money.

Margin of safety formula

(Intrinsic Value - Stock Price) / Intrinsic Value = Margin of Safety

Understanding margin of safety

Using the margin of safety to make investment choices -- for example, only investing when it is greater than 20% -- is often referred to as value investing. But growth investors should pay attention to the number, too.

Value investors typically use one of the following methods to find a stock’s intrinsic value:

- Discounted Cash Flow (DCF): With the discounted cash flow model, you project 10 years or so of future cash flows. You then discount the numbers because money you have now is worth more than money you might have in the future. The sum of the projected future cash flows is the intrinsic value.

- Multiples: Multiples such as price/earnings, price/sales, or price/book allow you to compare the stock with its competitors, its own historical numbers, or the market as a whole. If the subject stock has a lower multiple than comparable stocks or the overall market, it could have a margin of safety.

- Liquidation value: For some stocks, the only way to value them is to discount some of the assets to fair market value and determine what the whole company would go for if broken up and sold.

In value investing, you look for a quality, easy-to-understand business with good management, value it, and only buy with a sufficient margin of safety. Then you wait for the stock price to revert to its intrinsic value.

Growth investors have a harder time valuing stocks. It’s not unusual for a high-flying growth stock to have a P/E of 350 while the market is at 20 and still outperform over the next 10 years. Any discounted cash flow estimate is bound to look so outlandish as to be useless.

When I worked for a venture capital fund in college, we would value prospects by projecting what the total market for its industry could be in 10 years and then trying to figure out what level of market share it may have.

Another way is to use what Expectations Investing authors Michael Maubossin and Alfred Rappaport call price implied expectations analysis. Instead of running a DCF with crazy numbers, you figure out what amount of growth is needed to justify the current stock price.

Let’s say you’re looking at a growth stock with a high P/E but 100% annualized earnings growth over the past five years. When you run a DCF, it says the company needs to increase earnings at a 40% clip for the next five years to justify the current stock price.

To determine if you have a margin of safety, you need to figure out if that is doable. Forty percent per year for five years would turn earnings of $1 million into close to $5.4 million. That’s more than 400% over five years.

That level of growth is hard, but it isn’t unheard of. If the business is strong enough, it may be doable.

Margin of safety example

Let’s go back to Netflix to determine if it had a margin of safety following its stock price dive. To keep it simple, we’ll use price/earnings for our analysis. Netflix’s current P/E is 18, but you believe the P/E ratio will increase to around the S&P 500 number of 24.

With earnings per share (EPS) of $11.02, that means Netflix’s stock price is about $200 per share, and its intrinsic value is about $265.

($265 - $200) / $265 = 24%

A 24% margin of safety for a quality business such as Netflix is pretty good. We can also invert the formula and show that an increase of $65 per share to revert Netflix’s stock price to the intrinsic value would be a gain of 32.5% ($65 / $200).

Related Investing Topics

Margin of safety isn’t everything

It’s important to remember that the margin of safety you calculate for an investment is only as good as the intrinsic value calculation. If Netflix is destined to evolve into a no-growth company, a P/E of less than 18 may be realistic when you calculate its intrinsic value.

Margin of safety is a great way to measure risk and make sure you’re investing in a stock that has room to provide good returns, but you have to do good valuation work as well.