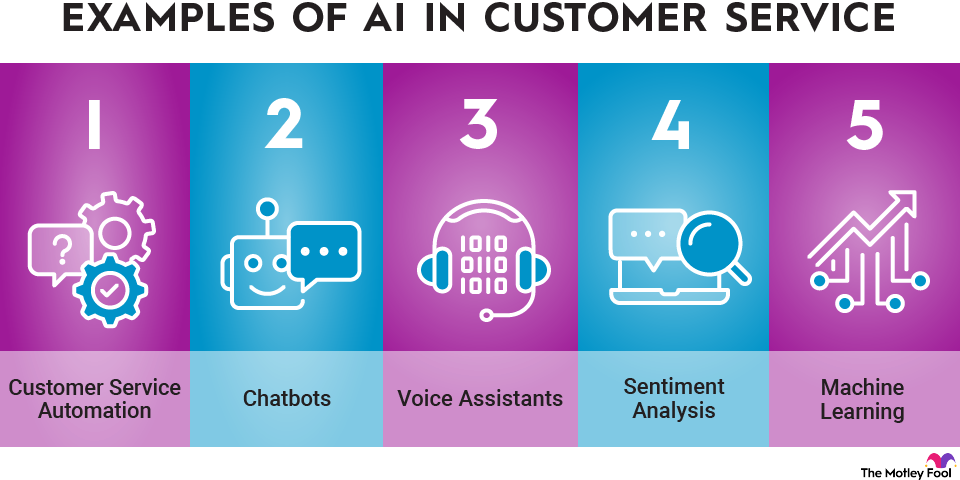

Intercom built a next-generation customer service platform for an artificial intelligence (AI)-first world. The company's technology combines an AI bot, AI Help Desk, and proactive support tools into a unified platform to help companies interact with customers. Over 25,000 companies use Intercom to send more than 500 million messages each month, including tech titans Amazon (AMZN +0.40%) and Microsoft (MSFT +0.77%).

The AI-powered customer service software company has quickly become a leader in helping companies improve customer communications. And it believes it's only scratching the surface of its potential.

That long growth runway has many investors eager to get their hands on its stock. Here's a look at everything you need to know about investing in Intercom stock ahead of a potential initial public offering (IPO).

Is Intercom publicly traded?

Intercom wasn't a publicly traded company as of late 2025. It was a private company backed by several venture capital funds. Notable investors in the company included Bessemer Venture Partners, Social Capital, Iconiq, Index Ventures, Kleiner Perkins, and Alphabet's (GOOG -0.80%)(GOOGL -0.83%) Google Ventures.

When will Intercom IPO?

Intercom didn't have an IPO on the calendar as of late 2025. However, many IPO watchers think the company could go public in the future.

IPO

The company has taken steps to go public in the past. It even selected a stock ticker and set an IPO date. However, it never went through with the offering.

Intercom's founder and CEO, Eoghan McCabe, discussed the company's IPO prospects in an interview with The Currency in late 2023. He said the company didn't need to go public then because it was producing positive cash flow, and its employees could sell their shares on a secondary market.

However, it could pursue a broad liquidity event in the future, which could "come by way of an IPO, or maybe someone buys us along the way, or maybe we sell a big chunk of the company to an investor," McCabe said. A liquidity event isn't a near-term focus because, "right now, we're really enjoying being private," he said. That could change if it needs a capital infusion or wants to become a public company.

Is Intercom profitable?

A vital aspect of researching a company is digging into its profitability. Ideally, you want to see that a company is growing its profitability or at least getting close to making money. Rising profitability is crucial to investors because it tends to drive a stock's performance over the long term.

The privately held Intercom doesn't publicly report its profitability, so there isn't much publicly available data about the company's financial performance. However, according to a Business Post article in mid-2024, Intercom wasn't yet profitable. The company's losses had risen despite a 23% increase in revenue due to a delay in moving to its new offices.

If Intercom does decide to go public, interested investors should check out its financial results to see if it's profitable or at least on the road to making money.

Alternatives to Intercom stock

Since Intercom hasn't completed its IPO yet, investors can't buy shares of the technology company in their brokerage account. However, some online secondary platforms, like Forge Global (NASDAQ:FRGE) and EquityZen, offer accredited investors (i.e., high-net-worth individuals or those with a high income) an opportunity to invest in the pre-IPO shares of companies like Intercom.

Non-accredited investors must remain patient and wait until Intercom goes public to buy shares. In the meantime, they can consider investing in a publicly traded competitor to gain exposure to the same trends driving its growth. Here are three AI-driven software stocks to consider while you wait to see whether Intercom will ever complete an IPO.

Salesforce

Salesforce (CRM -2.75%) is the world's leading AI customer relationship management (CRM) platform. The company's unified platform, Einstein, combines CRM, AI, and data to empower companies to connect with customers.

It also offers a growing list of cloud-based products and solutions like Tableau, Slack, and MuleSoft. The company generated $37.9 billion in revenue in fiscal 2025 (a 9% increase from fiscal 2024) and $12.4 billion in free cash flow (31% growth). It returned $7.8 billion of that cash flow to investors via share repurchases and dividend payments.

Should I invest in Intercom?

Unless you're an accredited investor, you can't invest in Intercom yet, giving you time to decide whether you want to buy shares if and when the company goes public. Here are some reasons you might want to invest in Intercom's IPO:

- You think Intercom can continue to grow briskly as more companies use its AI-powered solutions.

- You believe Intercom offers better solutions than competing platforms, enabling it to continue growing while winning market share.

- You want to invest in founder-led companies.

- You're seeking to invest in high-growth companies.

- Adding Intercom would help diversify your portfolio.

- You want to invest in profitable companies that can self-fund growth with retained earnings.

On the other hand, here are some reasons you might decide not to invest in Intercom:

- You're not exactly sure what Intercom does or how it makes money.

- You don't think AI tools will live up to their hype.

- You're at or nearing retirement and are seeking lower-risk investments than a venture-backed technology company.

- You're concerned about Intercom's growing competition.

- You already hold lots of technology companies in your portfolio.

ETFs with exposure to Intercom

Not everyone wants to actively manage a portfolio of individual stocks. Many would prefer the passive investing approach offered by exchange-traded funds (ETFs). ETFs enable you to gain some passive exposure to companies, specific themes, or the broader market.

Exchange-Traded Fund (ETF)

The bottom line on Intercom

Intercom is an early leader in using AI to help companies improve their customer communications. It's also a rarity among start-ups because it's already generating enough positive cash flow to self-fund its growth. Those features have investors eagerly awaiting its IPO.