Index funds can be safe investments, but not all of them qualify as such. Index funds can be an excellent way to build an investment portfolio that isn't too dependent on the success of any particular stock or bond. In this article, we'll dive into nine top index funds that should hold up well during turbulent times while still delivering strong long-term performance -- no matter what the economy does.

Before we proceed, it's essential to note that none of these index funds is entirely risk-free, especially over short time periods. However, these index funds offer an excellent combination of growth potential and long-term safety.

Nine of the safest index funds and ETFs to buy in 2026

There are plenty of index funds to invest in, but some are much safer than others. Some deliver fantastic long-term returns, regardless of what the economy, political climate, or stock market does in the short run. Others hold up better during recessions and other periods of uncertainty.

By incorporating index funds like the nine exchange-traded funds (ETFs) listed here into your portfolio, you can implement a well-rounded investment strategy that can help you build wealth and sleep soundly at night.

1. Vanguard S&P 500 ETF

Legendary investor Warren Buffett has said that the best investment the average American can make is a low-cost S&P 500 index fund like the Vanguard S&P 500 ETF (VOO -0.32%). As its name implies, the ETF invests in all 500 companies that comprise the S&P 500 large-cap benchmark index and aims to track the index's performance over time.

NYSEMKT: VOO

Key Data Points

With a rock-bottom 0.03% expense ratio, your annual investment fees will be just $0.30 for every $1,000 in fund assets. For all of these funds, note that an expense ratio isn't a fee you have to pay. It will simply be reflected in the index fund's performance over time.

To be sure, the S&P 500 isn't necessarily a safe investment over short periods of time. The index has historically fallen by 20% or more from recent highs every few years.

However, over time, you might be surprised by how consistent the performance of the S&P 500 has been. From 1965 through the end of 2024, the S&P 500 delivered annualized total returns of 10.4%. Performance like this can build tremendous wealth over long periods.

2. Vanguard High Dividend Yield ETF

The Vanguard High Dividend Yield ETF (VYM +0.32%) tracks an index of stocks that have above-average dividend yields. The fund has a 0.06% expense ratio and invests in 566 different stocks, with top holdings including Broadcom (AVGO +0.17%), Walmart (NYSE:WMT), ExxonMobil (XOM +0.51%), and JPMorgan Chase (JPM -0.17%), to name a few.

NYSEMKT: VYM

Key Data Points

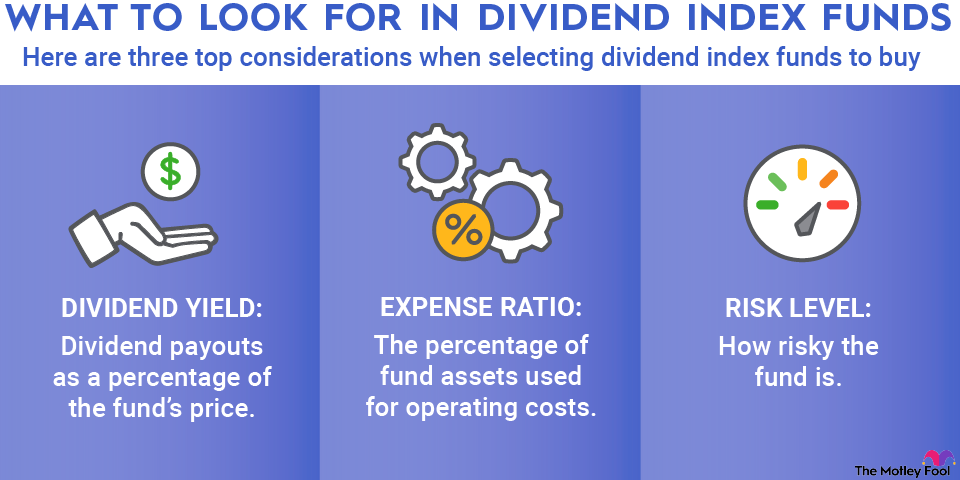

As you might expect, the ETF has an above-average 2.4% dividend yield. As a group, dividend-paying stocks tend to hold up better than their non-dividend counterparts during tough times; that's exactly what we saw during the most recent bear market.

This doesn't come at the expense of long-term performance. The dividend-focused ETF tends to outperform during tough times and underperform during bull markets, but dividend stocks have historically delivered about the same total returns as the S&P 500 over time. In a nutshell, the ETF can be a great option for investors seeking strong long-term performance with less short-term volatility than the overall market.

3. Vanguard Real Estate ETF

Real estate investment trusts (REITs) can be a great addition to any risk-averse investment portfolio. REITs tend to pay higher dividends than the typical S&P 500 stock, have lower volatility during difficult environments, and have actually outperformed the S&P slightly over the long run. The Vanguard Real Estate ETF (VNQ +0.10%) tracks a weighted index of about 150 REITs.

NYSEMKT: VNQ

Key Data Points

The fund's top holdings include American Tower (AMT -1.15%), Prologis (PLD +0.11%), Equinix (EQIX -0.62%), and Welltower (WELL +1.44%). REITs are designed to pass most of their income to shareholders, so the fund paid a dividend yield of about 4% as of December 2025. Its 0.13% expense ratio is on the lower end of the ETF spectrum, so you'll keep most of the returns the underlying stocks generate.

4. iShares Core S&P Total U.S. Stock Market ETF

Instead of choosing individual stocks or even a particular benchmark index, one way to reduce your risk is to simply invest in the entire stock market. You can do this by investing in an index fund that tracks a total market index, such as the iShares Core S&P Total U.S. Stock Market ETF. (ITOT -0.49%).

NYSEMKT: ITOT

Key Data Points

To be sure, the overall market can be quite volatile in the short term but has historically produced excellent long-term returns. As the name suggests, the ETF essentially aims to match the performance of the overall U.S. stock market. It owns about 2,500 different stocks, ranging from mega-cap giants to small-cap companies. Its 0.03% expense ratio is among the lowest in the entire ETF industry.

5. Consumer Staples Select Sector SPDR Fund

If you're concerned about safety during a recession or other tough environments, it can be a good idea to invest in companies that sell things that people need. The consumer staples sector is full of companies that do just that, and a great index fund to invest in is the Consumer Staples Select Sector SPDR ETF (XLP +1.68%).

NYSEMKT: XLP

Key Data Points

The ETF has a 0.08% expense ratio, which is certainly on the lower end of the spectrum when it comes to sector-specific index funds. It invests in the consumer staples companies in the S&P 500 index.

The fund's larger holdings include companies such as Costco (COST -1.21%), Procter & Gamble (PG +1.25%), Walmart, and Coca-Cola (KO +1.88%). In a nutshell, these businesses tend to do almost as well in tough economic times as they do in strong economies.

6. iShares 0-3 Month Treasury Bond ETF

When it comes to safe investments, the iShares 0-3 Month Treasury Bond ETF (SGOV +0.02%) is the next safest thing to simply holding cash in your portfolio. The index fund invests in a portfolio of Treasury securities with maturity dates of three months or less.

NYSEMKT: SGOV

Key Data Points

As you might imagine, this is more of a short-term cash alternative than a long-term wealth generator. Treasury securities are perfectly safe, and the short maturity nature of the fund means that your investment won't fluctuate as much with interest rate changes as comparable ETFs of longer-maturity bonds.

The fund has a yield of approximately 4.1% due to the current interest rate environment; however, this yield can be expected to change over time as interest rates fluctuate. Its 0.09% net expense ratio makes the ETF a far more appealing way to put your cash to work in a risk-free manner than actually buying bonds.

7. Vanguard Utilities ETF

Few types of businesses are as recession-resistant as utilities. Consumers and businesses need to pay their electric and gas bills no matter what the economy is doing, and these businesses generally have monopolies (or close to it) in the areas where they operate. An index fund like the Vanguard Utilities ETF (VPU -0.19%) that tracks the utility sector could be worth a look if safety is what you're after.

NYSEMKT: VPU

Key Data Points

This particular index fund has a 0.09% expense ratio, which is cheap for a sector-tracking ETF, and it owns a basket of 69 utilities stocks with a median market cap of almost $48 billion. Top holdings include NextEra Energy (NEE -0.32%), Constellation Energy (CEG -2.35%), Duke Energy (DUK +0.38%), and Southern Co. (SO +0.19%).

It's quite possible that if you own or rent a home in the United States, you make regular utility payments to a company included in the index.

This fund invests in an index linked to inflation-protected Treasury securities. Unsurprisingly, the current yield on the fund is good since it's linked to inflation.

As of December 2025, the ETF's yield was approximately 3.8%. Be aware that if inflation cools off, the index fund will have a lower yield; if it doesn't, the purchasing power of your money is safe. A 0.03% expense ratio can be a small price to pay for the peace of mind inflation resistance can provide.

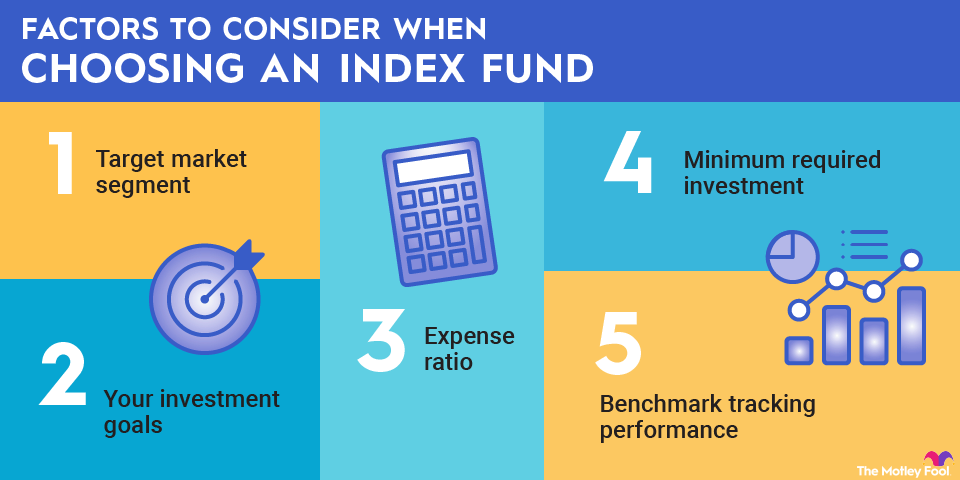

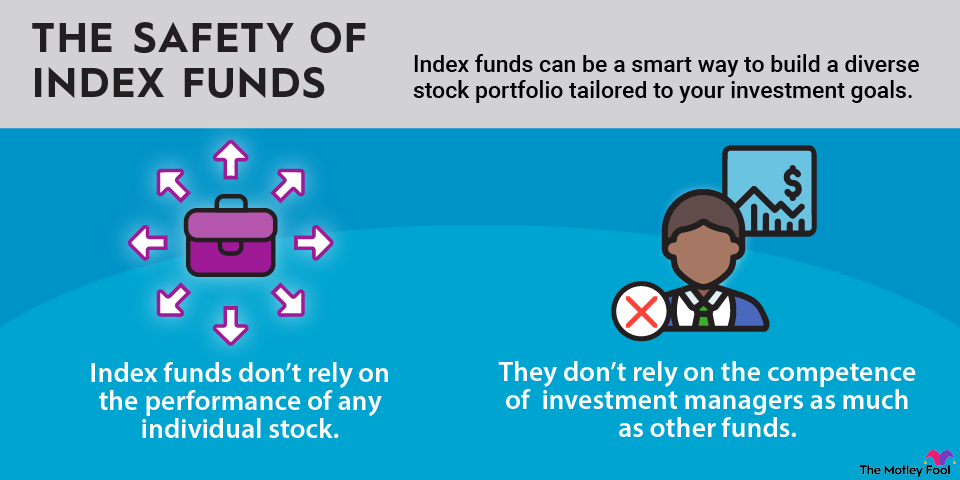

Why are index funds considered a safe investment?

Index funds are generally considered safe because:

- They don't rely too much on the performance of any individual stock.

- They don't rely on investment managers to make decisions.

- They have historically been a great way to build wealth over long periods.

Benefits of investing in safe index funds

A portfolio of relatively safe index funds, such as the nine examples discussed here, can enable you to put your money to work for the long term while still being able to sleep soundly at night.

Of course, these index funds (especially those that are stock-based) can experience significant fluctuations over short periods. But they are highly diversified and should perform well over the long run, regardless of any short-term stock market or economic noise.

Additionally, relatively safe index funds tend to be above-average dividend payers, making them excellent choices for investors who rely on their portfolios for income.

Related investing topics

The bottom line

Index funds can be a smart way to build a diverse stock portfolio tailored to your investment goals, whether your priorities are income, growth, stability, or a combination of the three. While this isn't intended to be an exhaustive list of the index funds that could add an element of safety to your investment strategy, these are nine examples of excellent index fund ETFs that could be a great start.