After leading Berkshire Hathaway (BRK.A +1.19%)(BRK.B +0.78%) for 60 years, Warren Buffett stepped away as CEO at age 95. To say it was a good run would be an understatement. Buffett and his managers turned Berkshire Hathaway into a trillion-dollar company (as of Jan. 28) and routinely outperformed the market along the way.

No doubt that lots of Buffett's philosophies will continue with Berkshire Hathaway, including many of the investments made while he was leading the way. If you're looking for a couple to add to your portfolio, these two Berskhire investments are built to be successful for quite some time.

Image source: Getty Images.

1. Visa

Visa (V 3.00%) isn't a large piece of Berkshire Hathaway's portfolio (0.9%), but it's one of the more reliable stocks it owns. Buffett frequently talked about the importance of a competitive moat, and in Visa's case, its competitive moat is its massive reach.

It's used in more than 220 countries and territories, trusted by more than 14,500 financial institutions, accepted by more than 175 million merchants, and in the 12 months leading up to Sept. 30, 2025, it processed 329 billion transactions.

NYSE: V

Key Data Points

Visa is in a great position in the financial industry thanks to its business model. Although you'll see Visa on your card, it doesn't actually issue the cards. Other companies, such as Chase, Wells Fargo, and Bank of America, issue the cards. Visa simply runs the payment network that enables card transactions.

This setup means Visa doesn't take a hit when someone doesn't pay their credit card bill. For example, if a Chase Sapphire customer bill doesn't pay their bill, Chase takes the loss, not Visa.

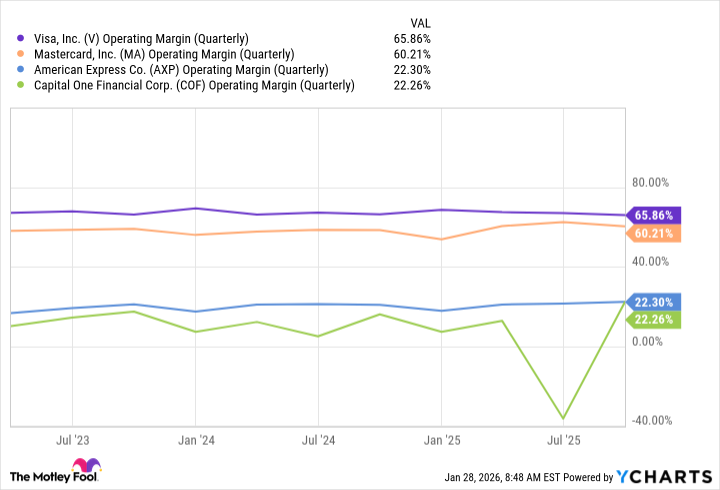

It also means that Visa can operate with high margins because its overhead is relatively small, and once the payment network is in place, there's virtually no additional cost per additional transaction.

V Operating Margin (Quarterly) data by YCharts

The world is progressively adopting cards and digital payments. As this continues, Visa will be one of the main beneficiaries. Not only does it increase the number of transactions on Visa's network (which means more revenue), but it also continues to solidify Visa's leadership position in the industry.

Visa is currently trading at 32.2 times its earnings, which is expensive but less than its average over the past decade (35.4). This could limit the chance for explosive growth, but Visa remains a great long-term buy.

2. Coca-Cola

Coca-Cola (KO +1.94%) is one of Berkshire Hathaway's longest holdings and one I'd bet it holds for a while.

NYSE: KO

Key Data Points

Two of Coca-Cola's biggest selling points are its brand moat and dividend. From a brand perspective, there's arguably no brand as well-known or popular globally as Coca-Cola. That takes unmatched distribution and decades of sustained success.

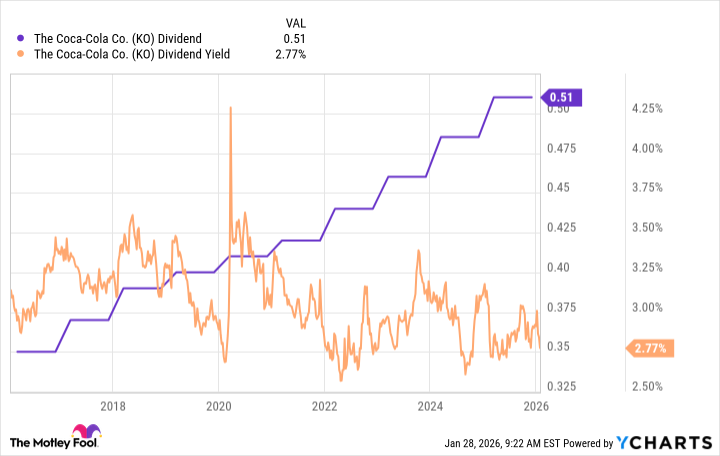

Dividend-wise, Coca-Cola is as reliable as they come. It has 63 consecutive years of annual dividend increases, making it a Dividend King (a company with at least 50 consecutive years of dividend increases). This is a testament to Coca-Cola's consistency and shareholder-friendly nature.

In the past decade, Coca-Cola has increased its dividend by more than 45%. It may not sound like much, but for a company that has been paying a dividend for as long as it has, it's more impressive than what appears on paper.

KO Dividend data by YCharts

There are very few places you can visit where you won't find Coca-Cola products. This wide distribution is made possible by Coca-Cola's business model. Coca-Cola doesn't typically sell directly to consumers. Instead, it sells syrups and concentrations to bottling partners globally, who then make the finished product and distribute it.

Having local companies handle distribution is much more efficient because it's generally easier for them to form partnerships with local stores and understand the logistical ins and outs of making deliveries happen. That would be a lot harder to do from a corporate office thousands of miles away.

Coca-Cola isn't an investment you make expecting high growth. It can happen, yes, but for the most part, Coca-Cola is a stock you invest in for the income. It routinely has a dividend yield that's more than double the S&P 500 average.