As a wise philosopher once said, life comes at you fast. That's why most financial experts recommend that your first major investment be an emergency fund.

If you lose a job, suffer a serious health issue, or experience a crisis that results in a major loss of income or an unanticipated expense, an emergency fund can save the day or at least ease some of the pain. Read on for more information about why you need an emergency fund and the best ideas for setting one up.

What is an emergency fund?

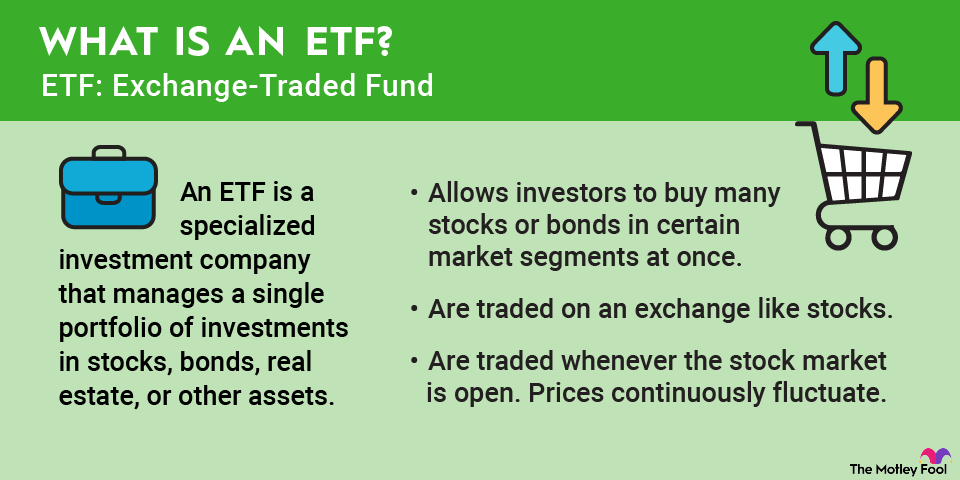

Sometimes called a rainy-day fund, an emergency fund should be a vital part of your financial journey. The Fool recommends building wealth through a buy-and-hold strategy that uses a diversified portfolio of stocks and bonds adjusted for your personal risk tolerance. But before you begin your investment journey, it's wise to insulate yourself from the financial catastrophes that happen to almost all of us at one time or another.

Liquidity

The easiest and most common form of an emergency fund is a simple savings account. You can grow wealth modestly while adding to your fund, and it's liquid enough that you can quickly withdraw funds if needed. Generally, it's best to have three to six months of cash on hand to deal with expenses that might include:

- Housing (mortgage or rent).

- Utilities (electric, gas, sewer, water, trash, etc.).

- Loan or credit card payments.

- Insurance premiums (health, life, auto, home).

- Emergency repairs (home, auto).

- Groceries.

Starting an emergency fund

You should follow five basic steps to create an emergency fund:

- Start small. Yes, you should have enough cash to cover three to six months of daily or emergency expenses on hand. But most of us would be fairly discouraged after figuring out how much money is needed and how long it might take to reach that amount. So, don't look at it that way. Consider breaking up your goals into smaller units. Start by calculating how much you'll need for groceries, and save up for them, one month at a time. Then move on to housing, then premiums, then loans and credit cards, and so on. Remember, this is a marathon, not a sprint.

- Don't overextend yourself financially. Again, small is beautiful (although big surely doesn't hurt if you can afford it). Regardless, make regular deposits into your emergency fund. One helpful trick is to reward yourself by putting money that you'd regularly spend on a luxury item or non-necessity into your emergency fund. Giving up avocado toast won't produce enough of a windfall to buy a house, but it might help speed the establishment of an emergency fund so you can begin an investment journey that will build real wealth.

- Automation is your friend. If a tree falls in the forest and no one hears it, does it make a sound? And if money from a paycheck goes into your emergency fund before you think about it, do you miss it? One of the best tools for creating an emergency fund is simply designating a certain amount of money to go into an emergency fund account. The less you think about it, the less you miss it, especially if it's a small amount that's consistently deposited.

- Focus on the long term. This means don't reward yourself with more spending. If you have more money left over at the end of a pay period, put it into your fund. The sooner you build your emergency fund, the sooner you can feel confident about dealing with an unexpected financial setback. This is as much about your mental health as your financial health.

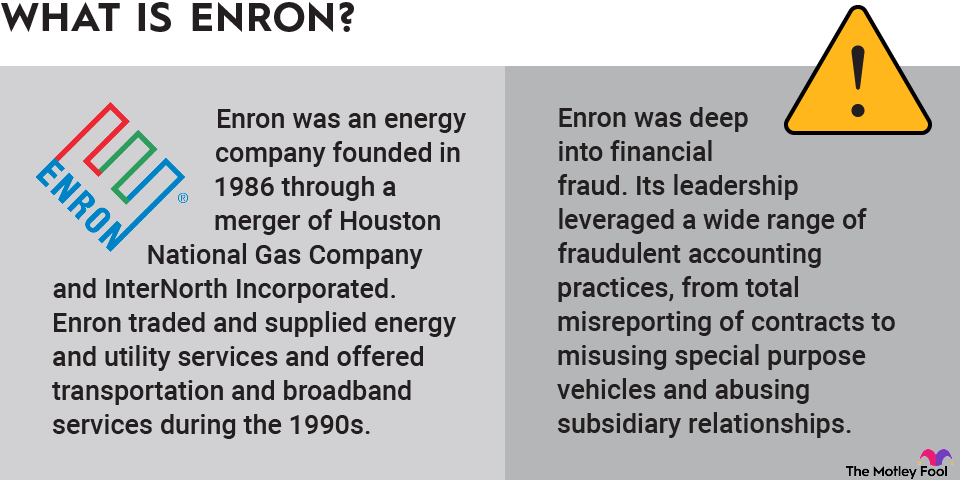

- Know when to stop. It's great if you can save money. But don't overdo it. Chances are good that your emergency fund money will be parked in a savings account offering a relatively low annual percentage yield (APY). Consider that in mid-2024, it was entirely possible to open an online savings account with a 4.5% APY. Sounds good, but the average return of an S&P 500 index fund over the last decade has been 10.7%. You want to have enough money to cover emergencies but not so much that you're missing excellent financial opportunities.

Related investing topics

Bottom line on emergency funds

A 2023 Bankrate survey offered some sobering statistics: Two-thirds of Americans worry they wouldn't have enough savings to cover immediate living expenses if they lost their primary source of income. Among adults who say they worry about their finances, 56% said they were concerned about a lack of emergency savings; the only larger fears were rising prices (68%) and paying for everyday expenses (60%).

It's true that you can't plan for every emergency. But at the very least, you can prepare to reduce some of the pain from an unexpected financial crisis. While saving enough money to cover three to six months of expenses may seem like an impossible mountain to climb, adjust your expectations. Take it one step at a time, and you'll soon be free of one of the biggest financial worries that any working person faces.