Investors have several ways to potentially profit from the cannabis industry's growth. You can invest in specific marijuana stocks. However, another alternative is to invest in marijuana exchange-traded funds (ETFs), which are ETFs that own stakes in multiple cannabis companies.

And this industry is poised for strong growth. Cannabis is projected to be a $444 billion global market by 2030, according to Forbes Business Insights. The industry is expected to grow by an impressive compound annual growth rate of 34%.

The main benefit of buying marijuana ETFs is that your money is spread across a basket of stocks, which can lower your risk compared to investing in only a few individual stocks. Here's what you need to know about the top marijuana ETFs on the market.

Top marijuana ETFs in 2026

Below are six top marijuana ETFs with their assets under management and net expense ratios.

ETF | Assets Under Management | Net Expense Ratio |

|---|---|---|

AdvisorShares Pure U.S. Cannabis ETF (NYSEMKT:MSOS) | $1 billion | 0.77% |

Amplify Alternative Harvest ETF (NYSEMKT:MJ) | $209.9 million | 0.75% |

Global X Marijuana Life Sciences Index ETF (OTC:HMLSF) | $59.8 million | 1.00% |

AdvisorShares Pure Cannabis ETF (NYSEMKT:YOLO) | $47.7 million | 1.12% |

Amplify Seymour Cannabis ETF (NYSEMKT:CNBS) | $124.5 million | 0.76% |

Cambria Cannabis ETF (NYSEMKT:TOKE) | $18.1 million | 0.43% |

1. AdvisorShares Pure U.S. Cannabis ETF

The largest marijuana ETF based on assets under management is the AdvisorShares Pure U.S. Cannabis ETF (MSOS -1.92%). It's the first ETF to focus exclusively on the U.S. cannabis market.

This ETF had more than 20 holdings in late 2025, including U.S. marijuana stocks and swaps (derivative contracts, where the values or cash flows of one asset are exchanged for another). Its top positions included swaps for Curaleaf Holdings (CURLF -1.74%), Trulieve Cannabis (TCNNF -2.11%), Green Thumb Industries (GTBIF +3.36%), Cresco Labs (CRLBF -1.89%), Verano Holdings (OTC:VRNOF), and Glass House Brands (GLAS.F +0.25%).

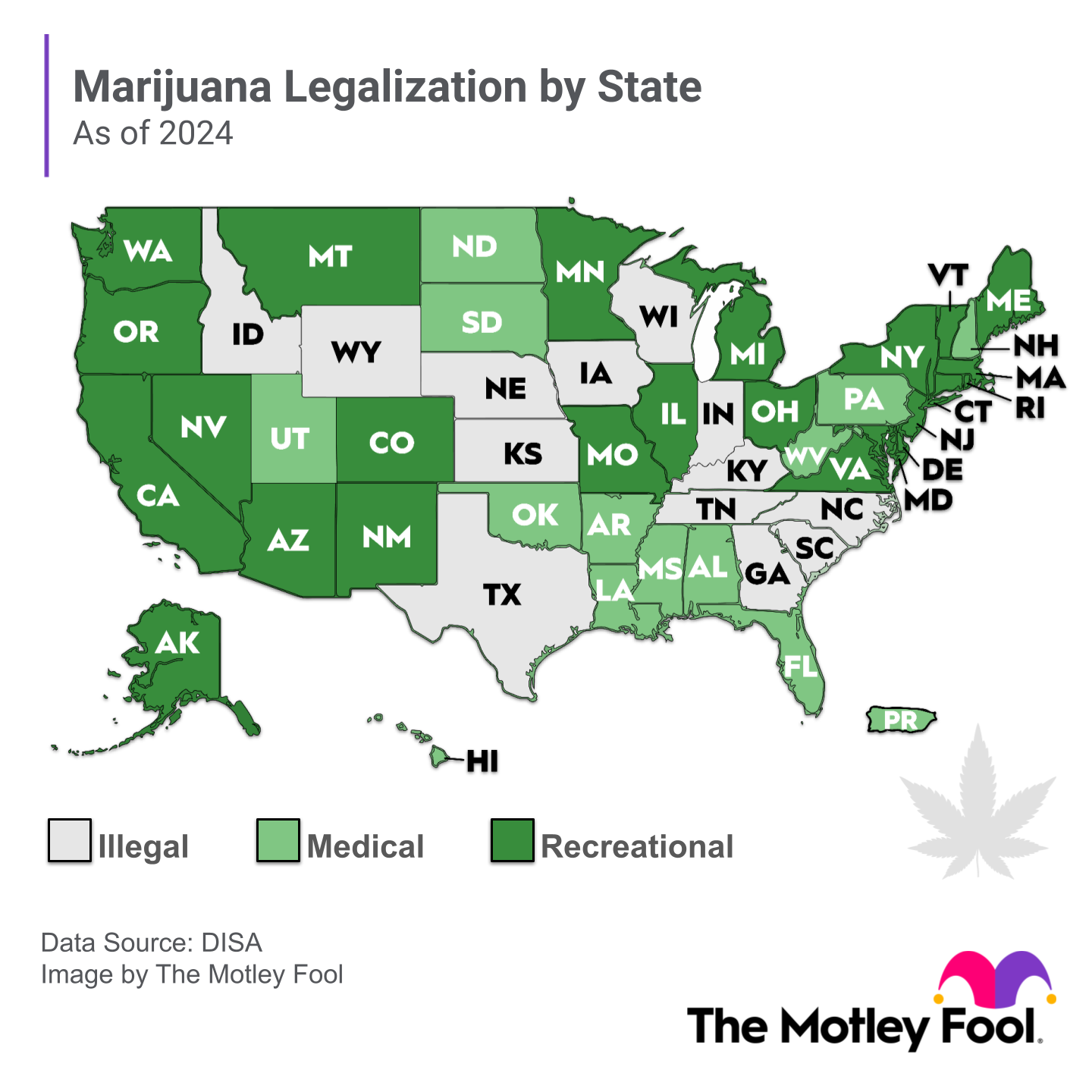

It's possible that the ETF's focus on the U.S. market could give investors greater growth opportunities than other ETFs. Although marijuana remains illegal at the federal level in the U.S., many states have legalized marijuana for medical and/or recreational use.

2. Amplify Alternative Harvest ETF

In 2015, Amplify Alternative Harvest ETF (MJ -1.94%) became the first U.S. ETF to target the global cannabis market. This ETF was established even before the Canadian cannabis industry took off after the legalization of recreational marijuana in 2018.

Amplify Alternative Harvest ETF owned 10 individual stocks in late 2025. Its top stock holdings included Tilray Brands (TLRY -2.63%), Cronos Group (CRON +0.20%), SNDL (SNDL -2.52%), Village Farms International (VFF -2.79%), and Aurora Cannabis (ACB -7.42%).

These five positions combined made up almost 43% of the ETF's total assets. Roughly 49% of the ETF was also invested in its sister fund, Amplify Seymour Cannabis ETF (CNBS -1.74%).

Canadian cannabis producers weigh heavily in the ETF's portfolio. This could hurt the ETF's performance while current U.S. federal cannabis laws remain in effect. The Canadian companies can't enter the U.S. cannabis market and retain their listings on major U.S. stock exchanges as long as marijuana is illegal at the federal level.

3. Global X Marijuana Life Sciences Index ETF

Although Global X Marijuana Life Sciences Index ETF (HMLSF +2.09%) isn't listed on a major U.S. stock exchange, U.S. investors can buy the ETF on over-the-counter (OTC) markets. Its 2017 inception makes it one of the oldest marijuana ETFs.

The ETF's top holdings include Tilray, Jazz Pharmaceuticals (JAZZ +0.29%), SNDL, Cronos Group, and Innovative Industrial Properties (IIPR +2.11%). Together, these five stocks account for approximately 51% of the ETF's total portfolio.

Global X Marijuana Life Sciences Index ETF became the first ETF to target the global cannabis market. The ETF was established even before the Canadian cannabis industry took off after the legalization of recreational marijuana in 2018.

4. AdvisorShares Pure Cannabis ETF

AdvisorShares operates two marijuana ETFs. One focuses exclusively on the U.S. cannabis market, but the AdvisorShares Pure Cannabis ETF (YOLO -1.57%) doesn't limit itself to the U.S. Instead, it focuses on the global cannabis market.

The ETF had 18 stock holdings in late 2025. Almost 42% of its assets were invested in the AdvisorShares Pure U.S. Cannabis ETF. The top five individual stocks in its portfolio were Village Farms International, High Tide (HITI +3.10%), SNDL, Cronos Group, and Organigram Global (OGI -1.27%). The stocks made up roughly 44% of the ETF's total holdings.

The AdvisorShares ETF could be an attractive alternative for investors who want exposure outside the U.S. but still want a heavier weighting to U.S. stocks.

5. Amplify Seymour Cannabis ETF

Amplify Seymour Cannabis ETF (CNBS -1.74%) bears the name of its manager, Tim Seymour. He is a well-known cannabis investor and has appeared frequently on CNBC's Fast Money TV show.

The ETF held 33 stocks in late 2025. Its top positions included swaps in Trulieve Cannabis, Green Thumb Industries, Cresco Labs, and Verano Holdings, as well as shares of CuraLeaf. The five positions comprised roughly 61% of the ETF's total assets.

U.S. multi-state operators make up much of this ETF's total portfolio. Cannabis companies focusing on cultivation and retail comprise a smaller portion.

Related investing topics

6. Cambria Cannabis ETF

Cambria Cannabis ETF (TOKE -0.52%) was formed in 2019. Although it's the smallest of the marijuana ETFs on this list, the fund has the lowest annual expense ratio.

This ETF had 22 holdings in late 2025. Its top positions included swaps in Green Thumb Industries, Grown Rogue International (GRUS.F -1.00%), Trulieve Cannabis, and Glass House Brands, as well as shares of Village Farms International. These five holdings made up almost 37% of the fund's portfolio.

Cambria Cannabis ETF doesn't just focus on pure-play cannabis companies. It also invests in related industries, including food, real estate, and tourism.

Pros and cons of investing in marijuana ETFs

The pros of investing in marijuana ETFs include:

- The potential for significant long-term gains.

- Diversification across multiple marijuana stocks.

- Exposure to some U.S. multi-state cannabis operators that can't list their shares on U.S. stock exchanges.

However, there are also cons associated with investing in marijuana ETFs, such as:

- High risk and volatility.

- Relatively high expense ratios.

- Marijuana ETFs could own some marijuana stocks that investors would prefer to avoid.