The Nasdaq is one of two major United States stock markets. Unlike its counterpart, the New York Stock Exchange (NYSE), the Nasdaq is best known for its concentration in technology and other high-growth stocks.

There are several stock indexes that follow Nasdaq stocks, and the broadest index is known as the Nasdaq Composite (NASDAQINDEX:^IXIC). Along with the Dow Jones Industrial Average and S&P 500, the Nasdaq Composite is typically considered to be one of the three headline indexes that are used to show how the stock market is performing. However, it is often the least understood of the major indexes in terms of composition and how it works.

With that in mind, here's an overview of the Nasdaq Composite Index. We'll discuss how it works and how you can invest in it if you decide it's a good fit for your investment strategy.

What is it?

The Nasdaq Composite Index defined

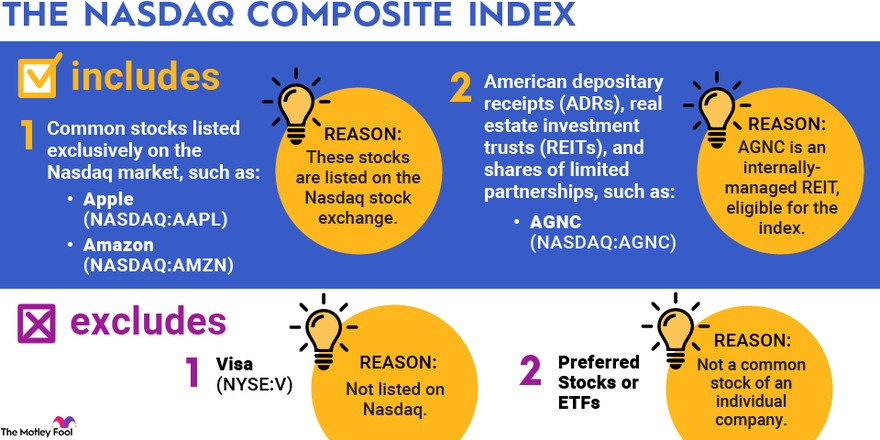

The Nasdaq Composite is a stock market index that consists of the stocks that are listed on the Nasdaq stock exchange. To be included in the index:

- A stock must be listed exclusively on the Nasdaq market.

- The stock must be a common stock of an individual company, so preferred stock, exchange-traded funds (ETFs), and other types of securities are excluded.

- American depositary receipts (ADRs), real estate investment trusts (REITs), and shares of limited partnerships are eligible.

That's why there are so many stocks included in the Nasdaq Composite and why the number of stocks in the index often changes. The index is designed to be representative of the entire Nasdaq stock market, not just the largest companies.

The Nasdaq Composite is one of the most widely followed stock indexes in the U.S. and is usually one of the three "headline" indexes that market commentators often cite -- along with the Dow Jones Industrial Average and the S&P 500.

Because the Nasdaq has a high concentration of companies in the technology sector -- particularly of the younger, fast-growing variety -- the Nasdaq Composite Index is often considered to be a good barometer of how well the tech market is performing.

How does it work?

How does the Nasdaq Composite Index work?

Like most major stock indexes, the Nasdaq Composite is weighted by the market capitalizations of its underlying components. This means that when larger companies' stocks move, it has a greater effect on the performance of the index than when the stocks of smaller companies move.

For example, a Nasdaq-listed common stock with a $100 billion market cap would have twice the influence on the index as a company with a $50 billion market cap, assuming an equal movement in both stocks' prices.

The level of the Nasdaq Composite Index fluctuates continuously during stock market trading hours.

How many companies are there?

How many companies are in the Nasdaq?

There are about 7,000 Nasdaq-listed securities as of September 2024, but as mentioned previously, not every type of security is included in the Nasdaq Composite index.

According to the latest monthly fact sheet for the Nasdaq Composite Index, there were a total of 3,293 different stocks in the index. It's worth noting that some companies have two classes of stock, so the total number of companies is slightly lower.

However, it's important to know that because the index is weighted by market capitalization and because some of the largest companies in the world are Nasdaq-listed, the index is rather top-heavy. In fact, the top 10 stocks in the Nasdaq Composite account for about 57% of the index's performance. With that in mind, here's a look at the 10 largest stocks in the Nasdaq Composite:

- Apple (AAPL 0.53%)

- Microsoft (MSFT 1.58%)

- Nvidia (NVDA 1.28%)

- Amazon (AMZN 1.62%)

- Meta (META 0.73%)

- Alphabet (A shares) (GOOGL 0.54%)

- Alphabet (C shares) (GOOG 0.51%)

- Tesla (TSLA 0.04%)

- Broadcom (AVGO 1.9%)

- Costco (COST 0.47%)

Data source: Nasdaq.com. Data as of Sep. 30, 2024.

Exchange-Traded Fund (ETF)

How to invest

How to invest in the Nasdaq Composite Index

The easiest way to invest in the Nasdaq Composite Index is to buy an index fund, which is a mutual fund or ETF that passively tracks the index. An index fund is designed to invest in all of the components of a stock index and in the same weights as the index. The idea is that over time, index funds will deliver virtually identical performance (less fees) as the index they track.

For example, Fidelity offers two investment vehicles that track the Nasdaq Composite. On the mutual fund side, the Fidelity Nasdaq Composite Index fund (mentioned above) has a 0.29% net expense ratio and no minimum investment. Fidelity also offers its Nasdaq Composite Index ETF (ONEQ 0.89%), which trades like any other stock and has a lower expense ratio of 0.21%.

Like the mutual fund, there's no minimum investment required. However, it's worth pointing out that the price of a single share is about $77 as of January 2025, so you'll need to invest at least that much or choose a broker that allows you to buy fractional shares of stock.

Financial Securities

Nasdaq-100: The other Nasdaq stock index

There's another Nasdaq-based index that is widely followed: The Nasdaq-100. This index, which is also market-cap weighted, is often confused with the Nasdaq Composite, but there's a big difference that's important to note.

Instead of including all of the common stocks listed on the Nasdaq exchange, the Nasdaq-100 only includes the stocks of the 100 largest nonfinancial companies listed. The 100 companies in the Nasdaq-100 make up more than 90% of the weight of the Nasdaq Composite Index. As you might imagine, the top 10 holdings of both indexes look very similar, as do their performance over time.

Just like with the Nasdaq Composite, there are mutual fund and ETF products that allow investors to track the Nasdaq-100 Index in their portfolio. Most notable is the Invesco QQQ ETF (QQQ 1.03%), which proportionally invests in the 100 index components for a low expense ratio of 0.2%.

Related investing topics

Should you invest?

Should you invest in the Nasdaq Composite Index?

Investing in stock market indexes is a great idea if you don't have the time or desire to research and select individual stocks to invest in or if you lack the knowledge necessary to properly evaluate stocks.

In fact, billionaire investor Warren Buffett, widely considered to be the most successful stock investor of all time, has said that index funds are the best investment choice for the majority of Americans. If you have the time and desire to invest in individual stocks properly, we encourage you to do so, but if you don't, there's nothing wrong with putting your investment portfolio on autopilot with index funds.

With that in mind, the Nasdaq Composite Index offers lots of exposure to tech heavyweights of today, such as Apple, Microsoft, and Amazon, while also giving investors some exposure to the tech heavyweights of tomorrow, thanks to its inclusion of every Nasdaq-listed common stock. As a result, the Nasdaq Composite Index could be a great investment choice if you don't yet feel comfortable choosing individual stocks or if you want broad exposure to the technology sector.

FAQs

Nasdaq FAQs

What is the Nasdaq Composite Index?

The Nasdaq Composite is a stock market index that consists of the stocks that are listed on the Nasdaq stock exchange. To be included in the index:

- A stock must be listed exclusively on the Nasdaq market.

- The stock must be a common stock of an individual company, so preferred stocks, exchange-traded funds (ETFs), and other types of securities are excluded.

- American depositary receipts (ADRs), real estate investment trusts (REITs), and shares of limited partnerships are eligible, however.

That's why there are so many stocks included in the Nasdaq Composite and why the number of stocks in the index changes often. The index is designed to be representative of the entire Nasdaq stock market, not just the largest companies.

What are stock market indexes?

A stock market index shows how investors feel an economy is faring. An index collects data from a variety of companies across industries. Together, that data forms a picture that helps investors compare current price levels with past prices to calculate market performance.

What is the S&P 500?

The S&P 500 (also known as the Standard & Poor's 500), a registered trademark of the joint venture S&P Dow Jones Indexes, is a stock index that consists of the 500 largest companies in the U.S. It is generally considered the best indicator of how U.S. stocks are performing overall.

From another angle, the S&P 500, as an index, is a statistical measure of the performance of America's 500 largest stocks. In this context, the S&P 500 is a common benchmark against which portfolio performance can be evaluated.