The Nasdaq-100 is a stock market index comprised of the 100 largest non-financial companies listed on the Nasdaq Stock Exchange. Nasdaq-listed stocks tend to be fast-growing companies. As such, this index tracks 100 of the largest growth stocks.

Here's a closer look at the Nasdaq-100, why it's important, and how investors use this index.

Why the Nasdaq-100 is important

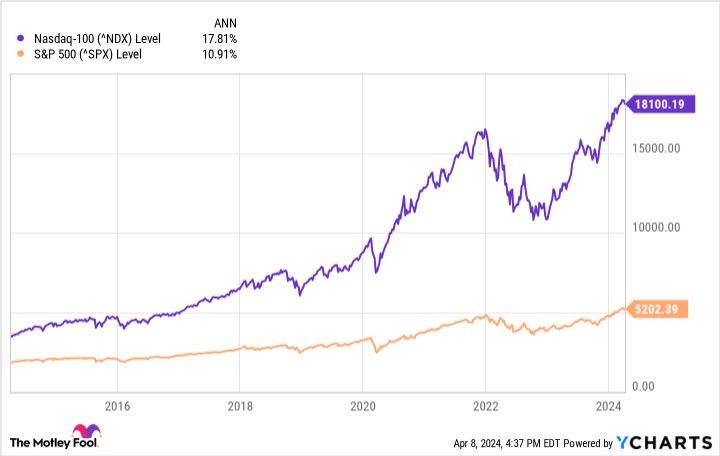

The Nasdaq-100 is an important index for investors because of its concentration in higher growth sectors, like technology stocks. It enables investors to track companies that have historically grown their earnings at above-average rates. As a result, the Nasdaq-100 has delivered stronger returns than the S&P 500 over the years:

An example of how to invest in the Nasdaq-100

Several funds enable you to invest in the Nasdaq-100. The most popular is the Invesco QQQ ETF. It's one of the oldest and largest ETFs. It has delivered a strong performance over the years. Since launching in 1999, the fund has delivered a more than 800% cumulative return, outperforming the S&P 500's return by over 300%.

The fund charges a reasonable ETF expense ratio of 0.2% that lets investors earn returns roughly matching the Nasdaq-100 index. Like that index, the ETF held 101 shares in early 2024, matching each stock's weighting in the index. It has delivered returns that have closely followed the index over the long term. For example, a $10,000 investment in the Invesco QQQ ETF a decade ago would have grown to $50,856 by the end of 2023. That has only slightly underperformed the $51,934 delivered by the Nasdaq-100 index due solely to the ETF's expense ratio.