While investors closely monitor Cathie Wood's stock picks, they also pay attention to the exchange-traded funds (ETFs) ARK Invest manages, like the ARK Autonomous Technology & Robotics ETF (ARKQ -1.14%). Since September 2014, the fund has been an option for growth-focused ETF investors.

NYSEMKT: ARKQ

Key Data Points

The ARKQ ETF provides diverse exposure to companies advancing autonomous technologies. Autonomous vehicles alone -- just one niche of the autonomous technology market -- are projected to experience considerable growth in the coming years.

For example, business intelligence firm Grand View Research estimates the autonomous vehicle market was valued at about $68.1 billion in 2024 and projects it will soar at a compound annual growth rate (CAGR) of 19.9% from 2025 to 2030.

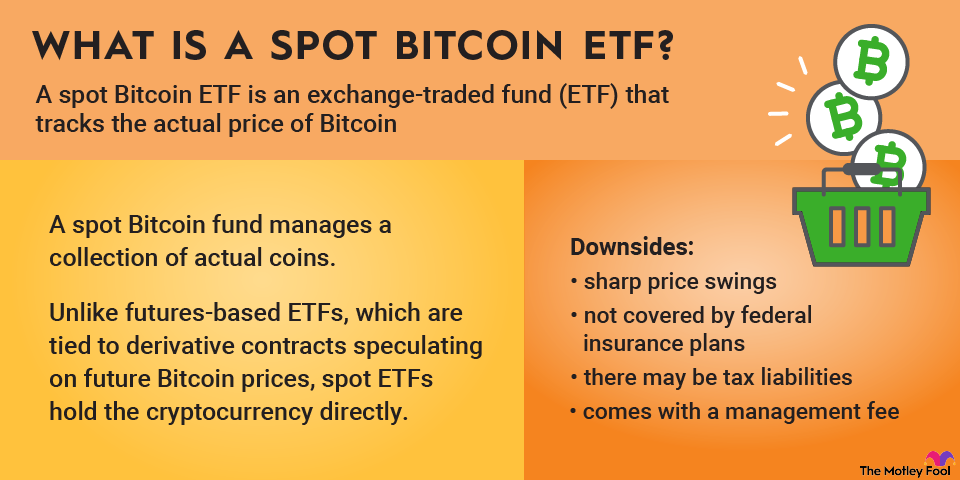

Exchange-Traded Fund (ETF)

What is the ARK Autonomous Technology & Robotics ETF?

People familiar with Cathie Wood are well aware of her focus on innovative businesses, and those found in the ARK Autonomous Technology & Robotics ETF are no different. In managing the fund, ARK Invest in selects businesses that are "expected to focus on, among other things, disruptive innovation in automation and manufacturing, transportation, energy, artificial intelligence, and materials."

Autonomous mobility stocks, including businesses focused on both land and air, are the fund's biggest holdings at 42.9%. Companies specializing in advanced battery technologies are next at 14.7%, with the remaining positions ranging between 6.7% and 9.3% of the total holdings.

Although the ETF includes some micro-cap stocks (which ARK Invest defines as those with market capitalizations of $50 million to $300 million), most of the holdings are considerably larger. Mega-cap stocks (market caps over $100 billion) make up 38.7% of holdings, while large-cap stocks (market caps of $10 billion to $100 billion) are the biggest portion at 48.2%.

For a different perspective on the stocks found in the fund, investors can look at the weighted average market cap, which is $503 billion.

How to buy ARK Autonomous Technology & Robotics ETF?

Investors interested in an ETF investment must take some basic steps to gain exposure to ARK Autonomous Technology & Robotics ETF, which trades under the stock ticker ARKQ.

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Holdings of ARK Autonomous Technology & Robotics ETF

The ARK Autonomous Technology & Robotics ETF usually contains between 30 and 50 positions. In late 2025, it has 37 holdings and about $1.8 billion in assets under management.

The five largest positions represent nearly 40% of the ETF's holdings.

- Tesla (TSLA -1.85%), 14.4%

- Teradyne (TER +3.60%), 9.2%

- Kratos Defense & Security (KTOS -6.72%), 7.3%

- Palantir Technologies (PLTR +0.80%), 5.9%

- AeroVironment (AVAV -3.02%), 4.7%

Despite the heavy weighting of the top five stocks, investors gain exposure to a variety of other businesses with the remaining names found in the fund. For example, providing investors access to the rapidly growing space economy, Rocket Lab (RKLB -7.47%) is the eighth-largest position in the ARK Autonomous Technology & Robotics ETF.

Investors also gain exposure to another business looking to blossom in the wild blue yonder: Archer Aviation (ACHR -1.95%) is an upstart aviation company working to provide air mobility service to urban customers in the coming years.

Should I invest in ARK Autonomous Technology & Robotics ETF?

With its considerable exposure to growth stocks, the ETF will more likely appeal to investors with multiyear investing horizons than to conservative investors who may have shorter investing horizons and won't view it as one of the best ETFs for them. Also, since the ETF doesn't provide a distribution, income investors will want to think twice before clicking the buy button.

On the other hand, those with a higher tolerance for risk and who are eager to gain exposure to a rapidly growing industry may find the ARKQ ETF especially enticing.

Does ARK Autonomous Technology & Robotics ETF pay a dividend?

Oftentimes, investors turn to dividend-paying ETFs to supplement their passive income. As of late 2025, the ARK Autonomous Technology & Robotics ETF doesn't pay a dividend, so people looking to generate steady income from their ETF investment will have to look elsewhere.

What is ARK Autonomous Technology & Robotics ETF's expense ratio?

Unlike Vanguard ETFs, which have extremely low expense ratios, the ARK Autonomous Technology & Robotics ETF is a little more costly to own. As of November 2025, the fund had a 0.75% expense ratio.

Expense Ratio

If you are considering an ETF or a mutual fund, it's important to be aware of the fees you'll be paying (if any) with an investment vehicle.

Historical performance of ARK Autonomous Technology & Robotics ETF

The investment options that ETFs afford are considerable. While some ETFs may track an individual index, others may provide exposure to specific sectors.

Contrasting the objectives of these other ETFs, ARK Invest states that the ARK Autonomous Technology & Robotics ETF's goal is the "long-term growth of capital." To gauge the fund's success to this end, we can compare its performance to that of the S&P 500.

It's important to recognize, however, that the ARK Autonomous Technology & Robotics ETF just launched in September 2014, so the ability to assess its performance is limited.

Fund | 1-Year | 3-Year | 5-Year | 10-Year |

|---|---|---|---|---|

ARK Autonomous Technology & Robotics ETF | 82.9% | 35.3% | 14.6% | 21.2% |

Market | 10.5% | 18.1% | 12.9% | 12.1% |

Related investing topics

The bottom line on ARK Autonomous Technology & Robotics ETF

Due to growth in the field, the ARK Autonomous Technology & Robotics ETF has been producing eye-popping returns in recent years. It's important to acknowledge, though, that the industry is far from mature, and there's plenty of growth yet to be recognized from the burgeoning field.

Investors should also appreciate that the ARK Autonomous Technology & Robotics ETF is merely one option among many worthwhile long-term ETFs.