Since launching a purple, no-fee credit card in Brazil about a decade ago, Nu Holdings (NU -0.06%) has grown into one of the world’s largest digital financial platforms, now serving 110+ million customers across Brazil, Mexico, and Colombia.

What started as a card is now a full suite of products: spending (credit/debit and payments), saving (checking/savings), investing, borrowing (loans and buy now, pay later), and basic insurance benefits. With a huge underbanked population across Latin America and a market estimated at more than $1 trillion, Nu still has a long runway.

Interest from investors has followed (including a past Berkshire Hathaway investment, though it held zero NU shares as of 2025). Here’s how to buy the stock and what to weigh before you do.

How to buy Nu Holdings stock

There are a few steps you'll need to take before buying shares of Nu Holdings. This guide will show you how to go about adding the digital financial services platform to your portfolio.

- Open your brokerage account: Log in to your brokerage account where you handle your investments. If you don't have one yet, take a look at our favorite brokers and trading platforms to find the right one for you.

- Search for Nu Holdings: Enter the ticker "NU" into the search bar to bring up the stock's trading page.

- Decide how many shares to buy: Consider your investment goals and how much of your portfolio you want to allocate to this stock.

- Select order type: Choose between a market order to buy at the current price or a limit order to specify the maximum price you're willing to pay.

- Submit your order: Confirm the details and submit your buy order.

- Review your purchase: Check your portfolio to ensure your order was filled as expected and adjust your investment strategy accordingly.

Should you invest in Nu Holdings?

Here are some reasons why you might want to buy shares of Nu Holdings:

- You're seeking a high-growth investment opportunity.

- You think shares of Nu Holdings can meaningfully outperform the S&P 500 over the next three to five years.

- You believe Nu Holdings could disrupt the banking system in Latin America.

- You like to invest in founder-led companies.

- You don't need to earn dividend income from your investment.

- Investing in Nu Holdings would help you build a more diversified portfolio by adding some exposure to the financial sector and Latin America.

- You're comfortable with Nu Holdings' lofty valuation, which you think the company will grow into eventually.

- You understand the risks, including the possibility that shares of Nu Holdings could lose value.

Meanwhile, here are some factors to consider that might lead you away from investing in Nu Holdings:

- You're cautious about investing in companies based outside the U.S. and Latin America in particular.

- You already own several financial stocks.

- You're concerned about the global economy and worry that a recession could slow Nu Holdings' growth and potentially impact its earnings if customers were to fall behind on paying their credit cards or other loans.

- You're a bit concerned about Nu Holdings' higher valuation.

- You're seeking investments with lower stock price volatility than Nu Holdings.

- You're in or nearing retirement and need investments that generate income.

NYSE: NU

Key Data Points

Is Nu Holdings profitable?

Crunching the numbers and analyzing a company's profitability is crucial to an investor's stock research process. Earnings growth typically powers stock price performance over the longer term.

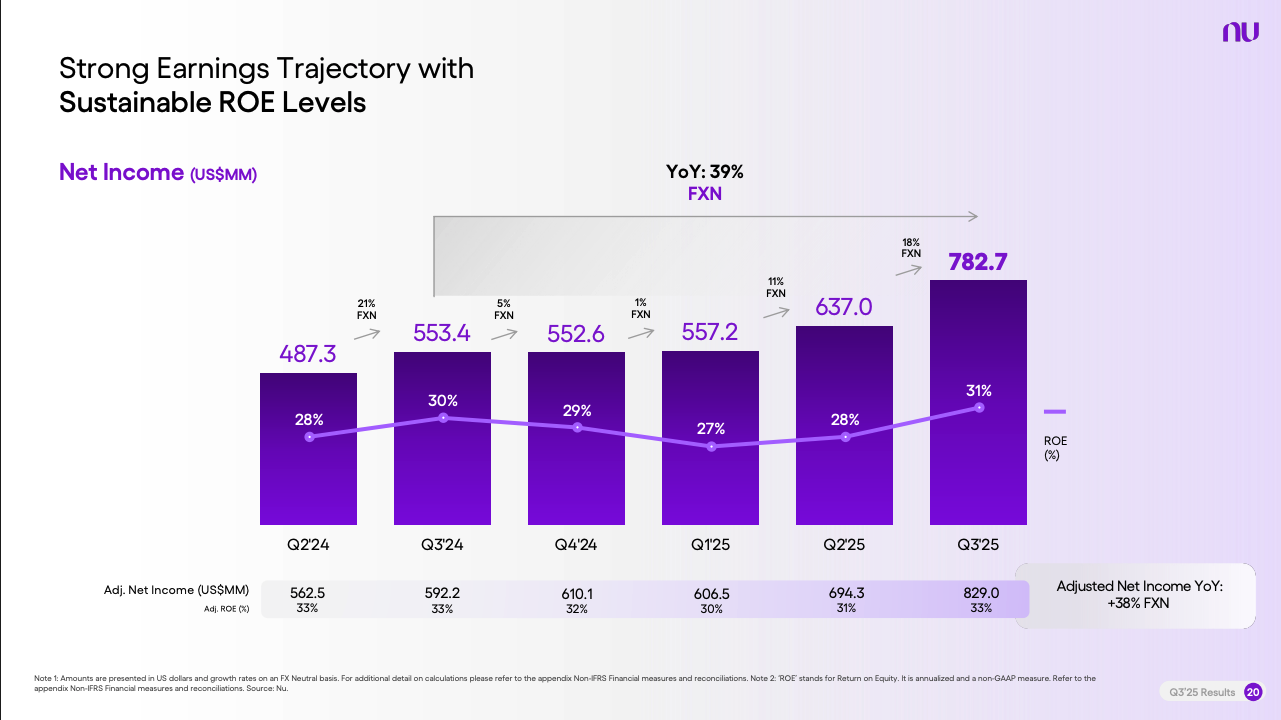

At the holding company level, Nu was profitable during the third quarter of 2025. The digital financial platform reported $782.7 million of net income in the period on $4.1 billion of revenue.

Nu's profitability has significantly improved over the past year. Its net income grew roughly 18.6% in the third quarter, while its revenue surged 42%.

After reporting losses in its first several quarters as a public company, Nu Holdings turned the corner on profitability in the third quarter of 2022 and hasn't looked back. Its net income has soared over the past year:

Will Nu Holdings stock split?

Nu Holdings didn't have plans for an upcoming stock split as of late 2025. The company has not completed a stock split since going public in 2021 and isn't likely to split its stock anytime soon.

As of late 2025, shares of Nu Holdings traded at around $15 per share, putting them slightly above their IPO price of $9 per share. The share price would need to gain significantly before Nu Holdings would need to split its stock to make it more accessible to investors.

The bottom line

Nu Holdings has grown phenomenally over the past decade by adding new financial products and services and expanding into additional Latin American countries. It's still only scratching the surface of its potential, so it could continue delivering rapidly rising revenue and profits for investors, which could drive its stock price higher over the longer term.

While Nu Holdings has tremendous growth potential, it might not be the best stock for everyone. It trades at a lofty valuation and operates in Latin America, which tends to be a riskier region for investors. Those interested in investing in the company must thoroughly understand its business and its risks before buying shares.