Chinese electric-vehicle maker NIO (NIO 0.25%) said this morning it sold 88.5 million new American depositary shares, about 20% more than planned, at $17 each amid intense investor demand for EV stocks.

The offering was priced at a discount. NIO's shares had closed at $18.50 on Friday.

NIO's offering raised about $1.5 billion, a number that could increase if the banks underwriting the offering exercise an option to purchase an additional 13.3 million shares within 30 days.

If you're wondering what this all means, and whether it's bullish for NIO's investors, read on.

Highlights of NIO's secondary stock offering

- NIO had said on Friday that it would offer 75 million shares; that number increased to 88.5 million over the weekend.

- Those shares have now been sold, at $17 per share -- a discount to the stock's closing price on Friday.

- NIO also said on Friday that the deal's underwriters (Morgan Stanley, China International Capital, and Bank of America Securities) would have a 30-day option to buy an additional 11.25 million shares. That number was also increased over the weekend, to about 13.3 million.

While the increased size of the offering suggests that demand was higher than the underwriters had expected, the discounted price suggests the story is a little more complicated. That might be related to NIO's plans for the money.

NIO's next new model will be the ET7 sedan, due in early 2021. Image source: NIO.

What NIO plans to do with the money

Bear with me for a moment, as this requires some explaining.

At the beginning of 2020, NIO was running very low on cash after spending aggressively to expand its sales and service network in 2019. That situation was exacerbated as the COVID-19 pandemic effectively shut down China for much of the first quarter.

In April, with its options dwindling, NIO struck a deal to get a cash infusion from economic-development authorities in its home province of Anhui. That brought in nearly $1 billion, but the deal had a catch: NIO had to place all of its China-based assets into a subsidiary (called "NIO China") -- and its new investors would own 24.1% of that subsidiary.

In other words, NIO gave up almost a quarter of its assets in order to secure the financing it needed to stay afloat and move ahead with its growth plan.

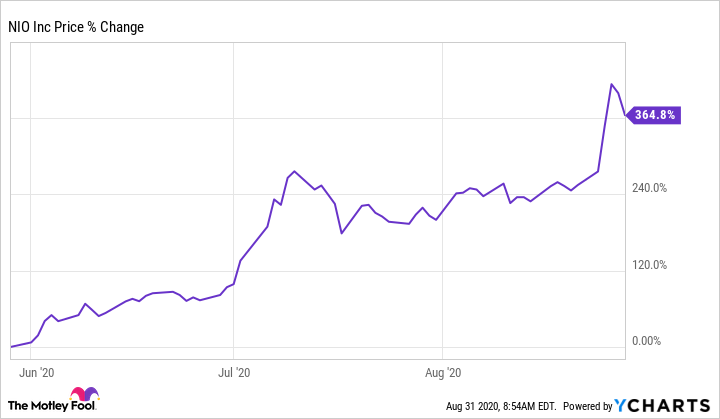

It was a tough deal, but on balance, investors liked it: NIO's stock price has soared since the deal closed in May.

NIO data by YCharts. Chart shows the percentage change in NIO's share price from May 31 through Aug. 28, 2020.

That brings us to this offering.

That soaring stock price gave CEO William Bin Li an opportunity to improve the terms of that deal by effectively buying back some of the 24.1%. NIO said on Friday that it will use the proceeds from this offering (about $1.5 billion, give or take) for three purposes.

- Up to $600 million will go into NIO China, under a provision in the May deal that gives NIO the right to add cash to the subsidiary in exchange for an additional 1.9% stake. (That cash will go right into NIO's business and will be used to fund its China growth plan.)

- About $357 million will be used to buy shares of NIO China back from some of the investors; that will give NIO "up to an additional 8.6%" of NIO China.

- The remaining cash will go toward NIO's self-driving development program, global market development, and for "general corporate purposes," the company said.

If all goes as planned, NIO will soon own 86.4% of NIO China, rather than the 75.9% it owns now.

Does that mean that NIO's offering is bullish?

I think it does, at least for auto investors taking a longer-term perspective.

First and foremost, remember that NIO's investors are government entities. The fact that this offering is happening suggests those entities have high confidence in NIO's ability to execute on its growth plan. (NIO's very good second-quarter result may have boosted that confidence.)

Second, NIO -- and its U.S. investors -- will own a larger share of its China assets once this is done. If nothing else, that should improve the parent company's cash flow, as a greater portion of NIO China's cash will now flow to NIO the parent.

My take here is that while the dilution and the discounted price of the offering might hurt NIO's stock price in the near term, on balance -- to me, at least -- the deal suggests Li and his team want to do right by the company's U.S. investors.

Over time, that seems likely to be quite bullish.

Editor's Note: This article has been updated to correct an error in Friday's closing price.