It's easy to be bullish on travel and tourism stocks. Over the last few years, travel and tourism have boomed back as a top growth industry. Who couldn't use a vacation right now?

U.S. travel spending has historically grown between 2% and 4% annually, according to the U.S. Travel Association. Total U.S. travel spending is projected to grow 3.9% to $1.35 trillion in 2025, reaching up to $1.46 trillion (inflation-adjusted) by 2028. In 2025, global travel spending is expected to increase by as much as 9% by some estimates.

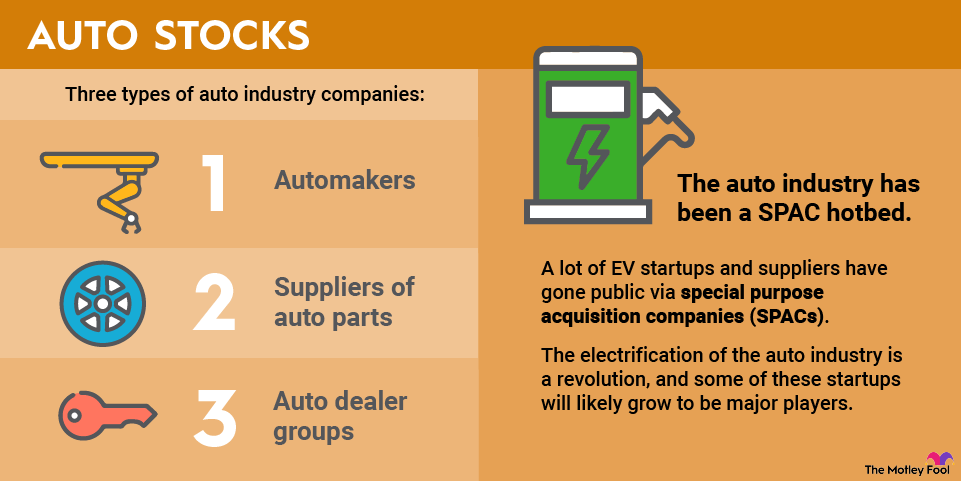

Travel and tourism is a broad category with a diverse list of well-known brands. For people planning to invest money in travel companies, you have plenty of options.

Best travel stocks to buy in 2025

There's a wide range of transportation, lodging, and amusement companies to get you to your destination and make sure you enjoy your stay. Since the companies vary so much, it's hard to nail down a single key metric to watch.

For example, some travel companies are asset-heavy transportation businesses like the airline industry and airline stocks. Many of these companies are broadly performing favorably for investors thanks to travel demand, despite the widely publicized headwinds facing a well-known U.S. company like Boeing (BA -0.36%). Other top picks are essentially tech companies.

The best travel and tourism stocks do share some traits, though -- namely, strong brand recognition, an easy-to-use website or app, and a loyal customer following. Here are some of the top travel and tourism companies.

| Name and ticker | Market cap | Dividend yield | Industry |

|---|---|---|---|

| Booking Holdings (NASDAQ:BKNG) | $171.3 billion | 0.71% | Hotels, Restaurants and Leisure |

| Marriott International (NASDAQ:MAR) | $72.9 billion | 0.97% | Hotels, Restaurants and Leisure |

| Airbnb (NASDAQ:ABNB) | $78.7 billion | 0.00% | Hotels, Restaurants and Leisure |

| Walt Disney (NYSE:DIS) | $205.5 billion | 0.87% | Entertainment |

| Uber Technologies (NYSE:UBER) | $194.0 billion | 0.00% | Road and Rail |

1. Booking Holdings

NASDAQ: BKNG

Key Data Points

Booking Holdings (BKNG +2.80%) is one of the largest online travel portals. It's the parent company of several popular travel booking sites, including:

- Booking.com.

- Priceline.com.

- Kayak.com.

- Rentalcars.com.

- Agoda.

Few companies have the ability Booking does to provide vacationers with a diverse set of travel planning and comparison tools. The travel company's global online reach should serve it well in the years to come.

Booking Holdings has done a great job of exceeding earnings and revenue expectations in recent quarters. The company's second quarter 2025 results were bolstered by a 13% year-over-year increase in gross bookings and a 16% increase in revenue.

The company is experiencing strong growth in its merchant, agency, and advertising revenue streams, driven by robust travel demand and investments in AI-driven tools as well.

2. Marriott International

NASDAQ: MAR

Key Data Points

3. Airbnb

NASDAQ: ABNB

Key Data Points

4. The Walt Disney Company

NYSE: DIS

Key Data Points

5. Uber Technologies

NYSE: UBER

Key Data Points