It may not be easy to save for retirement without a 401(k), but it's also not impossible. According to a study by the Aspen Institute, 55 million Americans are faced with that very challenge.

Fifty-five million is the number of individuals who have no access to a 401(k) -- which means that they're saving for retirement without the benefit of 401(k) perks like automatic payroll deductions, high contribution limits, or employer-funded contributions.

These perks may automate and expedite savings progress, but that doesn't mean you can't save for retirement without a 401(k) or other employer-sponsored retirement account. If you know the other retirement accounts available to you, including Individual Retirement Accounts (IRAs), taxable brokerage accounts, and solo 401(k)s, then you can set up the comfortable retirement of your dreams. Here's what you need to know.

How to Save without a 401(k)

Contribute to a Roth IRA if you can

1. Contribute to a Roth IRA if you're eligible

Roth IRA contributions cannot be deducted from your taxes in the current year, but earnings from Roth IRAs are tax-deferred, and withdrawals after the age of 59 1/2 are completely tax-free. The tax deferral on your Roth IRA's earnings is valuable because it expedites your savings growth.

The ability to withdraw money tax-free in retirement could save you thousands every year, especially if you are in a high tax bracket when you retire.

There's one other advantage of the Roth IRA. Since you contribute to your Roth IRA with after-tax money, you can withdraw your contributions at any time without paying a penalty. For this reason, a Roth IRA can also function as an emergency fund. You are only penalized for withdrawing earnings until you reach the age of 59 1/2 and at least five years have passed since your first Roth IRA contribution.

The Roth IRA does have two drawbacks. First, the annual contribution limits are fairly low. In 2025, you can contribute as much as $7,000 annually, or $8,000 if you're 50 or older. And second, eligibility for contributing to a Roth IRA is based on your income and tax filing status. As the table below shows, you can't put money in a Roth IRA if you have a high income. (However, there is a backdoor Roth IRA strategy.)

Roth IRA income limits for 2025

Roth IRA income limits for 2025

| Tax Status | Modified Adjusted Gross Income | Contribution Allowed |

|---|---|---|

| Single or head of household | Less than $150,000 | Full contribution |

| Single or head of household | $150,000 to $165,000 | Partial contribution |

| Single or head of household | $165,000 or more | No contribution |

| Married, filing jointly | Less than $236,000 | Full contribution |

| Married, filing jointly | $236,000 to $246,000 | Partial contribution |

| Married, filing jointly | $246,000 or more | No contribution |

2. Contribute to a traditional IRA

Traditional IRA

If your income is too high to contribute to a Roth IRA, then you can contribute to a traditional IRA instead. Those contributions are tax-deductible if you don't have an employer's retirement plan unless your spouse has access to a retirement plan and your household income exceeds $236,000 in 2025.

The tax structure of the traditional IRA mimics the 401(k). Contributions are made with pre-tax dollars, earnings are tax-deferred, and distributions are taxable.

Taxable brokerage accounts

3. Contribute to a taxable brokerage account

To secure a comfortable retirement solely with IRA contributions, you likely have to start saving in your early 20s because of those low contribution limits. If you've already seen your 25th birthday come and go, that's obviously not an option.

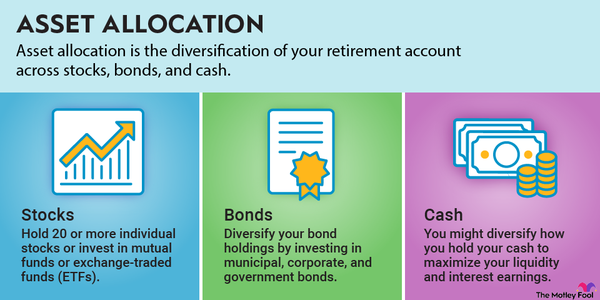

Instead, you can supplement your IRA savings with deposits to a taxable brokerage account.

You will have to manage your tax burden as your brokerage account grows. Dividends, interest, realized gains, and capital gains distributions from mutual funds are taxable annually. You can manage your tax bill proactively by investing in tax-efficient mutual funds and buy-and-hold stocks that do not pay dividends.

Your non-dividend-paying stock positions only incur taxes when you sell them and realize profits -- that's one of several good reasons to avoid impulsive trading. Invest in quality stocks that you can hold for long periods of time.

Self-employed retirement accounts

4. Launch a profitable side hustle and open a solo 401(k) or SEP IRA

If you really don't want to save for retirement without a 401(k), then you could open your own. You'd have to start a side hustle and establish a solo 401(k) or

Simplified Employee Pension (SEP) IRA. What's nice about these accounts is that they have very high contribution limits. In 2025, you can contribute as much as $70,000 to a SEP IRA or solo 401(k), depending on how much self-employment income you have. If you're 50 or older, then you can add an additional $7,500 to the solo 401(k) limit ($11,250 for those aged 60-63). There are caveats, though:

- SEP IRA contributions cannot exceed 25% of your income from the business.

- With a solo 401(k), you can contribute as both the employee and employer. As an employee of the business, you can contribute up to $23,500 of your compensation in 2025. As the employer, you can contribute up to 25% of earned income, up to a total solo 401(k) contribution of $70,000.

The broader takeaway is that your business must be profitable to make contributions to these accounts. You can't, for example, get a business license for a hobby, open a solo 401(k), and then contribute money from your day job.

Related retirement topics

Save and invest somewhere

A 401(k) may streamline retirement savings, but you can still build wealth without one. The trick is to save and invest somewhere, even if there are tax implications. The slight burden of a higher tax bill today is far easier to manage than the reality of facing your older years with no savings. But you can avoid that fate by tucking money away now and waiting patiently while your wealth grows.