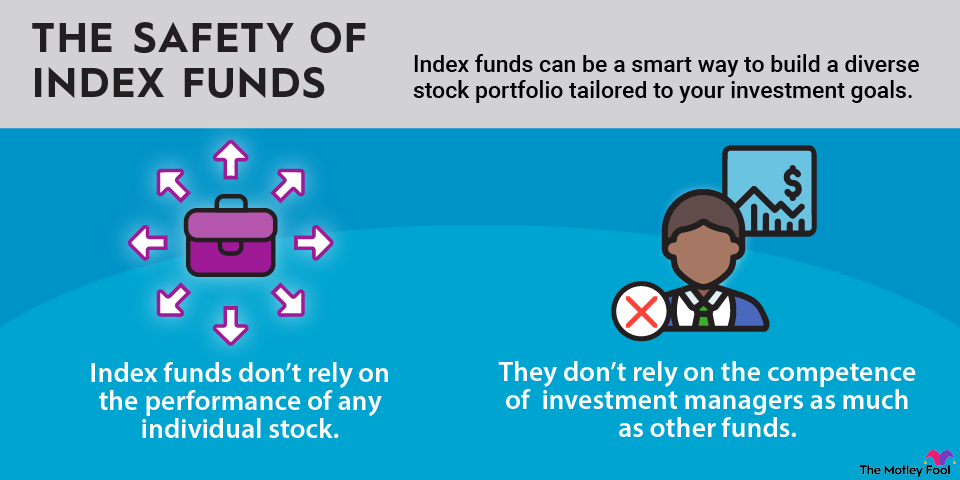

Index funds could also be part of a factor investing strategy where you seek exposure to something like small-cap value stocks. Importantly, the goal isn't to outperform the benchmark index its holdings are based on.

An actively managed fund will give you exposure to certain asset classes, but they'll also try to pick the best securities in those asset classes. For example, a large-cap U.S. stock mutual fund may look to outperform the S&P 500 by buying certain companies and overweighting in some sectors that the fund manager believes will outperform.

Unfortunately, most fund managers fail to outperform their benchmark index in any given year. In the 20 years from 2004 through 2024, 92% of fund managers underperformed the S&P 500. Picking the funds and managers that will outperform is practically impossible for investors since none have a consistent record of outperforming year after year.

Costs

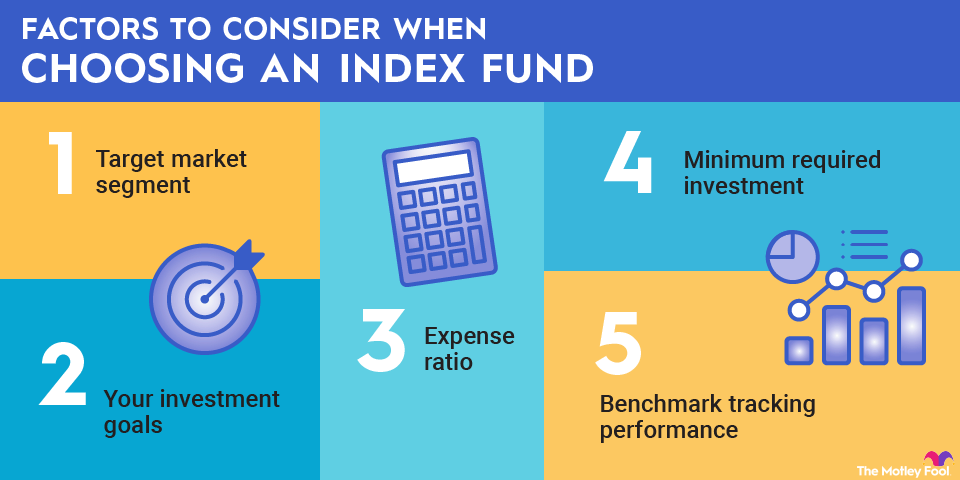

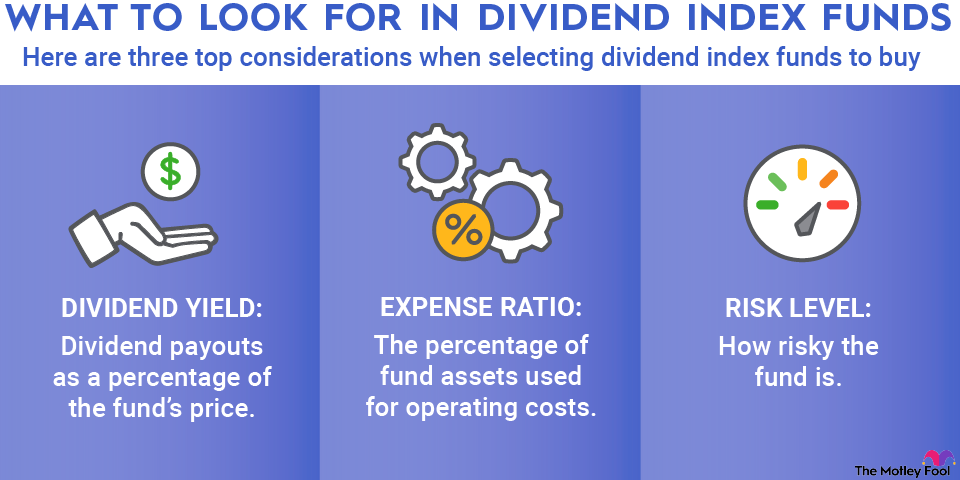

Both mutual funds and index funds make money by charging expense ratios, which are charged based on assets under management. For example, if you invested $10,000 with a mutual fund that charged a 1% expense ratio, you’d pay about $100 that year to invest your money. Of course, the nominal amount is always changing based on the fluctuating value of your portfolio, but expense ratios are generally very steady.

Since actively managed funds require a portfolio manager and a team of researchers to feed information about investment decisions, they charge higher expense ratios than index funds --sometimes 10 times higher. Many broad-based index funds have expense ratios of 0.10% or less.

If you purchase a mutual fund through a broker, you may also have to pay a sales load, which is a fee to compensate the broker. This could be paid up front (front-end load) or when the shares are redeemed (back-end load).

Taxes

Another cost to consider is that actively managed funds generally trade more frequently than passive index funds. That can trigger more taxable events for shareholders and create additional costs. What's more, shareholders have little control over those decisions despite being left with the tax bill.

Related investing topics