As investors have flocked to digital assets, we've seen more and more ways to invest in cryptocurrency. One of the latest options is a cryptocurrency mutual fund. In this guide, we'll go over how cryptocurrency mutual funds work and where you can invest in them.

Pros and cons to cryptocurrency mutual funds

Crypto mutual funds have their benefits and drawbacks. Here are the biggest advantages they offer:

- They're easy to buy. You can buy mutual funds with a brokerage account, so, like cryptocurrency stocks, they're a convenient way to invest in crypto. To buy most cryptocurrencies, you need an account on a crypto exchange.

- They can help you build a diverse portfolio. Mutual funds are a good way to diversify and reduce risk because they invest in a variety of assets. You can't really diversify much with crypto mutual funds yet due to the minimal options, but this should change if more funds are approved.

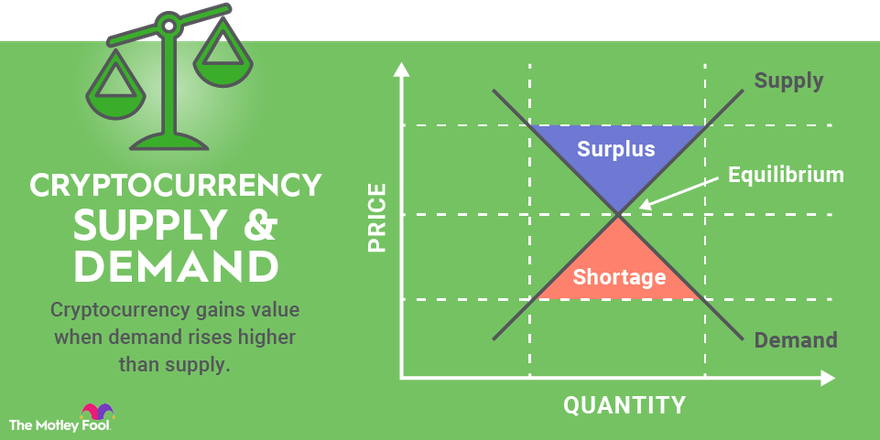

- Cryptocurrency prices can go up very quickly. The crypto market is known for large price movements. A crypto mutual fund could be one of your most profitable investments.

- You can invest in them using tax-advantaged retirement accounts. You can't buy Bitcoin directly with a retirement plan such as an IRA or a 401(k), but you could invest in a Bitcoin mutual fund.

Now, let's look at the most notable downsides with cryptocurrency mutual funds:

- There are hardly any available. Having so few options at hand means you might be out of luck finding one that appeals to you.

- Cryptocurrency is extremely volatile. While you could make a lot of money from crypto, prices could also plummet. Investors normally buy mutual funds to reduce risk through diversification, but you're still taking on significant risk with a crypto mutual fund.

- You don't own cryptocurrencies. Since it invests in futures contracts, a crypto mutual fund's price may not entirely follow the price of its cryptocurrencies.

- Expense ratios can be high. Bitcoin Strategy ProFund charges an expense ratio of 1.16%. Anything above 1% is considered on the high side.

How to invest in cryptocurrency mutual funds

If you're strictly looking for a cryptocurrency mutual fund, the closest option is Bitcoin Strategy ProFund. It doesn't invest directly in Bitcoin, but it invests in Bitcoin futures. You can buy it through a brokerage account.

You may also want to consider similar alternatives to crypto mutual funds. Here are a few of the closest types of investments.

Cryptocurrency trusts

An investment trust is a company that's set up as an investment fund. It offers a fixed number of shares, either privately or publicly, that investors can purchase. It pools that money and uses it to make investments.

Cryptocurrency trusts are investment trusts that focus on cryptocurrencies. They're similar to mutual funds in that they allow investors to take a more hands-off approach.

Grayscale is one of the largest companies offering cryptocurrency trusts. These include:

- Grayscale Bitcoin Trust (OTC:GBTC), which tracks the performance of Bitcoin.

- Grayscale Ethereum Trust (OTC:ETHE), which tracks the performance of Ethereum (ETH -0.50%).

- Grayscale Digital Large Cap Fund (OTC:GDLC), which tracks the performance of several of the largest cryptocurrencies by market cap.

Make sure to check out the fees before investing in a cryptocurrency trust. For example, the Grayscale trusts charge annual fees of 2% to 2.5%, so you're paying quite a bit for the convenience they offer.

Cryptocurrency ETFs

Cryptocurrency ETFs are another type of managed fund that invest in cryptocurrency. They invest in crypto futures contracts and attempt to track the price of one or more digital assets. Here are a couple of the most well-known crypto ETFs:

- ProShare Bitcoin Strategy ETF (BITO +3.35%) was the first cryptocurrency ETF approved by the SEC. It aims to track Bitcoin using Bitcoin futures contracts and has an expense ratio of 0.95%.

- Valkyrie Bitcoin Strategy ETF (BTF +4.71%) is a smaller Bitcoin ETF that also invests in Bitcoin futures contracts. It has an expense ratio of 1.25%.

Related crypto topics

Crypto-adjacent funds

If you're open to a more indirect method of crypto investing, you could look into what are called crypto-adjacent funds. These are mutual funds and ETFs invested in companies that work with cryptocurrency in some way. It's not the same as investing directly in crypto, but it gives you some exposure to that market.

Here are a few crypto-adjacent funds to consider:

- Amplify Transformational Data Sharing ETF (BLOK +1.30%) invests in businesses that are involved in the blockchain technology that powers cryptocurrencies. It has an expense ratio of 0.73%.

- Reality Shares Nasdaq NexGen Economy ETF (BLCN -0.08%) aims to invest in companies that develop, research, or utilize blockchain technology. It has an expense ratio of 0.68%.

Cryptocurrency mutual funds are an intriguing possibility for the future, but they're still very much a work in progress. Between the crypto mutual fund and ETFs that are on the market right now, most only attempt to track Bitcoin, so you don't get a diverse mix of assets. If the SEC relaxes its stance on cryptocurrencies, it will likely lead to far more crypto funds and give investors more options to consider.