The best chief executive officers (CEOs) in the world typically aren't the flashiest ones. They think beyond tomorrow's share prices or the next earnings call to create lasting value. Here are seven top CEOs for long-term investors to watch as they build great businesses with shares that are worth holding for decades.

Dr. Lisa Su, AMD

1. Dr. Lisa Su, AMD

Advanced Micro Devices (AMD -4.02%) seemed destined for bankruptcy in late 2014, when Dr. Lisa Su became the chipmaker's CEO. As of mid-February 2022, AMD's share price is almost 35 times what it was when she took command.

Su, who has a doctorate in electrical engineering from the Massachusetts Institute of Technology, led the remarkable turnaround by zeroing in on what the company did well -- making central processing units (CPUs) for computers and servers. She also diversified the business to focus on chips for gaming consoles and data centers, both of which have been lucrative bets during the COVID-19 pandemic. Just as important, though, were Su's decisions about what not to focus on, such as developing chips for smartphones and tablets (even though the rest of the chip industry still believed in mobile as the next big thing).

The semiconductor manufacturer recently completed its first acquisition under Su’s leadership, spending $50 billion to purchase fellow semiconductor manufacturer Xilinx (NASDAQ:XLNX). AMD has said that the acquisition will increase its total addressable market to $110 billion.

Brian Chesky, Airbnb

2. Brian Chesky, Airbnb

Airbnb (ABNB 2.39%) CEO Brian Chesky drew heat in 2020 when the company laid off 25% of its workers due to the pandemic. The move was obviously painful for employees, but Chesky has been praised for his humane handling of the layoffs. Each terminated employee received at least 14 weeks of severance, in addition to extended health coverage and mental health support. The company also provided extensive job placement services, launching a talent directory to help terminated workers find employment, even with potential competitors.

Since then, Chesky has used the pandemic to sharpen Airbnb’s focus. With remote work making it easier for people to live anywhere or travel for extended periods, the company is focusing more on long-term stays, a shift Chesky has described as “the biggest change to travel since the advent of commercial flying.” By the last three months of 2021, half of Airbnb stays lasted a week or more.

At the beginning of 2022, Chesky announced that he would join the ranks of the digital nomads. He’s making Airbnbs his home for now, relocating to a different city every few weeks and returning to Airbnb’s San Francisco headquarters as necessary -- a move Airbnb says will improve the design of its experience for users.

Marvin Ellison, Lowe's

3. Marvin Ellison, Lowe's

On his first day as the CEO of Lowe's (LOW 2.93%) in 2018, Marvin Ellison skipped the welcome celebrations. Instead he headed straight to the contractor's desk in a store to better understand pain points for customers. In February 2020, Ellison publicly told CNBC about another customer pain point, describing the company's website as so "clunky … you may not get the whole way to checkout." Ellison's push to improve e-commerce came just in time for the pandemic. Online sales surged by 111% in the company's 2020 fiscal year.

Home improvement chains in general were big pandemic winners as people spent more time at home. As the stay-at-home-related surge in sales has cooled off, Ellison has shifted his focus to increasing the company's business with professional contractors.

Mary Barra, General Motors

4. Mary Barra, General Motors

General Motors (GM 5.63%) isn't the electric vehicle maker that the world is talking about. But anyone who believes that the future of cars will be fuel-free should pay close attention to CEO Mary Barra's plans for GM. Barra is pushing forward with an ambitious plan to invest $27 billion in electric vehicles through 2025. In January 2021, Barra announced GM’s goal of going all electric for light-duty vehicles by 2035. The company plans to invest almost $7 billion to build a new battery plant and overhaul its existing plant in Orion, Michigan, to manufacture electric trucks.

Barra, an electrical engineer who joined GM in 1980 as an 18-year-old intern, doesn't have a track record of blowing cash on ill-fated trends. Upon becoming GM's top executive in 2014, Barra started streamlining by eliminating underperforming vehicles and pulling out of unprofitable markets, including Europe and India.

Barra has taken a streamlined approach to management as well. She famously distilled GM’s 10-page dress code down to two words: “Dress appropriately.” In April 2021, she took a similar approach when she announced GM’s new “Work Appropriately” policy of allowing employees to work remotely on a permanent basis if their jobs permit it.

Satya Nadella, Microsoft

5. Satya Nadella, Microsoft

In Satya Nadella's first five years as CEO, Microsoft's (MSFT -1.02%) market cap smashed the $1 trillion ceiling. One of the key drivers of Nadella's success was focusing on Microsoft's then-fledgling cloud services as the new core of the company's business and eventually ditching plans for a Windows smartphone. The company under Nadella has delivered plenty for investors, with the Microsoft share price increasing more than fivefold under his leadership.

Nadella has also accomplished the feat of overhauling Microsoft's notoriously cutthroat culture, which often resulted in employees competing rather than collaborating. When he first became CEO in 2014, he challenged employees to become "learn-it-alls" rather than "know-it-alls." But while Nadella has been widely praised for turning around Microsoft's culture, he's careful to not take too much credit.

"From ancient Greece to modern Silicon Valley, the only thing that gets in the way of continued success and relevance, and impact, is hubris," Nadella told The Los Angeles Times in 2019.

With a 98% approval rating, Nadella ranked No. 6 among Glassdoor’s Top CEOs in 2021.

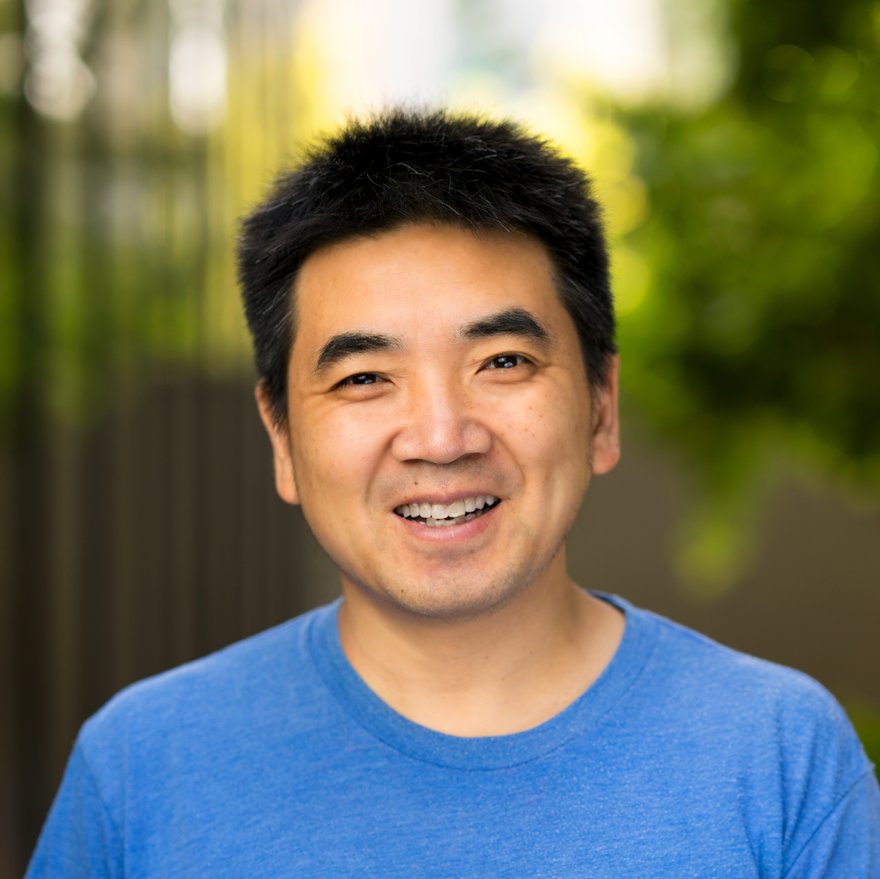

Eric Yuan, Zoom

6. Eric Yuan, Zoom

Zoom Video Communications (ZM -0.53%) founder and CEO Eric Yuan took his company public in 2019. Less than a year later, the pandemic suddenly made Zoom's video conferencing software the world’s epicenter for workplace meetings, school, social gatherings, and even weddings and funerals. By March 2020, Zoom was hosting 200 million virtual meetings daily, up from around 10 million in late 2019.

Zoom became the dominant virtual meeting platform in part because of Yuan’s vision from the beginning. His idea for Zoom dates back to the early 1990s, when he was a college student living 10 hours away from his long-term girlfriend (now his wife) in his native China. Zoom’s mission statement is simply: “Make video communications frictionless.”

The frictionless aspect of Yuan's company became clear from the start of the pandemic. Its cloud-native architecture made Zoom easier to use than rivals’ platforms in areas with weak internet connections. And while Zoom received plenty of negative attention early in the pandemic due to security and privacy issues, Yuan won praise for his transparency and quick action to address concerns. He stopped development of all new features until security flaws were fixed.

Yuan consistently gets high marks from employees. He won Comparably’s 2021 Award for Best CEO of Diversity, which is based on anonymous employee feedback. Employees of color gave him a 98 rating on a 100-point scale.

Related investing topics

Warren Buffett, Berkshire Hathaway

7. Warren Buffett, Berkshire Hathaway

Of course, no list of CEOs to watch for long-term investing would be complete without Uncle Warren. Although Warren Buffett, who turned 93 on Aug. 30, 2023, remains CEO of Berkshire Hathaway (BRK.A 0.73%) (BRK.B 0.82%), he appears to be letting investment managers Ted Weschler and Todd Combs make many stock picks these days. Even so, investors everywhere still scour the company's 10-K filings. "Buffett stocks" gain value because investors mimic Buffett's investing decisions and cling to Buffett's famed words of wisdom.

Regardless of whether Buffett personally agrees with all of Weschler and Combs' stock picks, you can bet that he holds the two men to the highest of standards. "Lose money for the firm, and I will be understanding," he has said. "Lose a shred of reputation for the firm, and I will be ruthless."

Despite the Nasdaq plummet of early 2022, Berkshire continues to thrive.