Vanguard exchange-traded funds (ETFs) are listed investment vehicles offered by The Vanguard Group, one of the largest investment companies in the world.

Vanguard has built its reputation around a straightforward mission: helping investors keep more of their returns. It pioneered the low-fee revolution, not just through its mutual funds but also with its lineup of ETFs, which continue to benefit from the firm’s unique ownership structure.

Because Vanguard is owned by its U.S.-based mutual funds, and in turn by the investors in those funds, it can operate at cost -- keeping fees lower than many of its competitors.

Vanguard has also led the way with key innovations, including patenting the first ETF structured as a share class of a mutual fund, giving it unique tax efficiencies.

In recent years, it’s made moves into new territory by expanding its lineup of active fixed-income ETFs and aggressively cutting fees across an already dirt-cheap lineup.

But with 103 ETFs to choose from in the U.S., it’s easy to get overwhelmed. Let's break down some of the best all-around, low-cost Vanguard ETFs to consider, no matter your goals.

Top Vanguard ETFs to invest in 2026

What’s best will depend on your risk tolerance, time horizon, and objectives—but virtually all investors are well-served by broad diversification, low fees, and tax efficiency. These select Vanguard ETFs embody all three and are well-capitalized, with sufficient assets under management (AUM) and liquidity, plus low 30-day median bid-ask spreads.

1. Vanguard S&P 500 ETF (VOO)

NYSEMKT: VOO

Key Data Points

The Vanguard S&P 500 ETF (VOO -0.02%) tracks the well-known S&P 500 Index, which includes 500 of the largest U.S. companies screened for size, liquidity, and earnings quality. It’s a simple buy-and-hold ETF that gives you exposure to the blue chip core of the U.S. equity market, with a portfolio currently tilted toward the technology sector at around 30%.

Thanks to its low turnover and the ETF structure’s in-kind creation/redemption mechanism, it is highly tax efficient and hasn’t distributed capital gains. With an ultra-low expense ratio of just 0.03% and a 10-year annualized return of 14.78% before taxes, it’s a reliable, low-cost option for long-term growth.

2. Vanguard Total Stock Market ETF (VTI)

NYSEMKT: VTI

Key Data Points

The Vanguard Total Stock Market ETF (VTI -0.06%) offers a more diversified alternative to the previous ETF by tracking the CRSP U.S. Total Market Index instead of the S&P 500. That means it holds more than 3,000 stocks, giving you exposure to large-, mid-, and small-cap companies across the entire U.S. equity market. However, it’s still market-cap weighted, so the top holdings look a lot like the Vanguard S&P 500 ETF.

This one carries the same ultra-low 0.03% expense ratio, with minimal turnover and strong tax efficiency. Its 10-year annualized return sits slightly behind Vanguard's S&P 500 ETFs due to the relative underperformance of small- and mid-caps over the past decade.

3. Vanguard Growth ETF (VUG)

NYSEMKT: VUG

Key Data Points

The Vanguard Growth ETF (VUG -0.06%) tracks the CRSP U.S. Large Cap Growth Index, which pulls the largest stocks from broader benchmarks like the Vanguard Total Stock Market ETF and filters them for higher earnings growth, price-to-earnings (P/E), and price-to-book (P/B) ratios. The result is a portfolio with a heavy tilt toward the tech sector at about 62%; all of the "Magnificent Seven" stocks show up among its top holdings.

With a low 30-day SEC yield of just 0.38%, it is even more tax-efficient than the previous two ETFs mentioned since there are fewer taxable distributions. It has delivered a 10-year annualized return of 17.45%, outperforming broader benchmarks because the past decade has been strong for large-cap growth stocks. That trend may not continue, but it remains a solid long-term choice with a low 0.04% expense ratio.

4. Vanguard Value ETF (VTV)

5. Vanguard High Dividend Yield ETF (VYM)

NYSEMKT: VYM

Key Data Points

While the Vanguard Value ETF offers an above-average yield as a byproduct of its focus on value stocks, it’s not a dedicated dividend strategy. For investors specifically targeting income, Vanguard offers the Vanguard High Dividend Yield ETF (VYM +0.06%), which tracks the FTSE High Dividend Yield Index.

The index excludes real estate investment trusts (REITs), screens out companies that haven’t paid a regular dividend in the last 12 months or aren’t expected to, and then ranks the rest by forward dividend yield. Holdings are then weighted by market cap.

The Vanguard High Dividend Yield ETF holds a diversified portfolio of more than 500 blue chip stocks, with notable overlap with the Vanguard Value ETF, but delivers a higher 30-day SEC yield of 2.45%. The expense ratio is slightly higher at 0.06%, though still very reasonable. As with the other ETFs, value and dividend stocks have lagged over the past decade, so its 10-year annualized return is lower at 11.32%, though it did pull ahead during the rotation into value in 2022.

6. Vanguard Dividend Appreciation ETF (VIG)

NYSEMKT: VIG

Key Data Points

Related investing topics

Pros and cons of investing in Vanguard ETFs

Pros

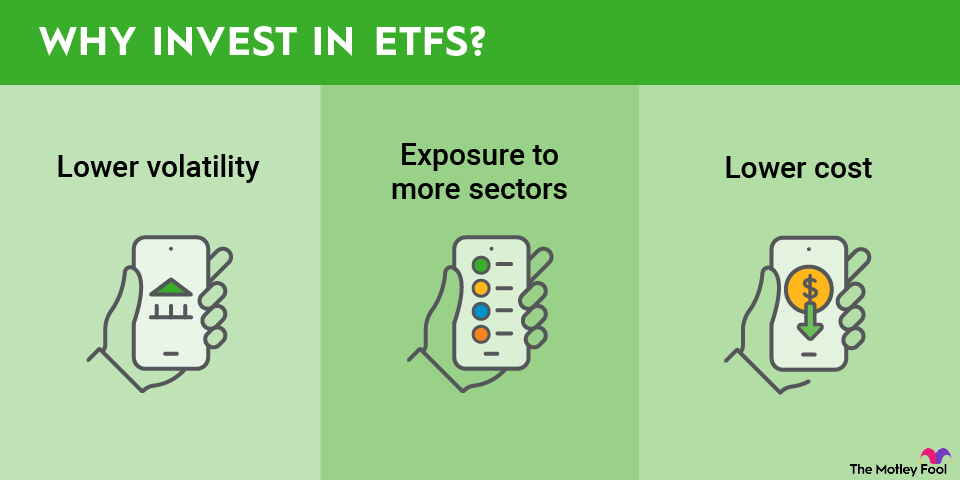

- Low fees: Most Vanguard ETFs are passively managed and track broad indexes, with expense ratios as low as 0.03%. Even Vanguard’s actively managed ETFs are relatively inexpensive compared to peers.

- Broad diversification: Vanguard designs its ETFs as core portfolio building blocks, offering exposure across sectors, company sizes, and global regions.

- Investor-owned structure: Vanguard is owned by its U.S. mutual funds, which in turn are owned by their investors. This unique setup means the firm’s long-term incentives are aligned with investors, helping to keep fees low and products straightforward.

Cons

- Limited breadth: Vanguard avoids niche products, so you won’t find leveraged, inverse, single-stock, or narrowly thematic ETFs in its lineup.

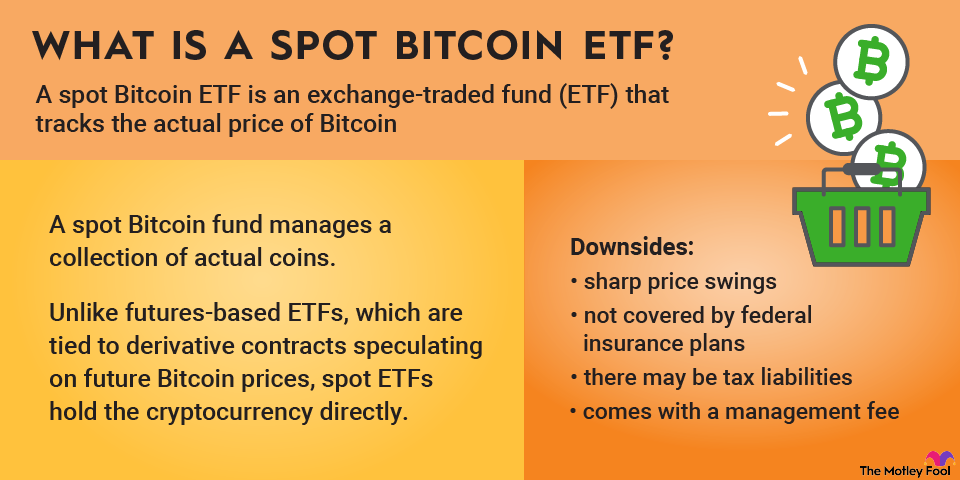

- No cryptocurrency options: Vanguard does not offer a crypto ETF and has publicly stated it has no plans to do so.

- Factor ETF underperformance: Vanguard’s smart beta and factor-based ETFs have largely lagged broad market index funds, meaning investors paid higher fees without seeing consistent outperformance.

How to choose the best Vanguard ETF

Choosing the right Vanguard ETF starts with narrowing the universe. The easiest way to do this is by using Vanguard’s ETF screener on its website.

Begin by selecting the “ETF” filter to remove mutual funds, which helps keep the list focused and comparable.

From there, a few screens are especially useful. Management style is a good starting point. Decide whether you want passive indexing, which tracks a benchmark, or active management, where portfolio managers select securities.

Next, filter by asset class. Vanguard offers ETFs across equities, bonds, money market instruments, balanced portfolios, and individual sectors.

Risk level is another important screen. Vanguard assigns a risk scale from one to five based on historical volatility. This helps align ETF choices with your risk tolerance and time horizon.

Finally, refine by region. You can target ETFs that hold U.S., international developed, emerging market, or global securities, depending on where you want exposure.

How to invest in Vanguard ETFs

- Open your brokerage account: Log in to your brokerage account where you handle your investments.

- Search for the ETF: Enter the ticker or ETF name into the search bar to bring up the ETF's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this ETF.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Tips for investing in Vanguard ETFs

A clear investment policy statement helps keep decisions disciplined. At a minimum, it should outline your goals, time horizon, risk tolerance, target asset allocation, and rebalancing rules. This reduces the temptation to react emotionally to market movements.

Tax efficiency matters, even with low-cost ETFs. Review whether distributions are eligible dividends, non-eligible dividends, or ordinary income, which is common in bond and REIT ETFs. Be mindful of account type, contribution room, and when professional advice may be appropriate, especially for complex tax situations.

Staying consistent with your investment philosophy is critical. Vanguard’s approach is rooted in broad diversification, low costs, and long-term discipline. That philosophy traces back to John Bogle, Vanguard’s founder. His work emphasized buying the entire market, keeping costs low, and staying the course through market cycles.